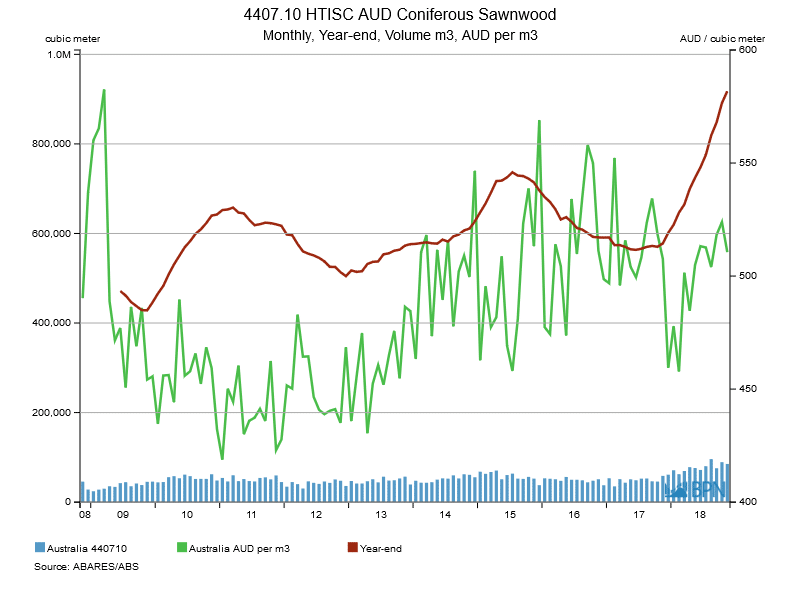

Imports of sawn softwood products lifted to a record 917,914 m3 over the year-ended November 2018. The rise of 58.9% compared with the prior year was dominated by structural grades, especially the main dressed grades.

As the chart below shows, total sawn softwood imports have risen through three peaks over the last decade. Both of those – in 2010 and 2015, were relatively short-lived. That does not diminish their importance to the market and its dynamics, but the similarities include they peaked and fell relatively quickly, without much of a plateau.

To go straight to the dashboard and take a closer look at the data, click here.

It is unclear to date, but the most recent import boom – they are up 330,000 m3 on the previous year – might prove to be different.

Statistics Count has discussed previously that one of the drivers for the rise in imports was the closure of the Morwell sawmill in late 2017. That may have accounted for about half – but probably less – of the rising import volume.

The remainder of the import rise requires some more consideration. Demand is still strong, especially in the most populous states, as the long pipeline of housing construction activity works its way through the economy. But housing approvals are declining, which will likely flow through into reduced demand for sawn softwood products at some point in 2019.

Normally, that would cause the flow of imports to decline as the market readjusts to the new demand position. But that may not happen in this instance, for a variety of reasons that include both local production dynamics and global demand and supply dynamics.

Almost 71% of all imports (648,000 m3) imported over the year-ended November 2018 was made up by three import designations. Combined imports of these three grades rose 84.6% on the prior year.

