Softwood Sales Volume

Note: More recent and granular data is available through the FWPA Data Dashboard.

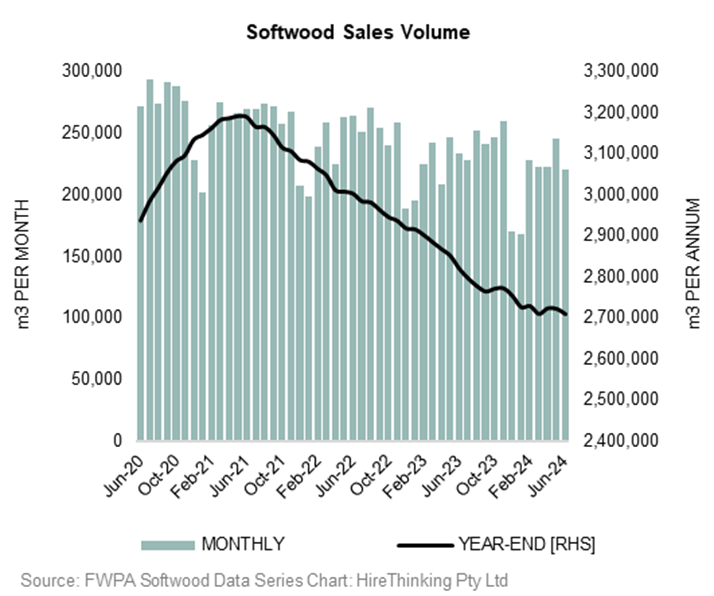

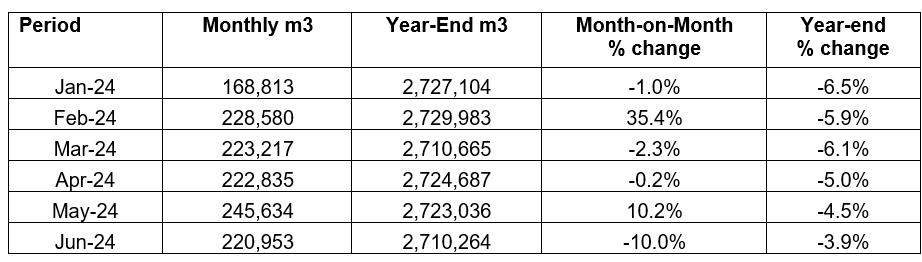

The June 2024 monthly softwood sales were 220,953m3, down 10.0% from the previous month. However, the monthly data continues to move around, with increases in May and February offset by negative periods. The more stable year-end measure shows a progressive decline in sales volume since May 2021, when sales peaked at 3.19 million m3. In June 2024, the year-end volume was 2.71 million m3, a decline of some 481,784 m3.

