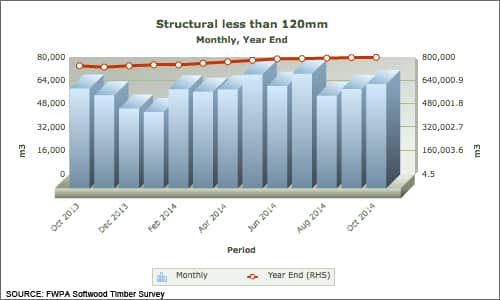

For the year to the end of October 2014, sales of sawn structural softwood were reported as 798,700 m3, having risen from 740,400 m3 for the year to the end of October 2013.

The 57,700 m3 year-on-year increase represents a 7.9% lift in sales on a year to year basis, consistent with growth in housing approvals and commencements.

However, as is demonstrated later in this analysis, this solid growth has been dwarfed by growth in sales of Treated Structural H2-F, the other major grade of sawn softwood.

Details of the last year’s sales of Australia’s largest volume sawn softwood products are displayed in the chart below.

To go straight to the dashboard and take a closer look at the data, click here.

Although this data shows solid improvements, it also details a flattening out of growth in sales in recent months. For instance, the rise in sales from September to October 2014 was a modest 0.4%.

Of interest in the short data series displayed in the chart above is that after October 2013, there were three successive months of sales declines. These are largely seasonal, as the next chart displays.

To go straight to the dashboard and take a closer look at the data, click here.

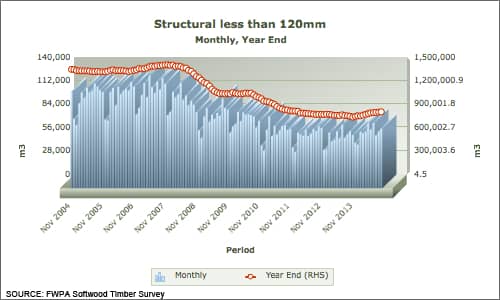

On first examination, this decadal chart appears to display a period of declining sales for Structural Softwood <120 mm. However, reference has to be made to other data extracted from the monthly Softwood Sales Survey for a full understanding of the market for structural softwoods.

In particular, the Treated Structural (H2-F) sales data needs to be examined. As the following chart shows, growth in sales of treated softwood has followed the opposite trajectory to those for the major untreated grade over the last decade.

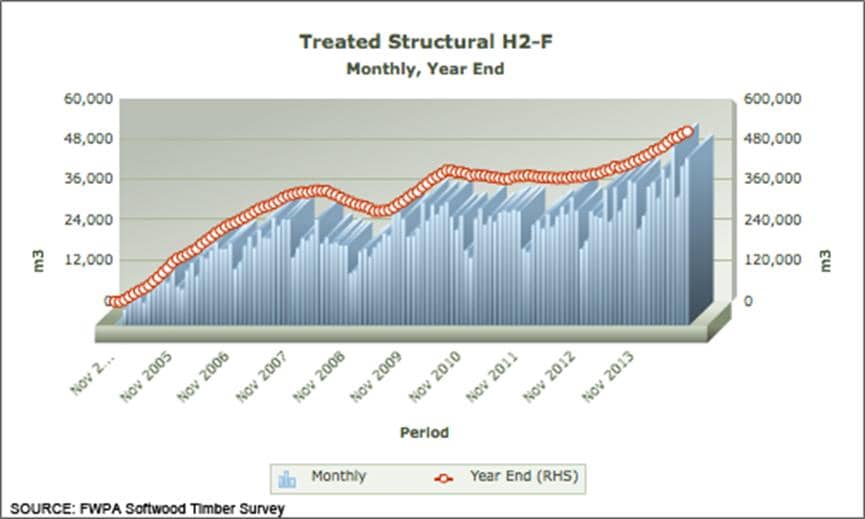

From negligible in 2004 to substantial in 2014, the growth in treated (either kiln or air dried) structural softwood has been strong and more or less continuous, except for the GFC period.

Treated Structural H2-F was introduced to the market in 2005 and by November 2005, sales had grown strongly to 16,800 m3. By October 2014, monthly sales totaled 49,600 m3. This has been the second highest monthly level recorded, after sales in July 2014 which reached 52,900 m3.

The growth in sales of Treated Structural H2-F to the year to the end of October 2014 was 23.6% compared with the year to the end of October 2013. That growth is almost exactly three times that experienced over the same period for untreated Structural Sawnwood <120 mm. The year to end October 2014 was the first year in which total sales of Treated Structural H2-F exceeded 500,000 m3.

It is evident from the data, as much as from industry intelligence, that some substitution is occurring from untreated to treated product. Of course, some caution needs to be exercised in comparing these data series. The definition of the Treated Structural H2-F grade is broader than the untreated Structural Sawnwood <120 mm.

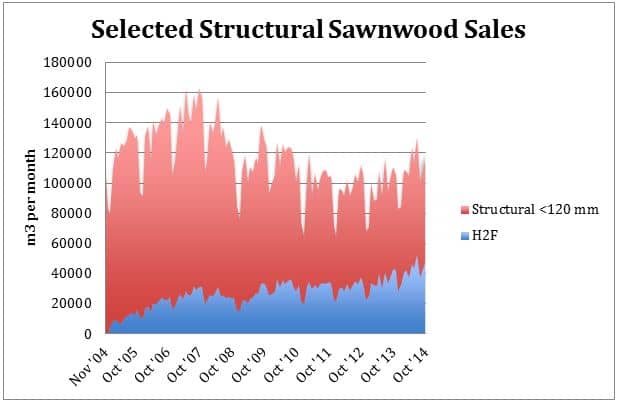

Nevertheless, combining the two sets of data available from the FWPA Economics & Statistics Data Dashboard is of interest, as the chart below shows.

It is evident that combined, these two major structural grades have been growing since the end of 2012 or the beginning of 2013. Confirming the differences in sales growth over the period, in January 2013, H2F hit a new record, accounting for 35.0% of total sales. By October 2014, it recorded another record, accounting for 41.0% of total sales.

Returning finally to the issue of seasonality, as outlined earlier, the charts display substantial seasonality, with every November in the decade recording lower sales than for October in the same year and likewise for December.

With a recovery in sales of these structural softwood grades underway and appearing relatively consistent, the seasonal sales data will be of interest over the next few months. The trend suggests that the seasonal decline must occur, but the more recent data suggests it will be softer than in recent years.

FWPA members can interrogate the data from the monthly Softwood Sales Survey, download finished charts and spreadsheets of data and review the data through the online database.