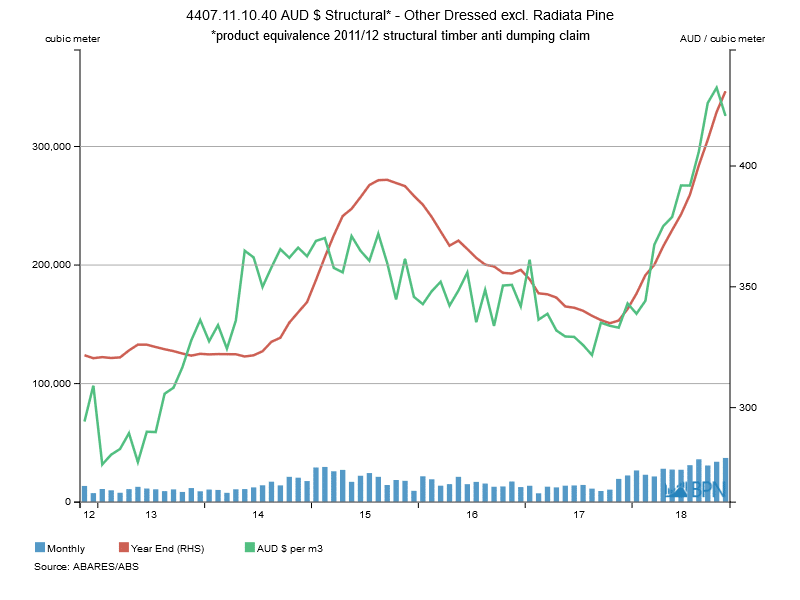

The first and most significant import line is Dressed Structural (Untreated), other than Radiata. Because imports of this grade exclude Radiata, virtually all shipments are from Europe. Imports lifted 126.4% over the year-ended November, to total a record 346,734 m3.

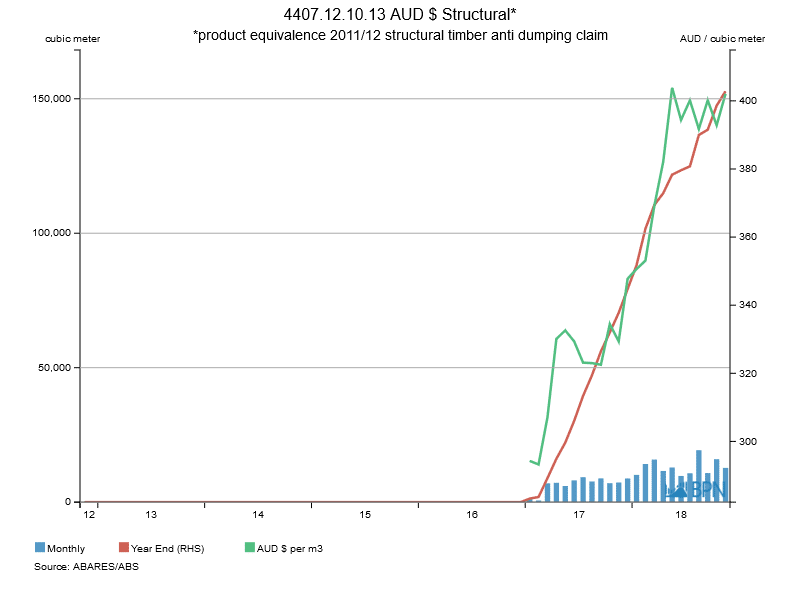

The first chart shows imports on a monthly and year-end basis, along with the average import price (measured in AUDFob/m3).

To go straight to the dashboard and take a closer look at the data, click here.

The apparently close correlation between annualized imports and average import price is notable. It is not clear which is the leader in all instances, but it is reasonable to assert that import volumes are sensitive to price. In that context, it is also reasonable to state that had the average import price not risen over the previous year to AUDFob420.66/m3 in November 2018, import volumes would have been unlikely to reach these new record levels.

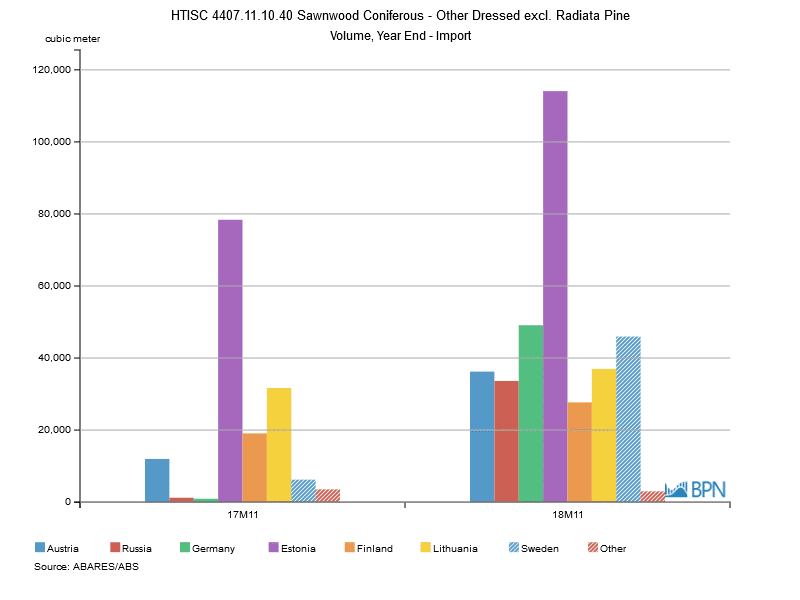

All of the significant suppliers are European and all grew their import positions over the year, as the second chart shows.