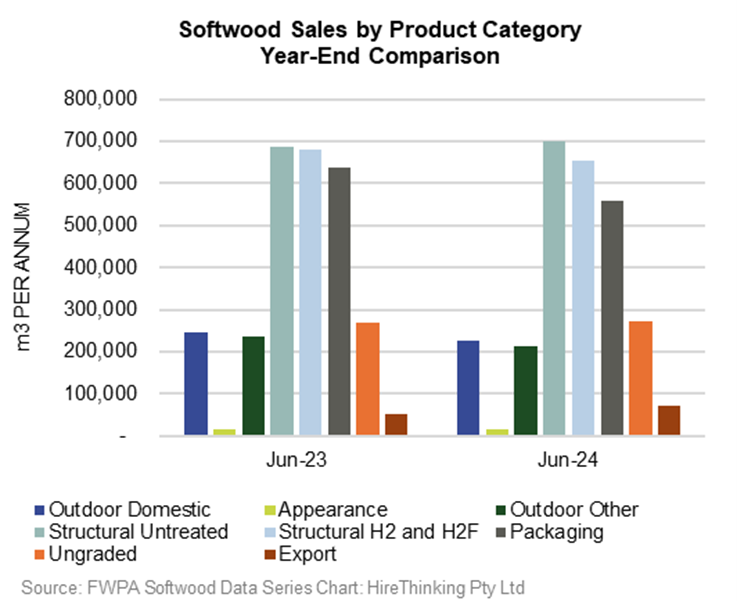

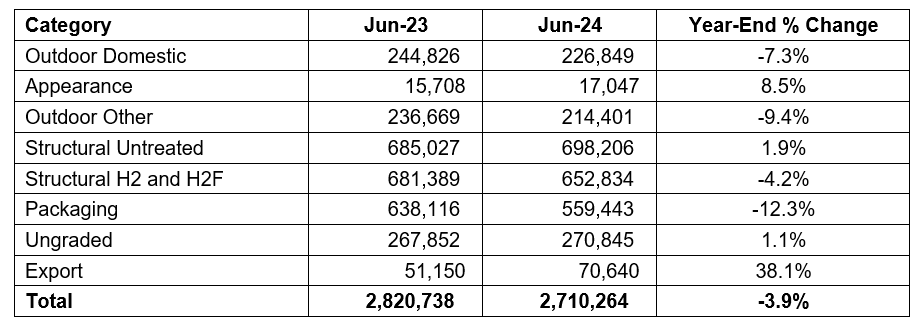

Looking at the product categories a clearer picture emerges of the gains made by some of the product groups compared to losses in other categories.

Importantly, structural sales remain the biggest category by volume, with sales of structural untreated up 1.9% compared to the previous period and structural treated down 4.2%. The decline in packaging is more complicated and may reflect a reallocation of volume into ungraded, which was up 1.1%, and exports, 38.1%.

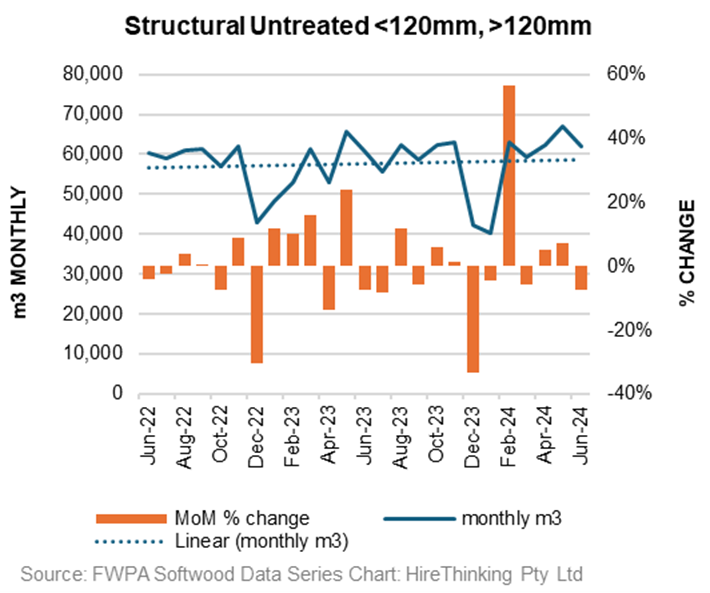

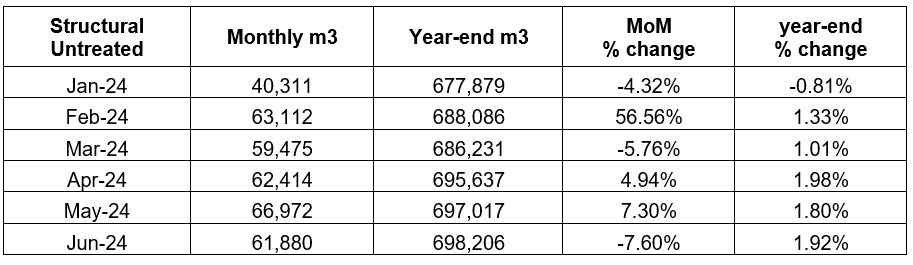

If we look at the Structural Untreated products, monthly sales over the past six months have fluctuated, with 3 negative months and 3 positive months. However, the gains in February 2024 were significant, with sales up 56.6% from January.

The trend line during this period is relatively flat.

