Latest value of building work data shows a continuation of declining activity, but equally, some of the indicators may be pointing to an early end to what historically, are significantly longer downturns. The downturn has – like those associated with approvals and housing credit – turned down across the board over the last year, but with declines that are smaller than the historical trend.

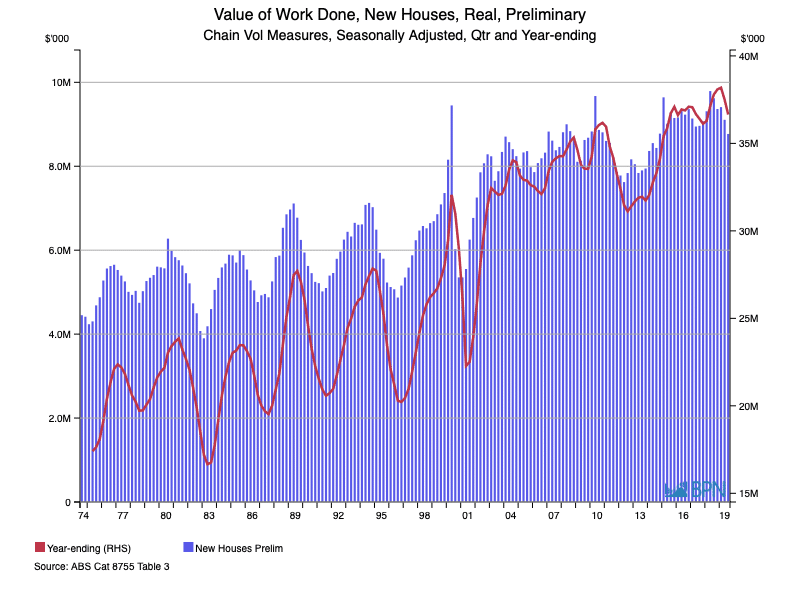

It is sometimes useful to examine very long-term data. In this first chart, the value of building work done on new houses allows us to look back to 1974. This quarterly data shows steadily rising building values that have, interestingly, seen flatter growth and less volatility since about 2002.

On an annualised basis, the value of work done on new houses was 3.0% lower year-ended September, than was the case a year earlier. However, in the September quarter, the value of work done in the sector fell 8.9% compared with the September quarter of 2018, dropping to $8.769 billion.

To go straight to the dashboard and take a closer look at the data, click here

The point of the long-run chart is the change in trend patterns and the declining volatility in the value of building work on new houses. But what about the other dwelling formats? Have they behaved in the same way?

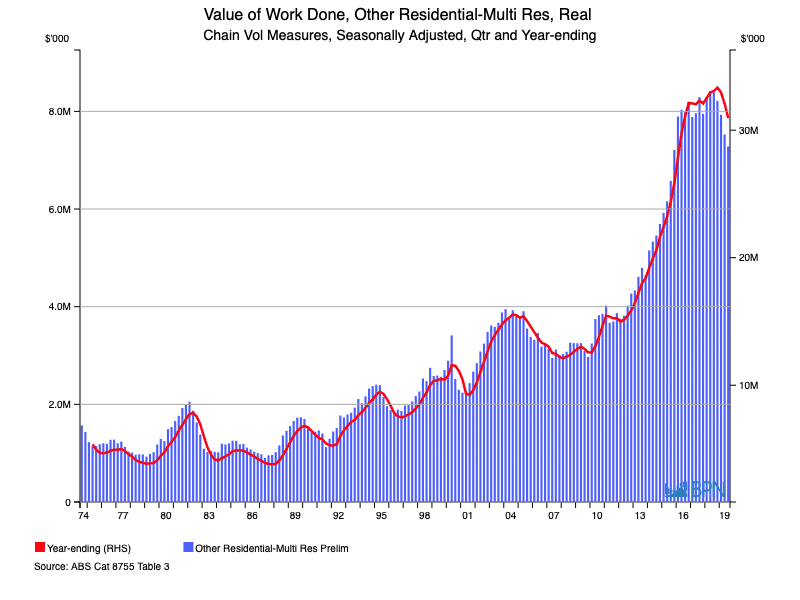

Using the same long-run data approach, we can observe there are several notable differences for building work done in the aggregated multi-residential sector.

