Is a reciprocal tariff an appropriate response? The trade balance of logs and wood products between Australia and the US (2015-2024)

This article is produced by FWPA’s Statistics and Economics program.

Over the past decade, from 2015 to 2024, Australia’s trade in logs and wood products—both imports and exports—has experienced notable shifts, particularly during the COVID-19 pandemic years. Despite these fluctuations, our primary trading partners for both softwood and hardwood have remained consistent. Key countries such as China, New Zealand, and several Southeast Asian nations, including Malaysia and Indonesia, continue to play significant roles in Australia’s timber trade.

In this context, attention is now toward the United States, especially in light of recent policy changes. Under the US laws in the section 232 of the Trade Expansion Act of 1962, the wood products industry has been designated as a critical manufacturing sector essential to the national security, economic strength, and industrial resilience. This industry plays a vital role in key downstream, including construction. Therefore, the new tariff is viewed as a protective measure in the domestic wood supply chain against imported products.

In the new tariff measures introduced by the US government, Australia faces a 10% tariff on all exported goods to the US, including logs and wood products. This policy presents a significant challenge to Australian exporters and raises questions about reciprocal trade measures.

Given the impact of this tariff, a key policy question arises: Should Australia respond by imposing an equivalent 10% tariff on logs and wood products imported from the United States? This decision will require careful consideration of trade balances, the broader implications for the timber and forestry industries, and Australia’s long-term economic relationship with the US.

