Housing Approvals for March 2025 are still volatile, but the overall trend is positive.

This article is produced by FWPA’s Statistics and Economics program.

The March 2025 Building Approvals continued to show volatility in the monthly data with detached house approvals of 8,944 for March down -4.2% on the previous month. Similarly, monthly approvals for total dwellings in March were 15,220 down -8.8% on the previous month.

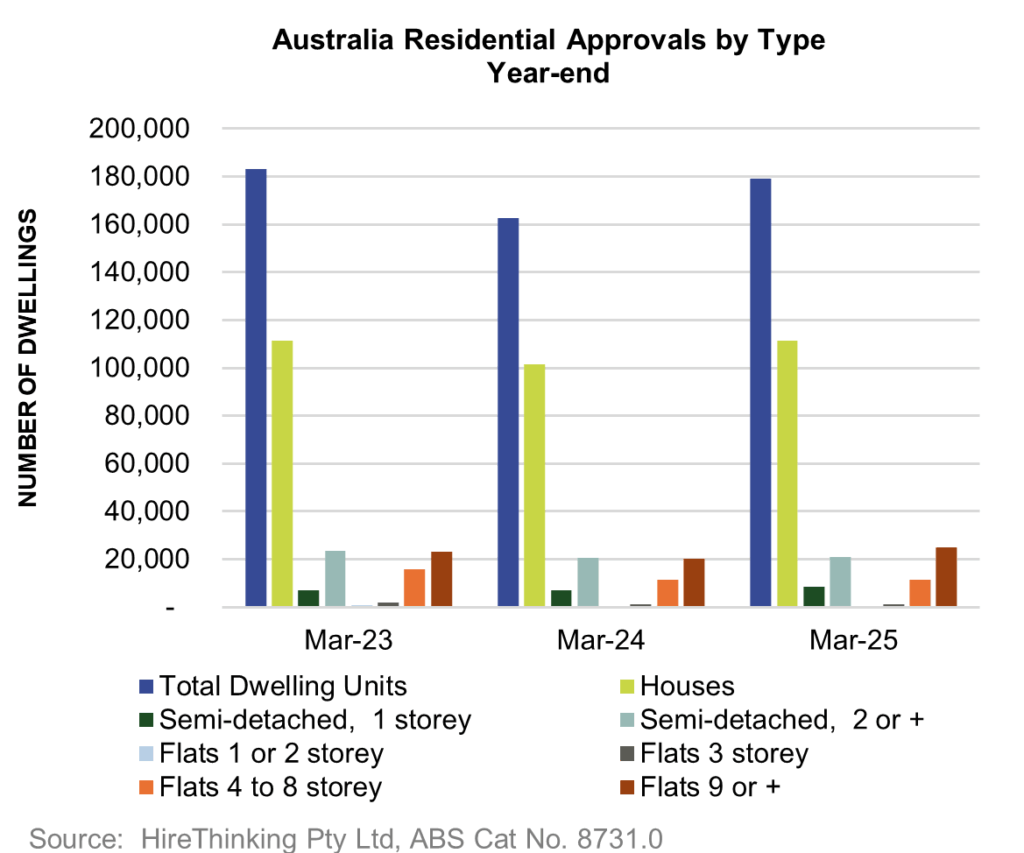

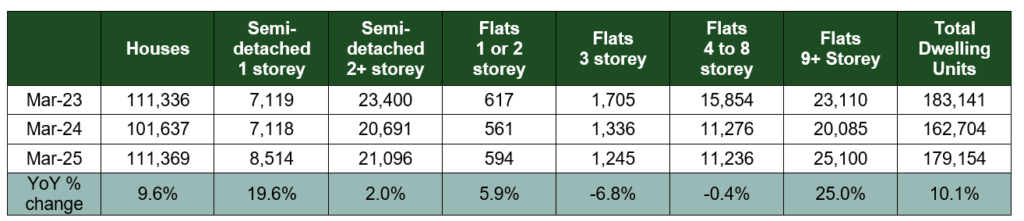

However, reflecting the fact that progress is being made on the less volatile annual data, detached house approvals year-end March 2025 were 111,369 up 9.6% on the year-end March 2024. Total approvals for year-end March 2025 were 179,154 which was a gain of 10.1% on the previous period.

