This article is produced by FWPA’s Statistics and Economics program.

The quarterly lending indicators, published by the Australian Bureau of Statistics (ABS), reflect new loan commitments made by lenders for both housing and business finance. Within the housing finance category, lending is further broken down into three key borrower groups: owner-occupiers, first-home buyers, and investors.

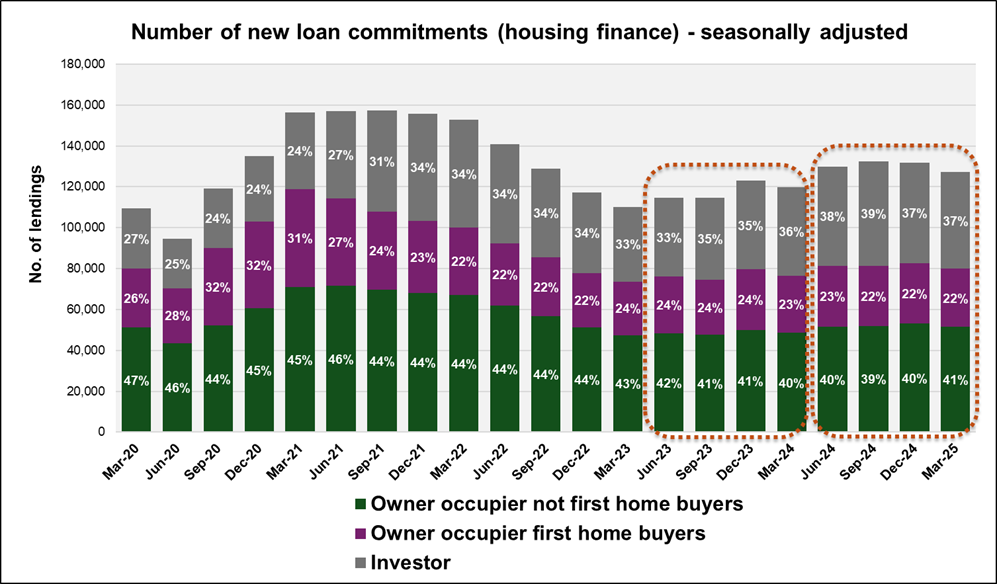

According to the ABS’s latest release of lending indicators for the March quarter 2025 (Q1 2025), year-on-year comparisons (aggregated across four quarters) show a general upward trend in housing finance commitments.

Between March 2023 – March 2024 and March 2024 – March 2025, the number of loan commitments for owner-occupiers grew by 7%, increasing from 194,531 to 208,134. First-home buyers within the owner-occupier category recorded a more modest rise of 4%, growing from 112,358 to 116,968. Notably, investors showed the strongest growth among the three groups, increasing by 19% over the same period.

These figures suggest a continued recovery and renewed activity in the housing finance market, particularly among investors. Figure 1 and Table 1 summarise the trend.

Figure 1: Number of new loan commitments

Source: ABS, FWPA analysis.

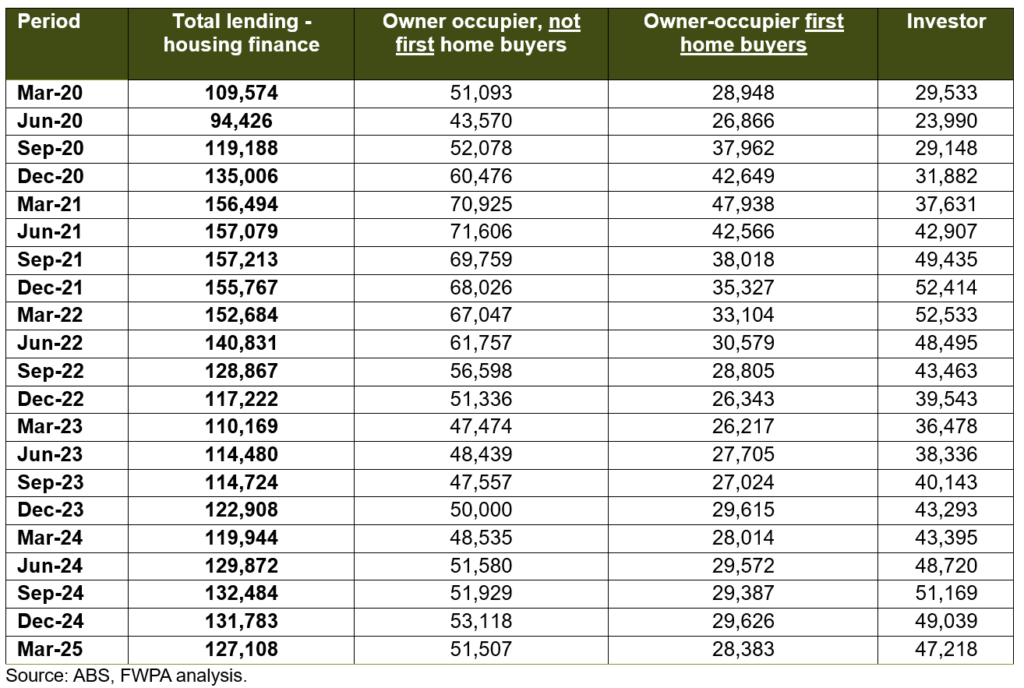

Table 1: Number of new loan commitments (quarterly)