To go straight to the dashboard and take a closer look at the data, click here.

In sheer volume terms, Estonia lifted its imports most significantly, but from Austria to Sweden, the upturn allowed every importer more volume.

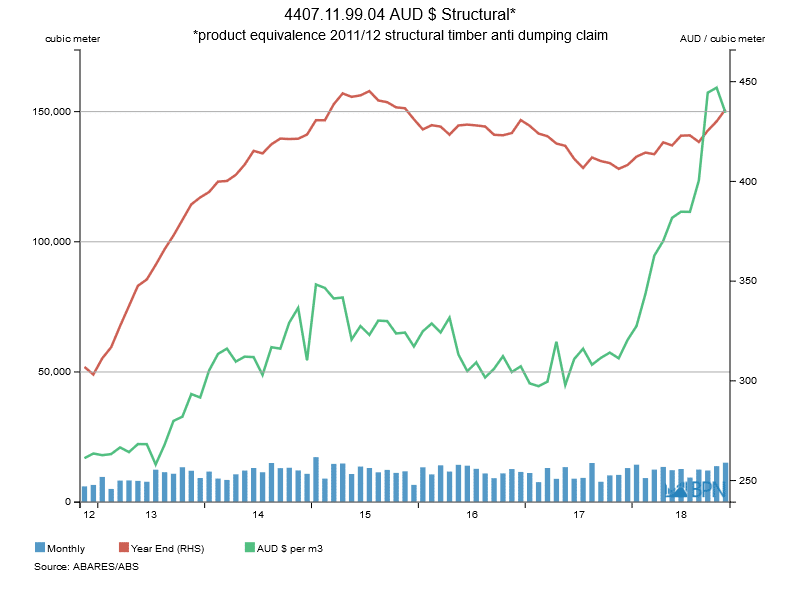

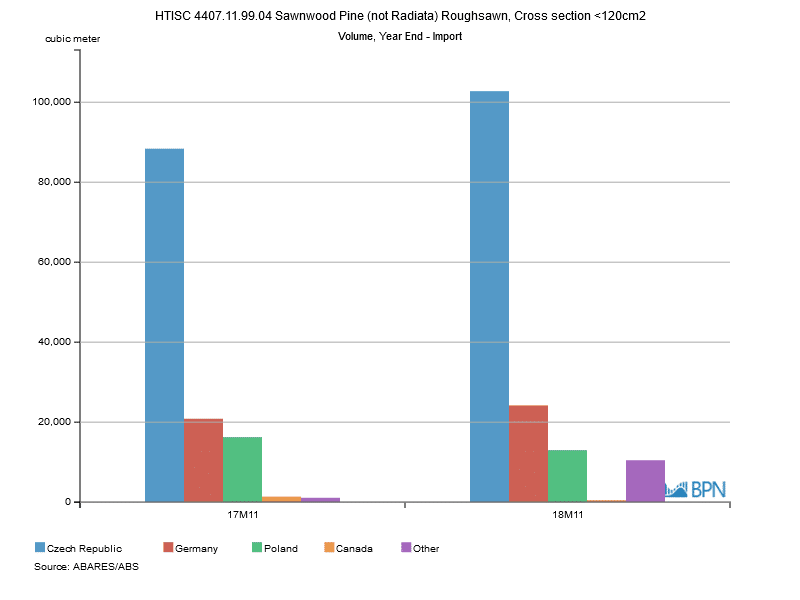

Imports of Roughsawn Structural (Untreated), other than Radiata has similar European supply lines, but with the addition of Canada. Although growth in imports was somewhat restrained (up 17.9%) over the last year, imports totalled 150,935 m3. As the chart below shows, this is still below the annual records set in mid-2015.