If we break that down by housing type gains were made across all sectors.

As well as gains in detached housing there was a significant increase in multi-residental with approvals for flats of 9 or more storey up 25.0% to 25,100 for the year-ending March 2025.

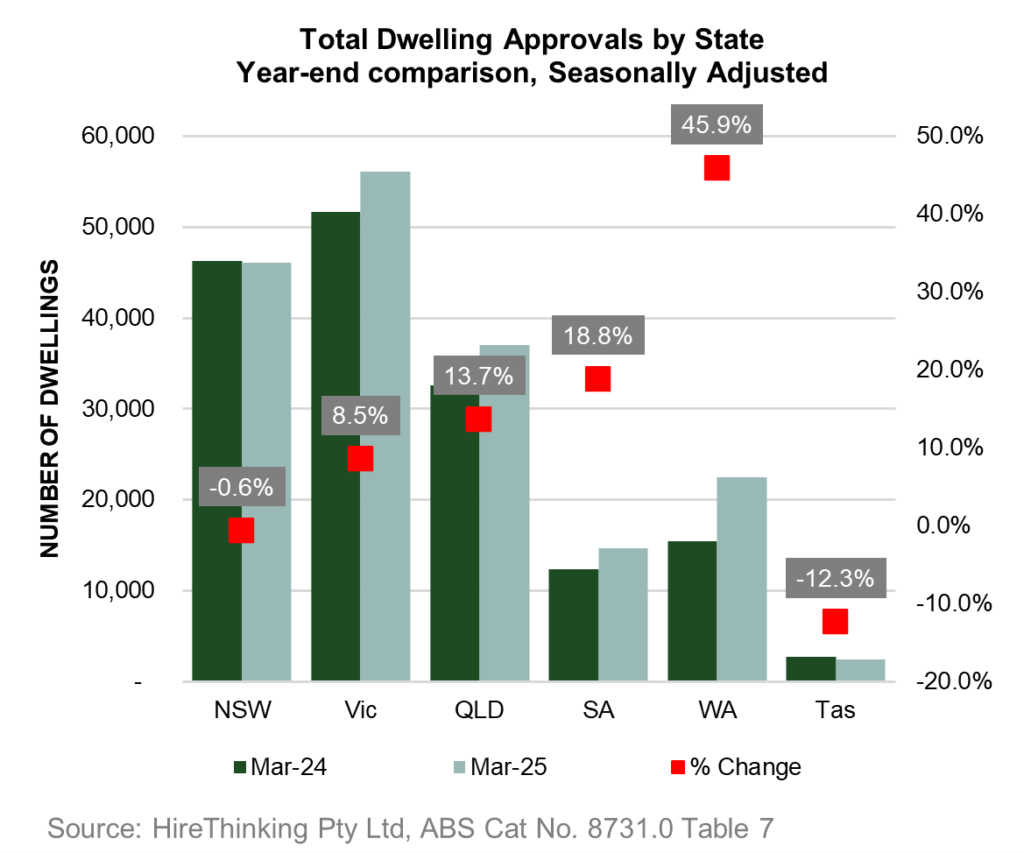

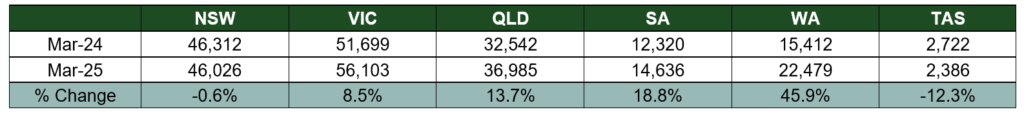

On a state basis gains were experienced in Victoria, Queensland, SA and WA with NSW steady and decline experienced in Tasmania.

Overall, Victoria is leading the way with total approvals year-ending March 2025 of 56,103, a gain of 8.5% on the previous period.

