The economy dodged another bullet in the December quarter with GDP up 0.2% over the period and annualised growth rising to 1.5%. Whilst a very moderate result, the sustained emphasis on lowering inflation has necessarily dented economic growth prospects. So much so, the sole reason Australia is not in recession is the recent spike in migration.

Few commentators would argue the slowdown in the economy was unnecessary. As John Kehoe wrote in the Australian Financial Review, the purpose of a slowing of economic growth was to dampen “the inflation fuelled by too much stimulus and supply chain blockage in the pandemic”.

The very positive news is this slowing of the economy has seen only a moderate increase in unemployment (discussed elsewhere in this edition of Stats Count). The unemployment rate lifted from 3.9% to 4.1% in January 2024.

It can be argued that one driver of slower economic growth and even slow productivity growth, has been the relative tightness of the labour market. It would be remarkable, in historical context, if falling economic growth came without the usual significant rise in unemployment.

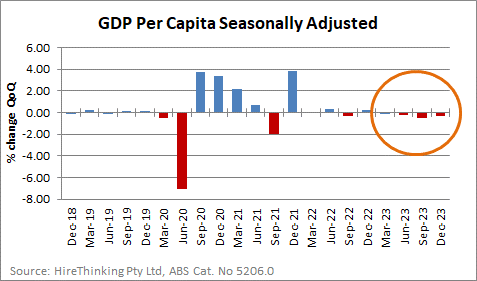

However, largely due to an expansion in the population that has been driven by significant migration since the apparent conclusion of the pandemic, on a per capita basis, economic output has either been flat or gone backwards for four consecutive quarters, as can be seen in the following chart.

One view, expressed by Greg Jericho in The Guardian, asserts that the Reserve Bank of Australia:

“…has slowed things down so drastically that Australia’s economy, for the first time for 40 years, has gone an entire year where it grew only because of population increases.”

The data supports Jericho’s assertion and demonstrates the balancing act required to land economic conditions into a stable inflation and employment paradigm from which it can proceed with greater confidence.

On a per capita basis the economy shrank 0.3% in December, was down 0.5% in September and fell 0.2% in June. In the March quarter it didn’t fall but was flat at 0.0%!

Jericho noted:

“2023 was only the third time in the past 40 years that the economy was smaller when accounting for population growth than it has been the year before.”

In short, Australia is in a per capita economic recession.

Little wonder the entire forestry and wood products supply chain, along with many other industries, has found itself operating in rapidly tumbling markets.

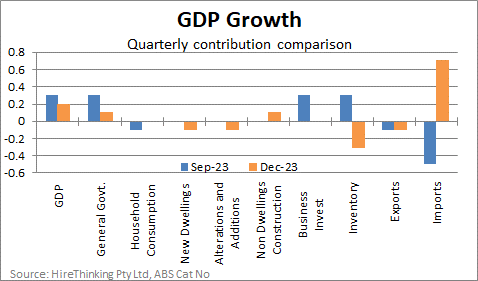

Though nothing to write home about, what drove the humble growth in the December quarter was mainly trade and general government spending as the chart below shows.

Ironically, the trade gain was not from greater exports but from the decline in imports, which generated a net contribution for the quarter of 0.6%. As the nation’s spending power is being eroded by inflation, we are spending less on imported goods.

The fall in goods imports also contributed to a decline in wholesale and retail inventories, as businesses did not replenish stock to previous levels during the quarter. Inventories fell $2.7 billion detracting 0.3% from GDP growth.

Government expenditure (+0.6%) contributed 0.1% to GDP. The ABS commented that:

“National non-defence spending rose 2.0% with strength in social benefits to households and employee expenses. Social benefits experienced broad based strength driven by a rise in health programs through Medicare and the Pharmaceutical Benefits Scheme. Employee expenses rose with some Commonwealth agencies increasing staffing levels, including staff for the Referendum on an Aboriginal and Torres Strait Islander Voice.”

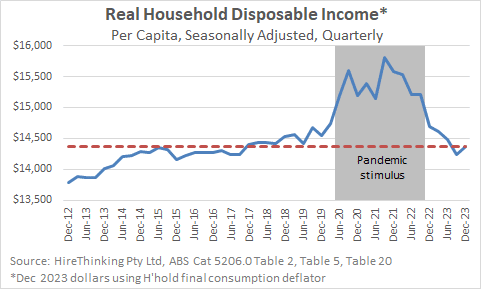

The improvement in wages (discussed elsewhere in this edition of Stats Count) has also flowed through to households. The steady decline in real disposable income from the pandemic-stimulus driven peak in September 2021 has finally eased, with an increase in real household disposable income experienced in the December quarter.

Deflated from December 2023, per capita real household disposable income was $14,372 in the December quarter, lifting just above the $14,420 achieved in the September quarter of 2017. This was preceded by a very flat period going back to June 2015.

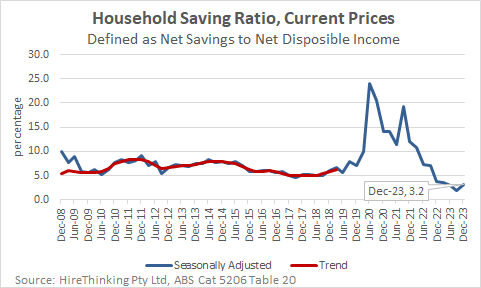

Given the weakness in household spending during the quarter, the increase in the household savings ratio was also a surprise. It lifted from 1.9% to 3.2%. At a headline level the two results imply that confronted by a fraction more household liquidity, on average, the nation dropped the extra funds into the bank account.

The ABS commented that:

“…saving rose in the December quarter due to a rise in gross disposable income and a fall in income payable. Compensation of employees (+1.4%), social assistance benefits (+5.9%), and interest received (+6.7%) drove growth in income receivable, while income payable declined through a fall in income tax paid by households (-3.3%).”

The solid result for interest received (up +6.7%) is the reverse side of the coin of higher interest rates which are directed at bringing inflation down. All seems normal and sensible there.

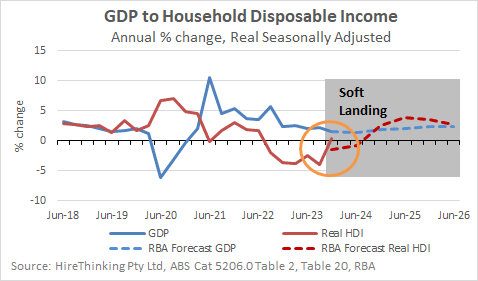

Overall, the December quarter data continues to support the RBA efforts to engineer a “soft landing” for the economy. A key driver of the economy is household disposable income (HDI).

The Reserve Bank of Australia’s February statement on monetary policy updated forecasts have GDP in positive territory through the end of 2024 when it is expected real HDI growth will move ahead. In fact, as can be seen in the chart below, in the December quarter of 2023, real HDI improved faster than the forecast (+0.3% vs forecast of -1.5%).

Looking ahead, there will be $20 billion of tax cuts to flow through the economy from July which will provide additional support for households, most of it unanchored to economic conditions. So, whilst the economy might be weak, the data suggests we may be at the bottom of this cycle.

Whether the tax cuts are potential good news or economic folly is a matter to consider over the second half of 2024. If they put a spur into spending on discretionary items – which right now seems unlikely – the tax cuts will have done the nation few favours. If, on the other hand, they help alleviate mortgage and rental stress, they may be of a little more value.