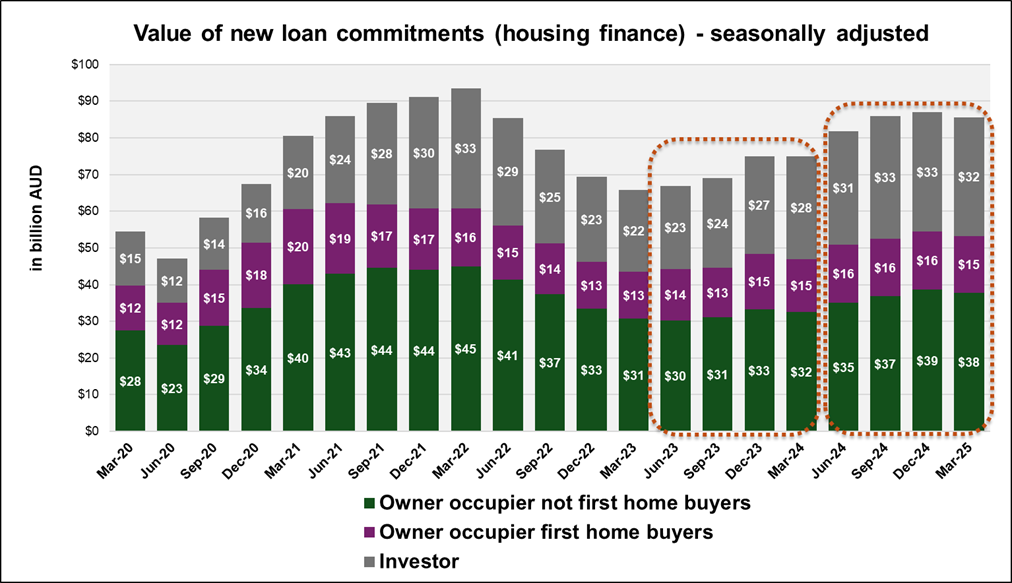

In terms of the total value of new loan commitments, the trends observed during the same period are similar to those seen in the number of commitments. The owner-occupier segment experienced a substantial increase in lending value, rising by 17% from $127 billion to $148 billion. For first-home buyers within the owner-occupier category, the total value of commitments increased by 10%, increasing from $57 billion to $63 billion. This more modest growth suggests steady but cautious activity among new entrants to the property market, likely influenced by affordability constraints and broader economic conditions.

The most significant growth was observed in the investor segment, where the total value of new lending commitments surged by 27%, from $102 billion to $129 billion. This sharp increase highlights more favourable investment conditions, including rental market dynamics and price expectations.

These movements in lending values highlight the overall strengthening of the housing finance market across all borrower types. Figure 2 and Table 2 summarise the figures.

Figure 2: Value of new loan commitments in billion AUD

Source: ABS, FWPA analysis.

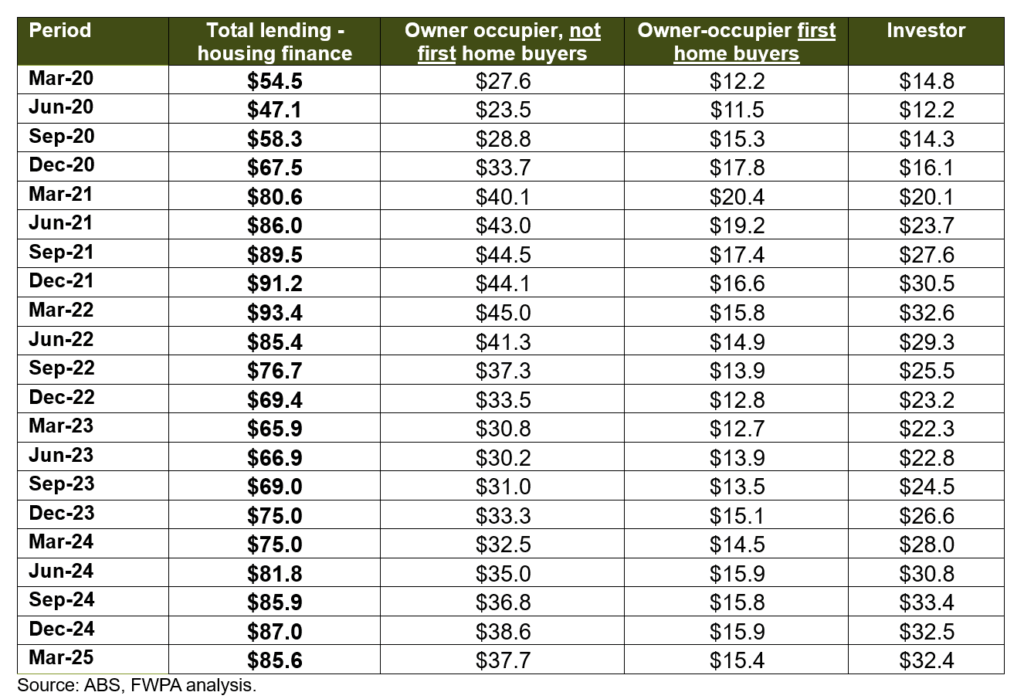

Table 2: Value of new loan commitments (in billion AUD)

Recent interest rate cuts and the prospect of further reductions this year are expected to boost housing finance activity by enabling borrowers to access larger loans. This is likely to result in an increase in loan commitments and upward pressure on property values. At the same time, increased access to finance supports residential construction, particularly for detached homes and low- to mid-rise residential, stimulating economic activity and employment across the sector.

However, while demand for housing finance tends to respond quickly to lower interest rates, the supply of new housing often lags. Ongoing challenges in the construction sector, including shortages of skilled labour, material constraints, and extended completion times, continue to delay new housing deliveries. As a result, housing markets may tighten in the short term, particularly in high-demand areas.