Progress on Interest Rates as RBA cuts another 0.25%

Mortgage holders received further relief in May with the RBA dropping the official cash rate by 25 basis points to 3.85%. This was widely expected by markets as the March quarter CPI data showed inflation within the RBA target band.

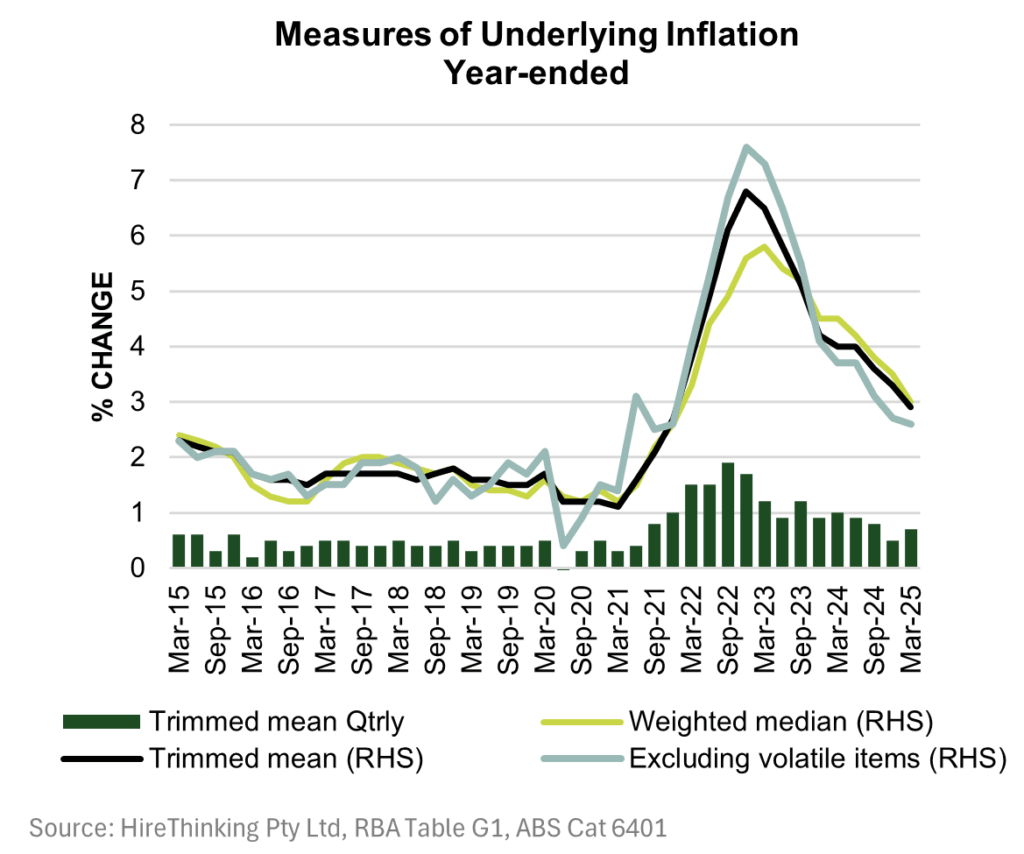

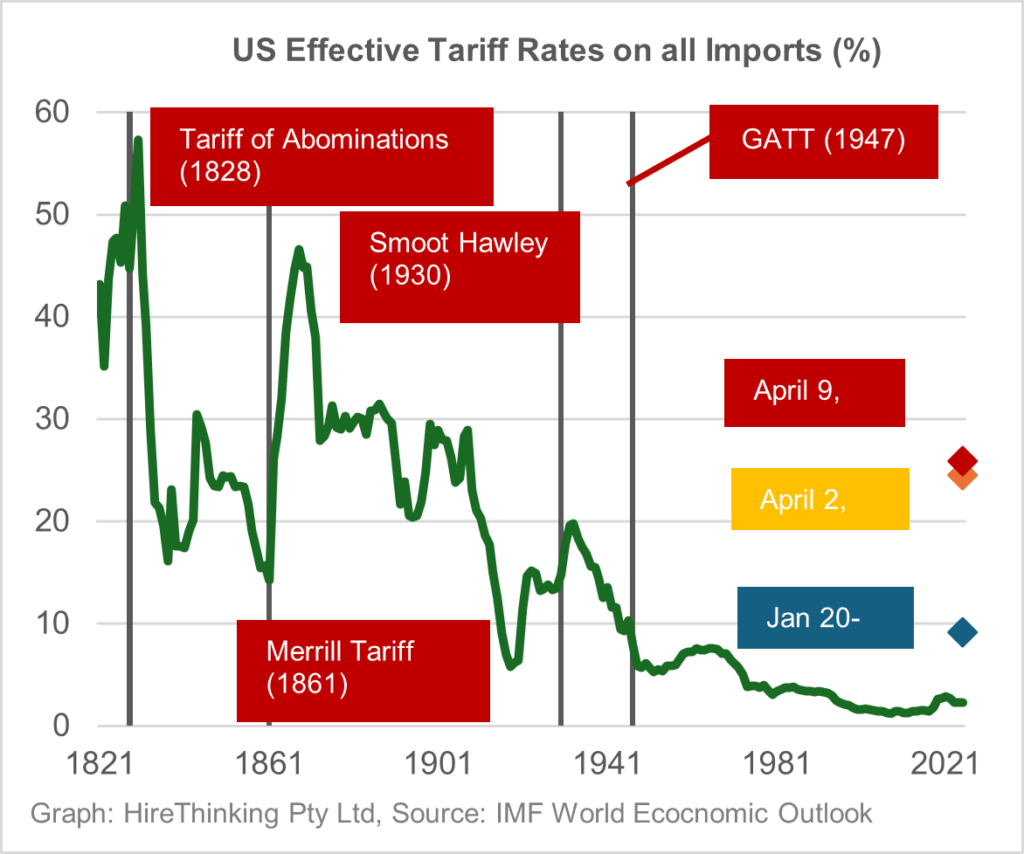

The trimmed mean, which is the main measure of underlying inflation tracked by the RBA has fallen consistently over the past year from 4.0% in March 2024 to 2.9% in the current quarter. This was the lowest annual trimmed mean inflation rate since the December quarter 2021. All good news on the inflation front.

However, the RBA remains cautious about the outlook. Commenting that “there are uncertainties regarding the lags in the effect