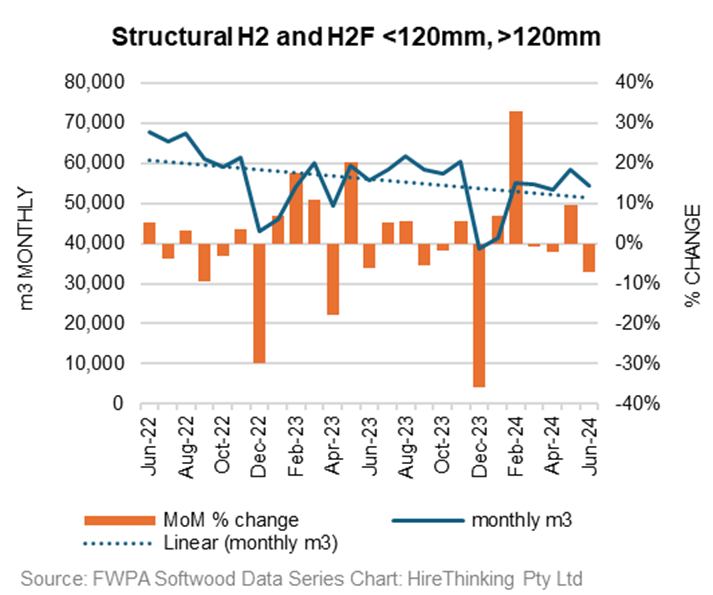

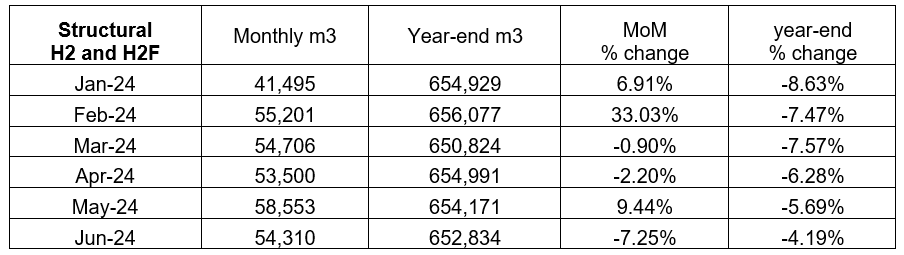

Structural-treated products have also seen 3 positive months and 3 negative months over the last 6 months. Again, reflecting the seasonality of January, there was a big bounce back in sales in February, with a gain of 33%. However, the overall trend position remains negative.

Softwood Weighted Average Prices

Note: More recent and granular data is available through the FWPA Data Dashboard.

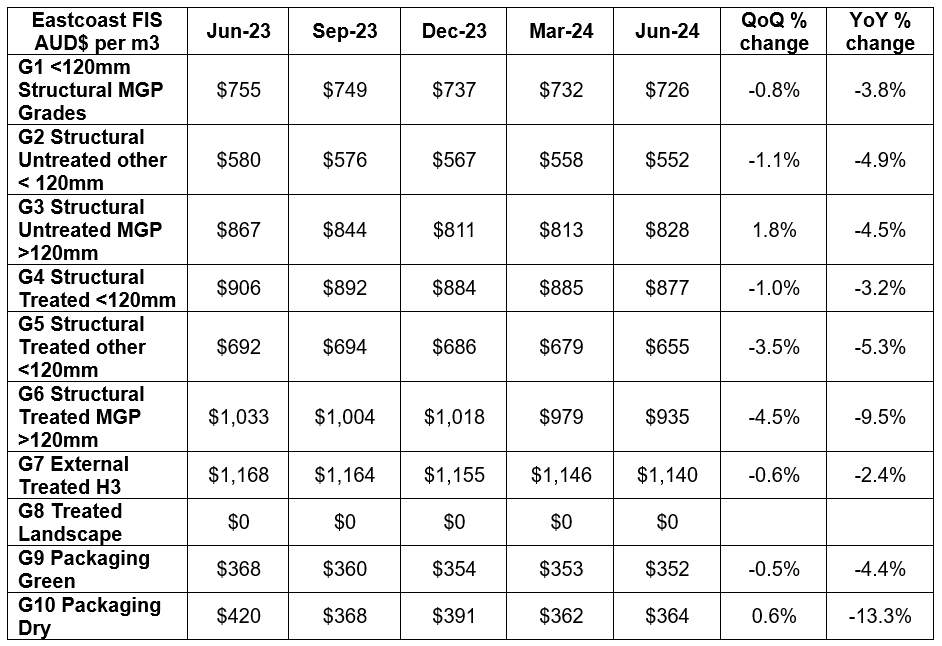

A summary table of the 10 product groupings covered in the FWPA weighted average price data series shows that prices continued stabilising during the June quarter 2024, with generally moderate declines.

