We would all be forgiven for thinking that the Australian Bureau of Statistics (ABS) gets a lot wrong, a lot of the time, such is the noise surrounding an error in Australia’s employment data.

Due to a change in questions asked in the monthly employment survey, it appears that many survey respondents have been inadvertently describing themselves as employed, when against the definitions, they are not.

The result is that the ABS has been forced to declare its employment numbers unreliable, to drop the seasonal adjustments measure it uses to smooth employment over a year, face questions in the Senate estimates process and conduct a review of its processes and outcomes.

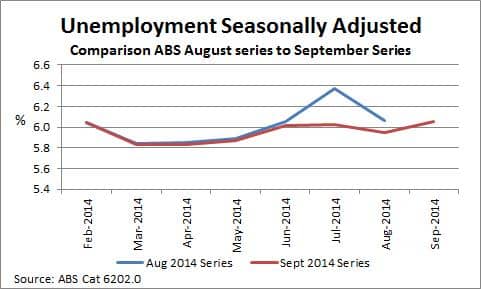

By comparing the ABS Unemployment Series for August to the most recent release in September one can see that significant changes have been made to the data for July and August. Instead of a decrease in unemployment from 6.4% to 6.1% those entries have now been “normalized” at 6.0% resulting in a slight increase in the unemployment rate from 6.0 to 6.1% in September. The comparison is shown in the following graph:

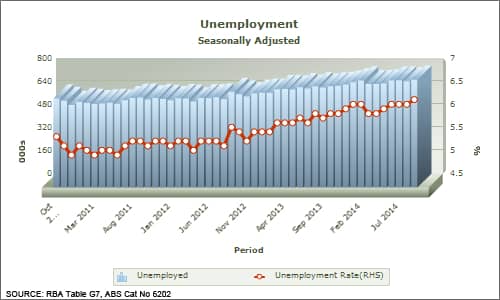

For the record, in September 2014, the ABS recorded that 747,000 Australians were unemployed and the unemployment rate was 6.1%. On the other side of the ledger, the FWPA data dashboard records continuing rises in the number of people who are employed on a part time basis, but a declining participation rate (those in or actively seeking employment).

To go straight to the dashboard and take a closer look at the data, click here.

However, for the national statistical agency, the confidence draining public debate about the veracity of its data comes amidst financial challenges.

That is all bad enough, but the real risk is far greater than loss of organizational reputation. Reliance on high quality public headline economic data is critical to investor confidence, both here and internationally.

As a recent front page article in the Australian Financial Review (AFR 9/10/14) observed, “The debacle threatens to damage Australia’s reputation among international investors, who have often criticized countries such as China for publishing dubious statistics.”

Domestic governments and local and global investors alike, rely on headline economic data to make their decisions about the underlying and relative strengths of an economy. They are interested in the macro picture for a country long before they consider the very granular, business level data that informs most specific investment decisions.

Many of our client reports, for instance, start with macro-economic data from traditionally reliable national statistical agencies like the ABS.

There is doubtless concern inside the ABS that its recent amendments to the basket of goods measured for the Consumer Price Index will be found to be flawed in some way, but for the sake of social and economic confidence, we should hope that is not the case.

Confidence in the quality of economic growth measures and forecasts, inflation measures (for consumption, production and investment), employment data and a range of other indices is vital to sustaining robust capital flows and supporting rational business decision-making.

Of course, it is equally true that a wide range of other data is critical to business decision making.

The ABS conducts hundreds of data surveys more or less constantly. In addition, it collects, collates and reports data from other government agencies.

This latter group includes the merchandise trade data collected by Customs. Trade data relies specifically on raw data supplied by importers and exporters on declarations. It thus relies on the quality of the data that industries and specific businesses supply to it.

Although there are occasional grumbles, trade data is used extensively by Australian businesses to benchmark their own trade with the average. It is used to take the pulse of the market. That is why it makes sense that as much of the regular trade data as possible is available for analysis. .

For those involved in trade of wood products, the data is sufficiently important for alternative sources to be sought when data is unavailable. The best examples of that are the ‘redactions’ of data for woodchip and log exports.

As a result of currently applicable redactions, almost no data is available on woodchip and log exports, from the ABS. Customs collects data on a monthly basis, from each port, but all the ABS is able to report is the nation’s total softwood and hardwood exports by volume and value.

These redactions render the data essentially useless for most business applications.

When the woodchip export data was redacted in June 2013, there was a flurry of activity that resulted in IndustryEdge collating the same data from the statistics services of the countries of delivery (Japan, China and Taiwan and occasionally India, in the main) and commencing the tracking of the global woodchip shipping fleet.

The result is that the same data is being supplied, with some differences, and with even more data sets and points being available for analysis. Trade transparency and information was increased, not removed.

Most strangely is that we consider that all of the significant exporters (the only potential applicants to the ABS for the redaction to have been applied) subscribe to the commercial data service.

Thus, the redaction served no purpose other than to disrupt the reliable supply of public data.

It is not just the ABS that needs to keep its attention on the quality of its data. Industry has a role to play also and cannot complain about the quality of the outputs when it contributes poor quality inputs or causes the restriction of publication of meaningful data.

Tim Woods can be contacted at tim@industryedge.com.au or +61 3 5229 2470.