First, we can see that the period through to 2002 when housing building work was very much boom or bust, that was less the case for the multi-residential dwellings. Smaller peaks and mainly shallower troughs dominated. Growth really commenced in the late 1980s as apartment living and ever-taller towers of apartments became the norm.

To go straight to the dashboard and take a closer look at the data, click here.

Second, we can observe that the big, continuous and long lift in the value of building work in the multi-residential sector started around the end of the GFC in 2009 and other than pausing for breath in 2011, only really turned down since the start of 2019.

Third, unlike for houses, the lingering doubt must be, after such a long period of growth, whether there will be a dramatic period of decline in the value of building work. That seems unlikely as there are multiple dwelling formats populated in this category and they do not operate to exactly the same cyclical or specific drivers. For instance, infill townhouses in capital city fringes are very different to speculation fuelled 4+ Storey apartments.

In the September quarter, building work done was valued at $7.283 billion, down 13.3% on the September quarter of 2018. Annualised data shows the value done 6.4% $30.996 billion. How long will the decline last? That is very hard to say, but at least another few quarters.

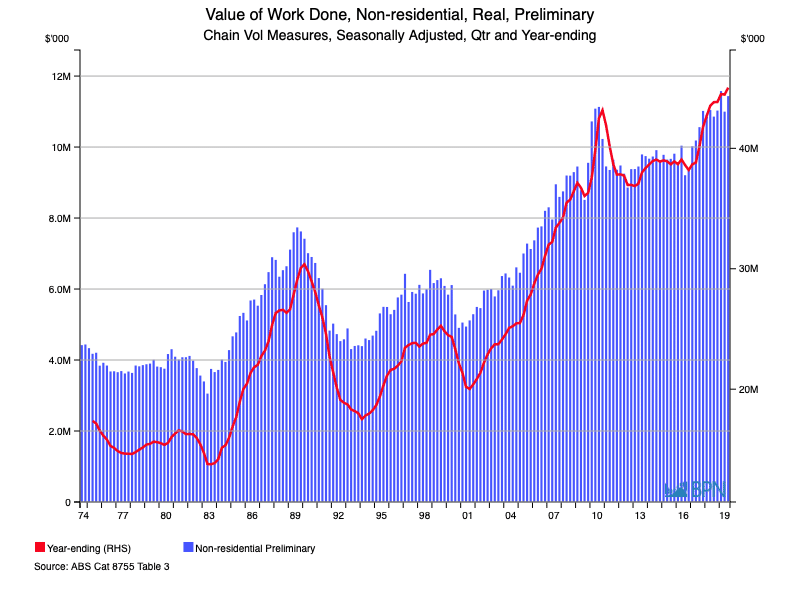

Finally, we take a brief look at the long run data for building work done in the non-residential sector. The value of this work has continued to climb since 1974, and in fact, unlike for dwellings, was at record levels in the September quarter as the chart below shows.

To go straight to the dashboard and take a closer look at the data, click here.

On an annualised basis, activity in non-residential building was valued at $45.037 billion year-ended September, up 2.8% on a year earlier. Considered from a quarterly perspective, the September quarter’s activity of $11.435 billion was up a firm 5.3% on the September quarter 2018.

It is not clear how long the current upswing in the value of non-residential building work will last. The trend suggests it has some time to run yet.

The building sectors are not exact replacements for one another. There is still economic churn when the housing market is down and the non-residential sector is up, and vice versa. Labour and capital cannot just switch from one to the other with abandon. However, there is an extent in the current period where there appears to be a relative sympathy and relationship between the sectors.