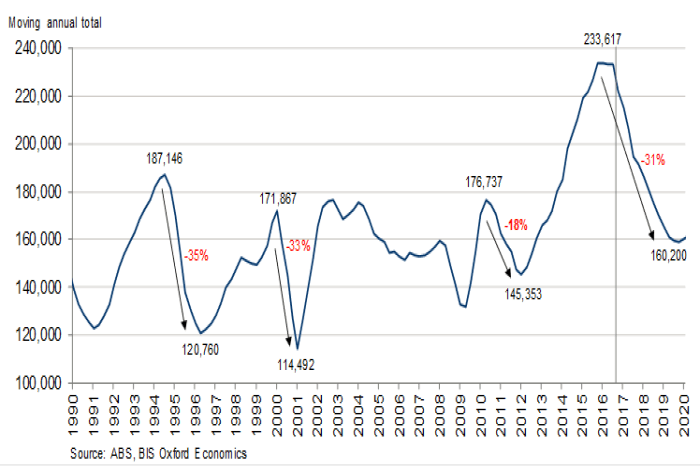

Australia’s housing market is coming off the longest sustained period of growth in new dwelling approvals and commencements. While opinions differ as to how far approvals will fall over the coming years, according to BIS Oxford Economics (BIS), annual dwelling commencements will fall to around 160,000 – a decline of 31% from the peak – over the next three years.

At first blush, this seems a remarkably bearish forecast – displayed in the chart below – especially when considered the apparent underlying strength in approvals and commencements of free-standing houses (see the first item in this edition of Statistics Count). However, closer examination makes the BIS analysis appear more realistic.

The analysis suggests that the pain will be felt in declining approvals and commencements – which have already clearly commenced – for multi-storey apartment buildings. As BIS Managing Director, Robert Mellor told the ABC’s Michael Janda:

“We won’t see it impact significantly over the next six months. But as we move into 2018, particularly as those big high-rise apartment projects come off — commencements have been falling for nearly 12 months in Brisbane and they’ll start falling in Sydney and Melbourne — 12 months down the track, the level of work being undertaken will decline significantly.”

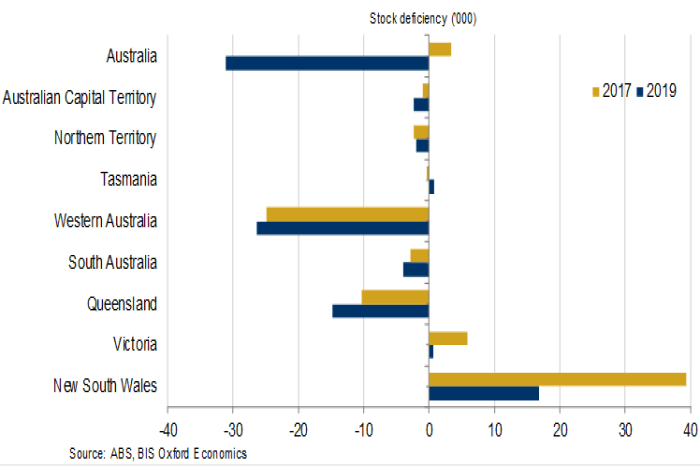

Additionally, BIS points to the extent to which historical under-supply has been removed from the market, by the recent boom. They consider the sustainable, or at least, required number of new dwellings to be approximately 184,000 per annum. As the chart below shows, BIS’ analysis suggests New South Wales will be the only state still in substantial under-supply by 2019.

BIS sees risks stacking up for the Australian economy, as a result of its expectation of a large bust in the housing market. These risks include:

- A sharp downturn in employment in the construction sector;

- Withdrawal of funding from investors, especially those from overseas, and with a large impact on apartments;

- Reductions in interest only loans, due to tighter lending criteria imposed by the Australian Prudential Regulatory Authority (APRA).

Other commentators pointed to the likely expansion of the commercial and infrastructure sectors as offsetting any serious bust in the dwelling construction market.

There is inevitable and constant debate about the complex Australian housing market and the data that is generated by and about it. The forecasts arising from them diverge and are regularly the headline item in the news – even ahead of the data itself.