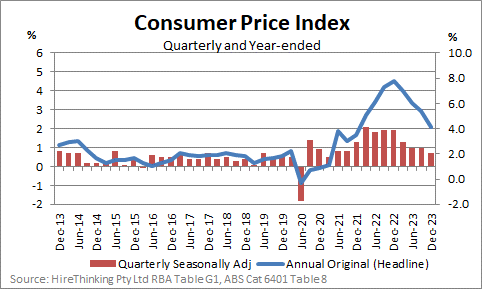

December quarter Consumer Price Inflation (CPI) data was better than expected, coming in at 0.6% for the quarter, just half the 1.2% recorded for the September quarter. This was the smallest quarterly rise since the March quarter of 2021, feeding into an annualised headline rate of 4.1%, down from 5.4% in the September quarter. Inevitably, attention quickly turned to the implications for interest rates.

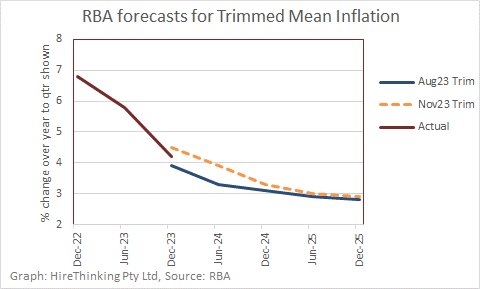

The chart here shows that almost as rapidly as inflation climbed, it has fallen away, with the quarterly data pointing toward a trajectory that could take annual inflation comfortably into the RBA ‘target band’ of 2-3% per annum.

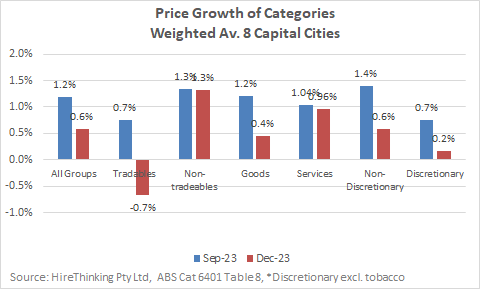

A break down of the factors which contributed to inflation in the quarter confirms the ‘imported’ inflation caused by disrupted supply chains during the COVID19 pandemic is now under control.

One measure is that Tradables decreased in price during the quarter by -0.7%, driven by reductions in the value of imported goods including clothing, footwear, furniture and household appliances. Inflation has had the effect of dampening this expenditure.

The challenge now is domestically induced inflation, where Non-Tradable inflation was the highest of any grouping, rising 1.3% in the quarter.

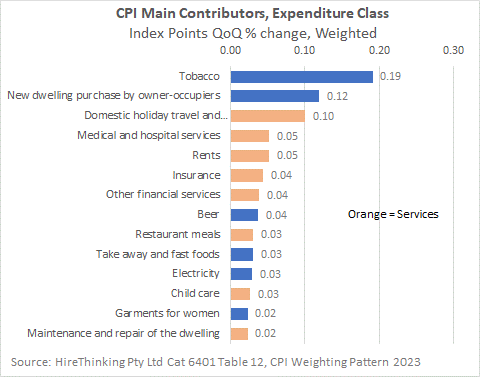

This can be seen more clearly by looking at the main contributors for the quarter.

The data is arranged to show the highest weighted percentage change in the quarter compared to the previous quarter. This is derived from the percentage in the ABS index data, modified to reflect the actual weighting for that expenditure class.

New dwelling purchases, for instance, added 0.12% to inflation, on a weighted basis. The ABS commenting that:

“Higher labour and material costs contributed to price rises this quarter for construction of new dwellings. The 1.5 per cent increase is slightly higher than the 1.3 per cent rise in September 2023 quarter.”

Rents contributed 0.05% on a weighted basis. The ABS commenting that:

“Rental prices rose 0.9 per cent for the quarter, following a 2.2 per cent rise in the September quarter. The rate of quarterly growth was moderated by changes to Commonwealth Rent Assistance. Excluding the changes to rent assistance, rental prices would have increased by 2.2 per cent in the December 2023 quarter.”

Insurance increased 0.04% on a weighted basis. The ABS commenting that:

“Insurance had a strong quarterly movement of 3.8 per cent, following the 2.8 per cent rise in September 2023 quarter. The increase in Insurance was due to higher premiums across motor vehicle, house and home contents insurance. Over the past twelve months Insurance rose 16.2 per cent, making it the largest annual rise since March 2001.”

Overall, dwelling-related and linked costs have contributed significantly to inflation over the last year, as these examples indicate. The drivers might be shortages of rentable dwellings on the one hand, materials costs on the other and the ever-growing costs associated with natural disasters and other events, including the impacts of climate change.

Some of these drivers could play a long-term role in elevating inflation in future and may be challenging to address.

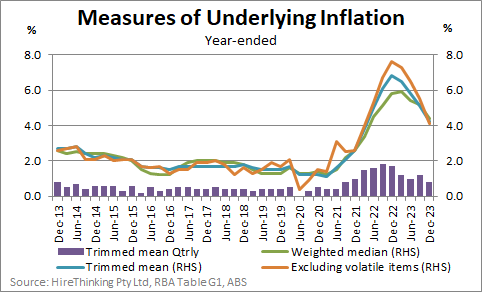

An examination of the level of underlying inflation indicates that overall, the results for the quarter were very promising in terms of the outlook for interest rates. The measure of underlying inflation the RBA watches closely is the Trimmed Mean, which strips out the ‘noise’ from irregular or temporary price changes. The annualised Trimmed Mean CPI was 4.2% in the December quarter, down from 5.1% in the September quarter.

Significantly, in response to the poor September quarter results, the RBA increased interest rates a further 0.25% and revised their forecasts for inflation and monetary policy.

The November forecast for the December quarter 2023 was increased to 4.5% with the return to the target band of 2-3% per annum, extended into 2025. Effectively, the RBA at that time, forecast inflation as having a ‘higher for longer’ outlook.

The good news from this quarterly CPI data is the actual Trimmed Mean was lower than the forecast at 4.2%, suggesting that the trajectory for inflation is easing faster than was expected in late 2023.

This has prompted a variety of responses from commentators but general agreement that official interest rates may have peaked. A measured response from Sean Langcake, an Economist at Oxford Economics was referenced by John Kehoe in the Australian Financial Review commenting:

“We expect we have reached the peak of the rate hike cycle and rates will be kept on hold at the RBA’s February meeting. But with cost-of-living measures due to roll off and underlying inflation still above target, we do not expect to see rate cuts until late 2024.”

However, the flip side is the toll being inflicted on the economy as interest rate rises continue to impact demand and the economic activity that supplies it.

The ABC’s Michael Janda specifically referenced the concerns raised by Innes Willox, the CEO of the AiGroup. Janda reported Willox as saying:

“…that many businesses are feeling the pinch, and accuses the Reserve Bank of lifting rates too far, especially with its last rate rise in November that took the cash rate from 4.1 to 4.35 per cent. The warning arising from today’s announcement is that the economy may be slowing too rapidly and we may be looking at a hard rather than a soft landing.”

That is now where attention seems focussed. That is, will Australia find its way to a soft landing, or will it bang into a recessionary floor because perhaps, the RBA was too eager to keep yanking on its interest rate lever. An interesting and critical year ahead.