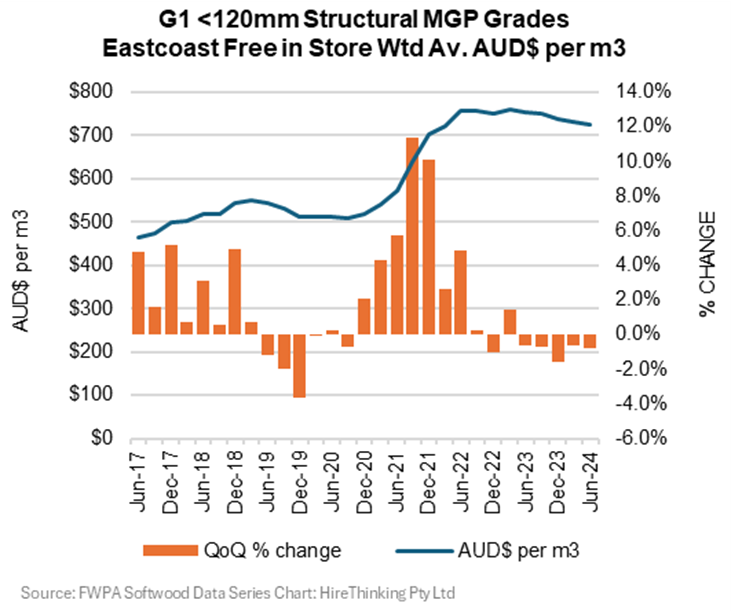

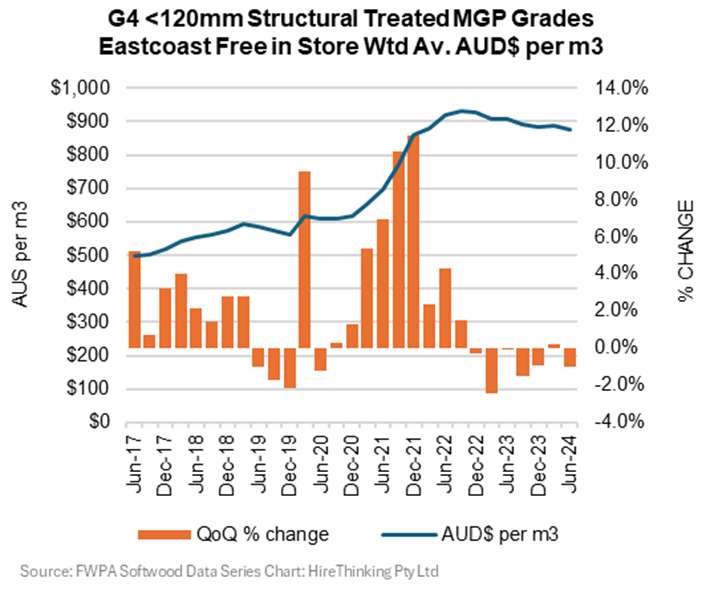

The largest products by sales volume are G1 (Structural Untreated <120mm MGP grades) and G4 (Structural Treated <120mm MGP grades). These products cover most of the structural framing used in residential detached dwelling construction.

Reflecting the impact of the COVID 19 stimulus housing boom and the shortage of all building materials during that period prices accelerated steeply from March 2021 before plateauing in June 2022. Since then, prices have eased with declines experienced in each of the last 5 quarters.

The equivalent treated product G4 reflects a similar trend.

In the June quarter 2024, prices were down 1.0%, with falls outnumbering gains over the past seven quarters dating back to September 2022.