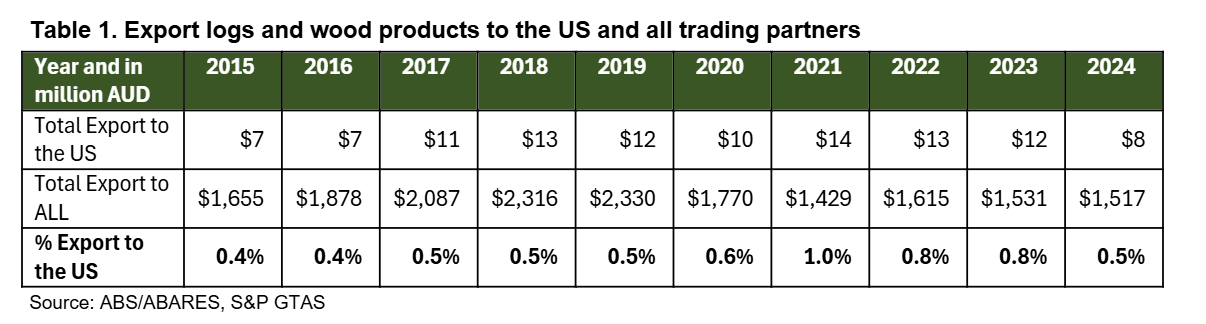

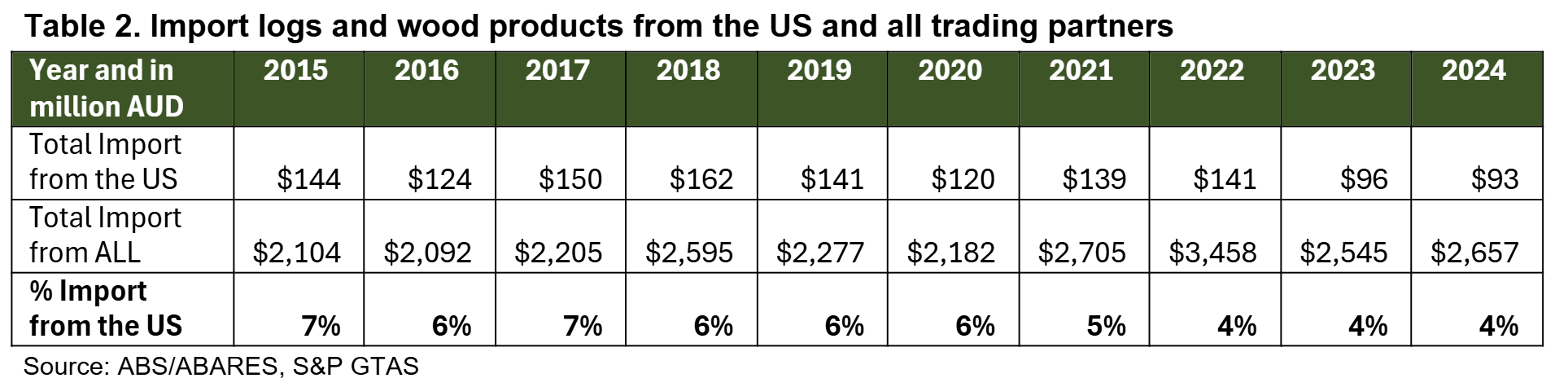

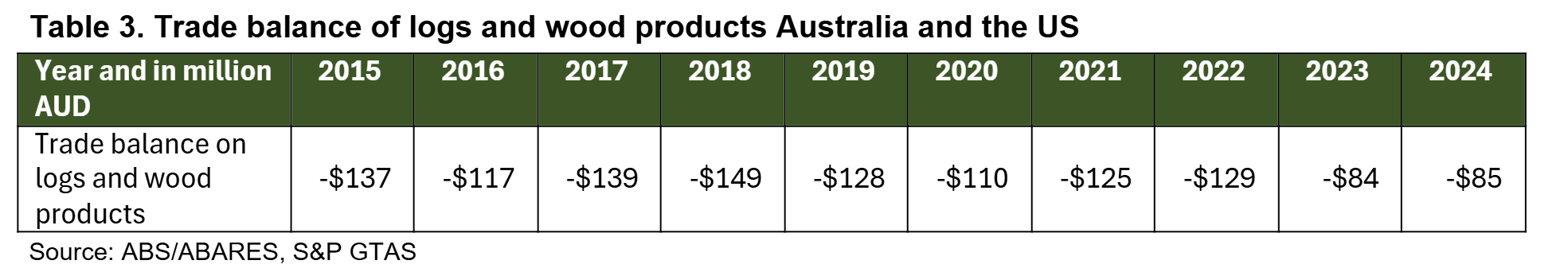

The tables below summarise export and import activities in the last ten years.

Key points:

- Logs and wood products exported from Australia to the US are not substantial, with an average value of AUD10 million and less than one percent of the total export.

- In terms of imports, some products from the US to the Australian market include builders’ joinery, carpentry wood, plywood, and veneer. In the last ten years (2015-2024), Australia imported around AUD130 million from the US.

- However, the US import trend has been declining over the last ten years, with the proportion of US imports out of all imports dropping from 7% in 2015 to 4% in 2024.

- Overall, the Australian trade balance of logs and wood products with the US has consistently shown a deficit over the past ten years, although this trend is declining from approximately $137 million in 2015 to around $85 million in 2024.

The 10% tariff imposed by the United States on Australian wood products is expected to have several implications for trade dynamics and consumer markets. For the US domestic market, this tariff will likely result in higher prices for wood products sourced from Australia, as the additional cost is anticipated to be passed on to end consumers. This could pressure the US housing and construction sectors, particularly for projects that rely on imported timber to supplement the domestic supply.

Conversely, any reciprocal move by Australia, such as imposing a matching 10% tariff on wood and log imports from the US, would similarly raise prices for Australian consumers. However, the impact of such a policy would be disproportionate. This is primarily due to the significant imbalance in trade value: Australia imports more than ten times the value of wood products from the United States than it exports to them. As a result, Australian industries and consumers would likely bear a more significant economic burden if a reciprocal tariff were implemented.

About FWPA’s Statistics and Economics program

FWPA’s Statistics and Economics Program provides reliable industry data to support stakeholder decision making and business planning across the forest and wood products industry. Learn more about the range of tools we provide, including the new FWPA Data Dashboard, via this link.