Continuing the theme of the impact of new housing on the Australian economy, reported Australian timber fencing sales continue to climb.

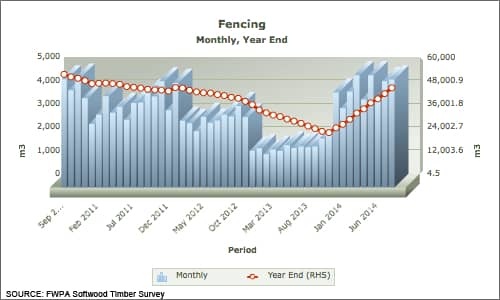

For the year to the end of August 2014, total sales of fencing were 44.2 km3, the highest recorded on a year-on-year basis over the last four years. But what is most impressive in these numbers, as the chart below shows, is recovery from the prior year’s lows.

To go straight to the dashboard and take a closer look at the data, click here.

Over the year to the end of August 2014, sales have averaged a record 3.7 km3 per month, underscoring the recent resilience of the fencing timber market. For the prior corresponding period (to the end of August 2013) fencing sales averaged just 2.0 km3 per month.

The highest recorded monthly sales were achieved in March 2014 (4,825m3). The most recent month saw the third highest recorded sales of fencing timber (4,639.7m3) over the entire series and the second highest recorded sales for the last year.

In fact, if the last six months of fencing sales are repeated in the next six months, annual sales by the end of March 2015 will amount to a whopping 52.8 km3.

The driver for sales appears to be new housing developments. With new dwelling strength being sustained and expected to remain high (seasonal adjustments aside) over coming months, new fencing sales records seem likely.

This is all the more likely as the data shows greatest sales strength in the warmer months. There is no surprise in that of course. What is surprising is that high levels of sales were recorded all through the middle of 2014, during the usually quiet period of the year.

Given the low levels of sales from December 2012 to September 2013 (they averaged just 1.7 km3 per month), there is a prospect that some pent up demand for fencing has been met over recent months as neighbours tired of the sight of one another. Though that is possible, it is more likely there is a direct link to housing approvals and commencements.

It is important to note that fencing sales are a lagging indicator and that no specific correlation has been confirmed with housing approvals.