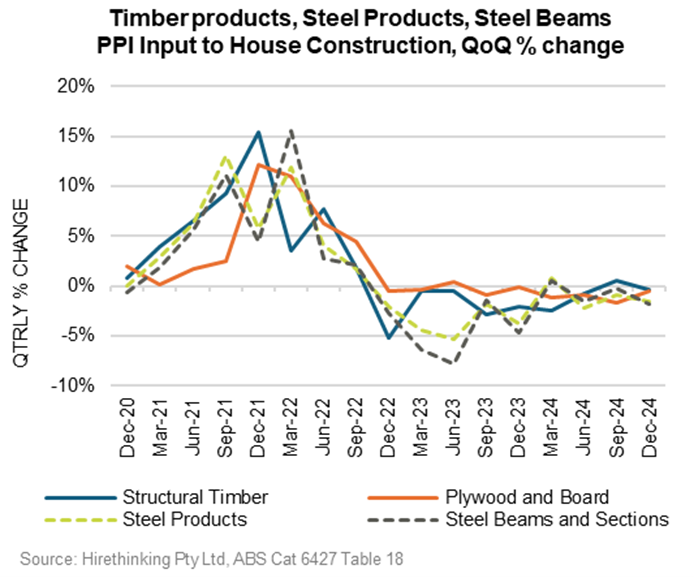

This trend is consistent with the ABS Producer Price Index, which provides some insight into building material price movements. The current structural materials index shows similar price movements.

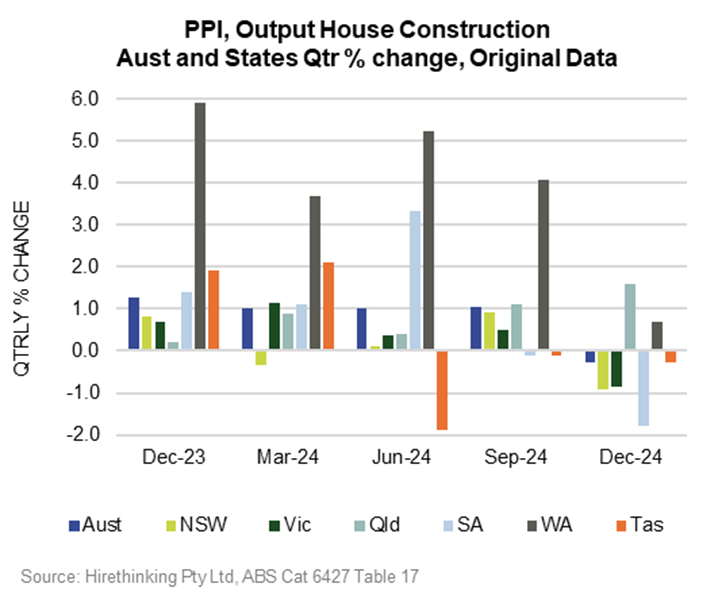

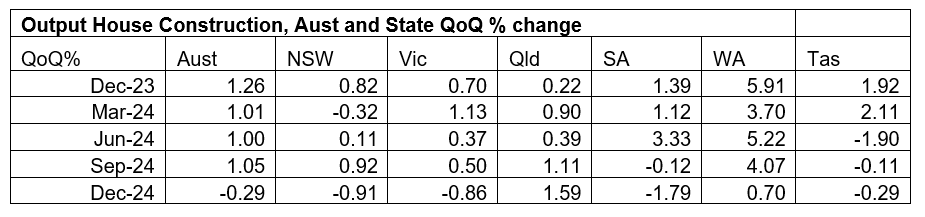

Affordability is also improving more generally for housing, with the Producer Price Index for the December quarter 2024 showing a decrease for Australia of -0.29% in the output of house construction, the first negative quarter since June 2020.

Output prices were down for NSW, Vic, SA and Tasmania. The ABS commented that “…affordability concerns have negatively affected demand for house construction across most states. To attract customers, builders have increased promotion activity, reducing prices.”

The reduction in interest rates following the RBA’s decision to lower the official cash rate to 4.10% on 18 February 2025 should also improve affordability over coming months.

Subscribe to updates from FWPA’s Statistics and Economics Team:

To receive regular updates on data and analytics relevant to the forest and wood products industry, you can subscribe via this link.