of monetary policy and how firms’ pricing decisions and wages will respond to the demand environment and weak productivity outcomes while conditions in the labour market remain tight”.

The reality check is that rates are still regarded as “restrictive” and give the RBA room to move should growth slow below current forecasts.

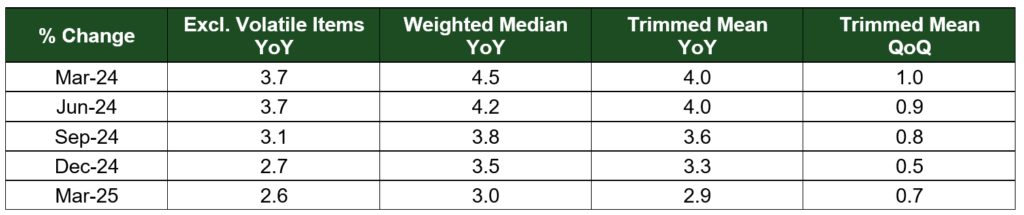

Looking at the top 10 contributors to inflation over the past year, rent had the biggest impact with a year-on-year weighted percentage change of 0.37%.

Also in the top 10 were new dwelling purchases which contributed 0.11% on a weighted basis to overall inflation during the year.

Both factors reinforce the need for more housing supply to address the demand driven by population growth and a reduction in household formation rates.

