Australia’s total Residential Dwelling approvals declined 7.8% in September 2014, compared with the prior month. The majority of the decline was a sharp 22.2% decline in Multi-residential 4 or more storeys.

The original records that supply the above data need to be smoothed, over time and considered from a trend perspective, a function that is available on the FWPA Economics & Statistics Data Dashboard, as the chart below shows.

To go straight to the dashboard and take a closer look at the data, click here.

The year-on-year data clearly shows that September 2014 saw solidly higher residential approvals than in September 2013. While that is encouraging, it remains important to examine the data further, to understand what has occurred to deliver a reasonably large fall in month-on-month approvals.

Considered on a 12 month year-end basis, to the end of September 2014, total Residential Dwelling approvals were 193,493, just 1.0% lower than for the year to the end of August 2014.

As the major decline in September 2014 was in Multi-residential 4 or more storey (apartments) it is relevant to look in greater detail at this form of residence.

Our first point of reference, is the chart above, which shows that for the year to the end of September 2014, total approvals were a substantial 27.9% higher than for the year to the end of September 2013. To put that into context, total Residential Dwelling approvals were 15.9% higher over the same period, with no other form of residence growing as strongly.

Our second reference point is the month on month approvals data, over the last year, for Multi-residential 4 or more storeys. This is displayed in the following chart, created from a download of data available on the FWPA Economics & Statistics Data Dashboard.

This data shows that while Multi-residential 4 or more storeys has declined from its 2013 peaks when it recorded 5,848 approvals in September 2013, it has experienced something of a recovery through to August 2014 when it recorded 3,882 approvals, after which it fell back in September to 3,019 approvals.

Before turning to state specific data, it is pertinent to pause and consider the nature of large-scale and high rise apartment approvals. Inevitably, they are approved in large batches and big numbers. With the largest apartment buildings and complexes including literally hundreds of apartments, month-on-month movements are inevitable and not particularly remarkable.

On a state-by-state basis, Residential Dwelling approval data provides little data to contradict the above. Only the territories (ACT and NT) experienced declines for the year to the end of September 2014, compared with the same period to 2013. The state-by-state experience over that period is detailed in the following chart.

To go straight to the dashboard and take a closer look at the data, click here.

To put the chart into numbers, on a period-to-period basis, total approvals in NSW grew 13.3%, Victoria 14.9%, Queensland 21.4%, SA 19.7%, WA 16.5% and Tasmania 12.1%.

The state data displays no specific indicators of a softening in any of the significant regional Residential Dwelling approval markets in Australia.

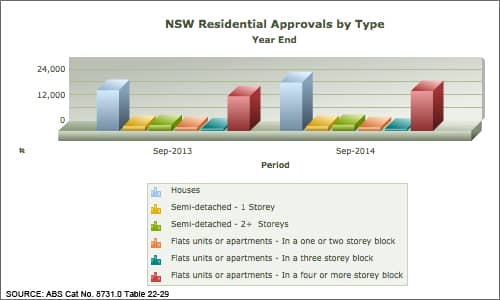

Taking the time to examine individual states is always a worthwhile activity. In this case, New South Wales is examined in further detail, with the following chart displaying NSW Residential Approvals by Type for the years to the end of September 2013 and 2014.

To go straight to the dashboard and take a closer look at the data, click here.

In general, the chart provides two points of interest. First it shows that houses and Multi-residential 4 or more storeys make up the bulk of the residential approvals. In fact, in September 2014, combined they accounted for 86.1% of the total. Second, it displays solid growth in year-on-year approvals to the end of September for both the major residence types.

The data for other states is similar, though of course, not exactly the same.

Whether there is a turn down in Residential Dwelling Approvals is significant and will continue is a matter for conjecture. Commentators generally consider the conditions remain favourable for further expansion through to at least mid-2015. There are however those who remain concerned about a residential housing price bubble that, should it materialize, could only result in lower approvals for some time.

To conduct you’re own analysis or review the underlying data, click here to go to the dashboard.