Sales of locally produced sawn softwood products declined 5.8% over the year-ended March 2023, falling to 2.952 million m3, resting below the 3.0 million m3 mark for the fourth consecutive month. Structural grades have – for the most part – led sales lower, with packaging, poles and other grades sustaining their market presence.

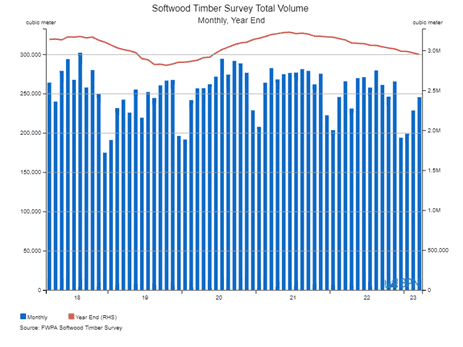

The first chart shows aggregate monthly local sales and the red line displays the annual sales volume. It is clear that annual sales ramped up relatively quickly to peak in mid-2021, before a more gradual decline.

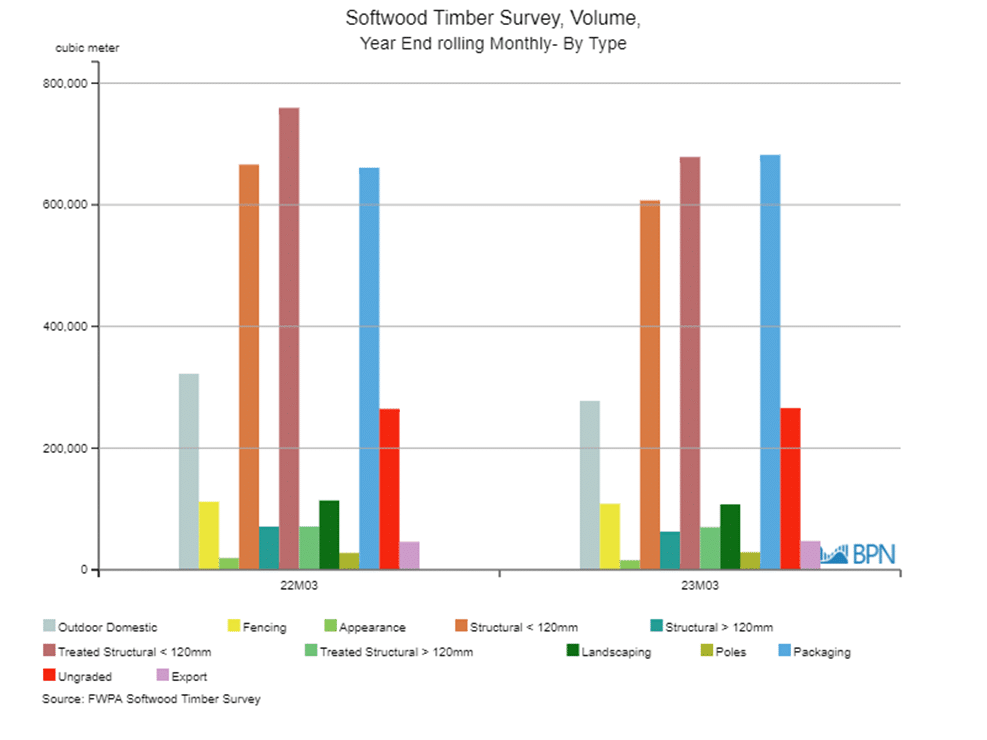

Structural grades continue to represent the largest sales volume, on a combined basis. As the table below shows, all structural grades recorded lower sales over the year to the end of March.

|

Grade |

2022M03 |

2023M03 |

% Change |

|

Outdoor Domestic |

322,191 |

277,604 |

-13.8% |

|

Fencing |

111,881 |

108,498 |

-3.0% |

|

Appearance |

19,253 |

15,658 |

-18.7% |

|

Structural < 120mm |

666,074 |

607,210 |

-8.8% |

|

Structural > 120mm |

71,115 |

62,862 |

-11.6% |

|

Treated Structural < 120mm |

759,353 |

678,556 |

-10.6% |

|

Treated Structural > 120mm |

71,109 |

69,939 |

-1.6% |

|

Landscaping |

113,994 |

107,618 |

-5.6% |

|

Poles |

27,640 |

28,887 |

4.5% |

|

Packaging |

660,951 |

682,046 |

3.2% |

|

Ungraded |

264,386 |

265,834 |

0.5% |

|

Export |

46,094 |

47,395 |

2.8% |

|

Total |

3,134,041 |

2,952,106 |

-5.8% |

For all that the big volume structural grades led sales lower, other grades have fared worse. Most notable is the Appearance grade, which continues to trend toward obscurity, with annual sales down 18.7% to just 15,568 m3.

Similar declines – though not a grade in long-term decline – were recorded for Outdoor Domestic (down 13.8% over the year). This grade’s trends are usually cyclical and there is no evidence that has changed.

As the table and the chart below show, there are some grades that continue to do well in the current sales climate.

Strongest of those – and to be clear, now the largest of the sales grades – Packaging saw its sales rise 3.2% over the year-ended march, to total a record 682,046 m3. It now accounts for 23.1% of total softwood sales!

Sales of Poles were up 4.5%, Export grade 2.8% and the ‘Ungraded’ grade was up 0.5%.

The sales situation is doubtless a function of the cycles and a sign of the specific times in which we find ourselves.

However, the trend lines for locally produced sawn softwood sales also speak to challenges in supplying timber packaging in Australia, and to the higher values that are being recorded for all sawn timber products in what remains a ‘fibre challenged’ global and local market.