“Freedom Day” not so free for global trade

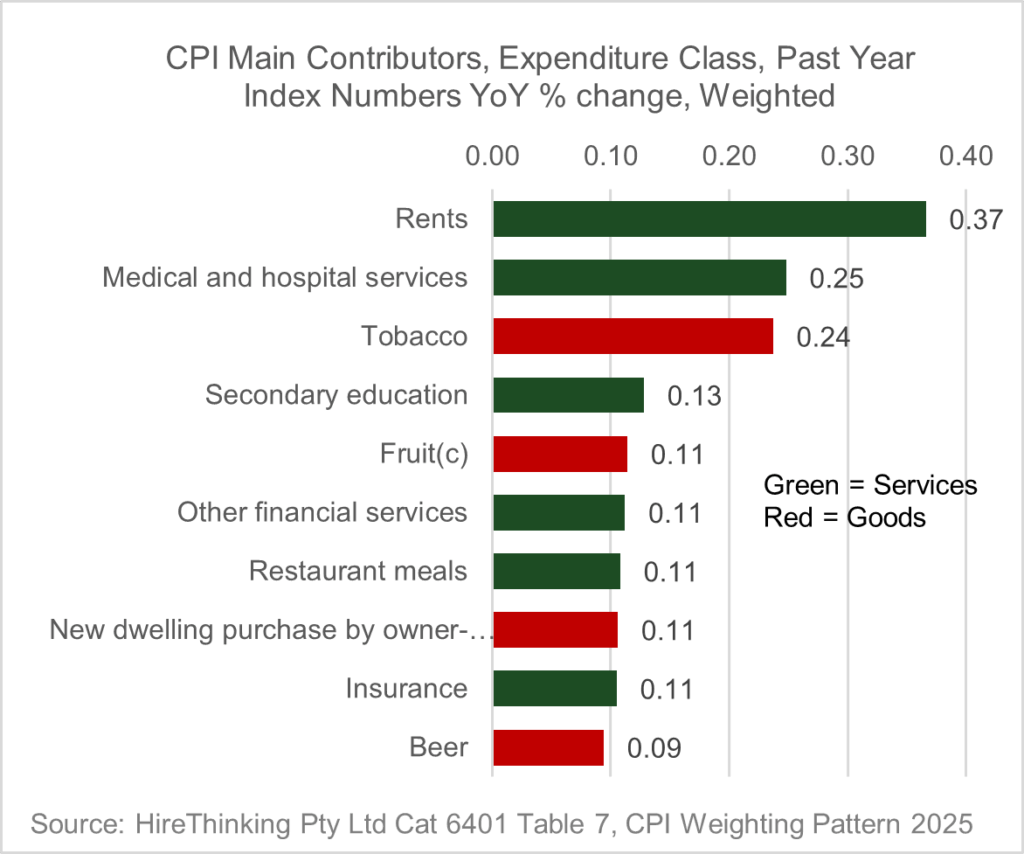

On 2 April, President Trump’s “Freedom Day” announcement covered a range of tariff measures on imports to the US. Australia was affected by a general rate of 10% applicable to our exports in addition to previously announced higher levels for Aluminium and Steel. The direct effects for Australia may not be significant given our limited exports to the US market. However, the impact on global trade will be significant and this may spill over to Australia.

The IMF, in its recent World Economic Outlook, has cut the growth forecast for Australia by 0.5%. The expectation is that Australia will not be immune from the global slow down resulting from the new tariffs in the US – the world’s largest consumer market.

The IMF forecast of 1.6% is below the 2.0% plus growth that the RBA and Treasury had forecast before the introduction of this new round of tariffs.

The scale of the tariffs which are still evolving, is beyond anything seen since the late 1800’s early 1900’s.

The January Tariffs include 20% tariffs on China, 25% on Aluminium and Steel, 25% on Mexico and Canada, and a 10% tariff on Canadian energy imports. The April 2 tariffs include auto sector tariffs and country specific tariffs. The April 9 tariffs include an increase in tariffs on China to 145% and a reduction in tariffs on other countries to 10%. It also includes exemptions on some electronic products announced on April 11.

If these tariffs remain in place then the effective rate as of April 9 would be 25.9% which in historical terms is very high and at levels last seen in 1905 when the effective rate was 23.8%.