To go straight to the dashboard and take a closer look at the data, click here.

The chart is remarkable not because of the lift in volume, but because despite its solid but modest growth, the average price of imports has risen quickly and rapidly passed its previous peak. In November 2018, despite a downturn on the prior month, the average import price was at AUDFob434.40/m3. That is, the average roughsawn price was higher (not by much) than the average price for the dressed equivalent.

It is mainly different countries influencing this market, with the Czech Republic dominating and appearing to gain market share against Poland, among others.

To go straight to the dashboard and take a closer look at the data, click here.

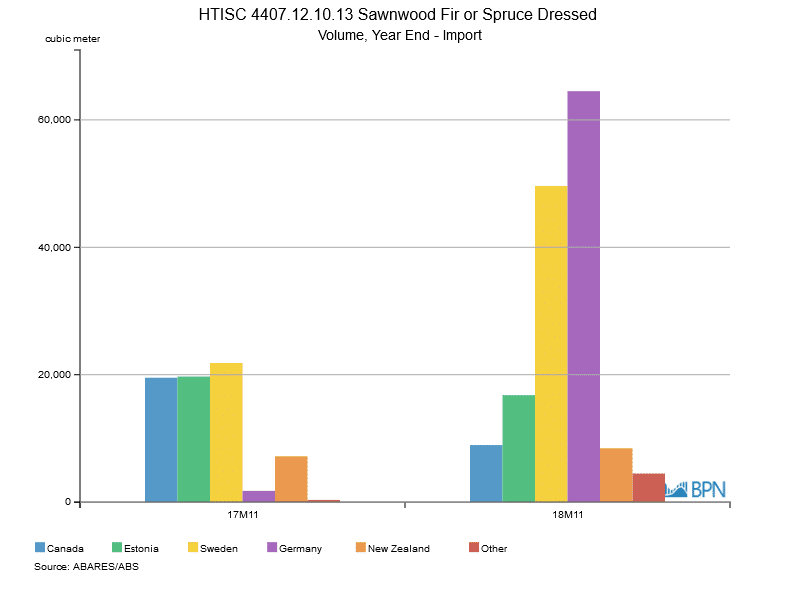

The third large volume import grade is Dressed Structural, Fir or Spruce. This can be one of those import designations against which a range of products could be imported. It is however a structural import designation. It is also a new import code, introduced in January 2017 to distinguish between coniferous species. We therefore have to be cautious in our application of analysis.

At a headline level, imports of this grade lifted 117.1% over the year-ended November, but were probably slightly less than that due to the prior year only having eleven months to count.

However, total imports clearly lifted by something greater than 100% over the full year, with imports totalling 152,852 m3 year-ended November 2018.

To go straight to the dashboard and take a closer look at the data, click here.

The chart tells all of the volume story, but it also tells – as is the case for the other grades – a price story that is difficult to escape.

A sharp rise in imports was met by a long run of successive average price increases that rose as the volume rose, until the early part of 2018, since which the price has found its reasonable equilibrium. In a consistent story, in November 2018, the average import price was AUDFob402.10/m3.

To go straight to the dashboard and take a closer look at the data, click here.

Unlike the other grades, in this case, Germany and Sweden won market share over their Canadian and Estonian counterparts over the year. The Canadians have been busy supplying the North American market, and without even considering the rest of the world, the Estonians have delivered significantly more wood into Australia over the year, with this grade suffering slightly, as others grew dramatically.

So, what we know is that sawn structural softwood imports have grown very dramatically over the last year. We also know that supply has largely come from Europe and has been delivered at higher prices, at least in Australian dollar terms.

We can reasonably surmise that imports would not have been so extensive had prices not increased, but of course, demand also had to be strong enough to sustain the imports. Demand for imports came about in part because of domestic capacity closure, and it does seem that domestic capacity constraints also played a part in the rising import volume.

What remains to be seen is whether imports will decline when housing construction activity falls back. That seems likely, especially with the apparent sensitivity of imports to prices, but it is by no means certain that will occur.