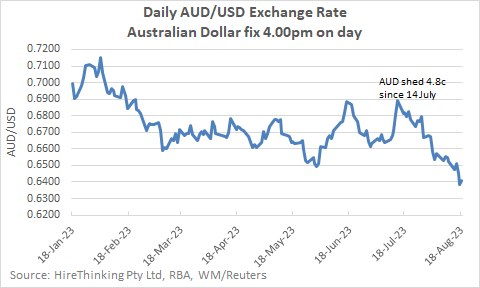

As massive stimulus begins to take hold in the US, the Australian dollar has tracked sharply lower. Mid-August, the Aussie was down to around USD0.635, having crashed over the last month or so, following 1H23 when it tracked lower anyway.

It was not lost on Cecile Lafort at the Australian Financial Review that the Australian dollar’s decline was also linked to trade with China plunging 11% for the month. A faltering Chinese economy has less reason to buy Australian dollars because it is buying less of our raw materials.

The commentariat is not entirely of one mind on the trajectory for the Australian dollar over coming months, but also in the Australian Financial Review, Alex Gluyas reported the Commonwealth Bank as being concerned the deteriorating Chinese economy could see the Australian dollar fall below USD0.60 by the end of the year.

As a scenario, it is pretty simple to see the dilemma. Investment and cash funds are flowing to the US where stimulus and the need for the cash are driving the currency higher relative to other currencies, while meantime, Australia’s reliance on Chinese raw materials consumption – especially for its besieged and becalmed construction sector – sees less demand for Australian dollars.

A lower domestic currency could arise from the twin forces railing against it as the world’s two largest economies suffer very different trends and expectations.