Forecasts of treated structural pine sales in the March quarter were exactly consistent with actual sales, which totalled 194,390 m3. The forecast was an irrelevant 69 m3 (one large truck) different to actual. Demonstrating the relevance and importance of good reporting, measurement and forecasting, these increasingly reliable forecasts by ABARES point to higher consumption for the four grades for which forecasts are produced, over the next year.

One advantage to ‘pure math’ forecasts, based on ever-larger numbers of observations, is that they ignore opinions, attitudes and other qualitative measures. These ‘quantitative’ forecasts are not the be-all and end-all of forecasting future demand, but they are a strong beginning for business-level decision making.

The following details each of the four major grades, and includes the ABARES’ commentary for each.

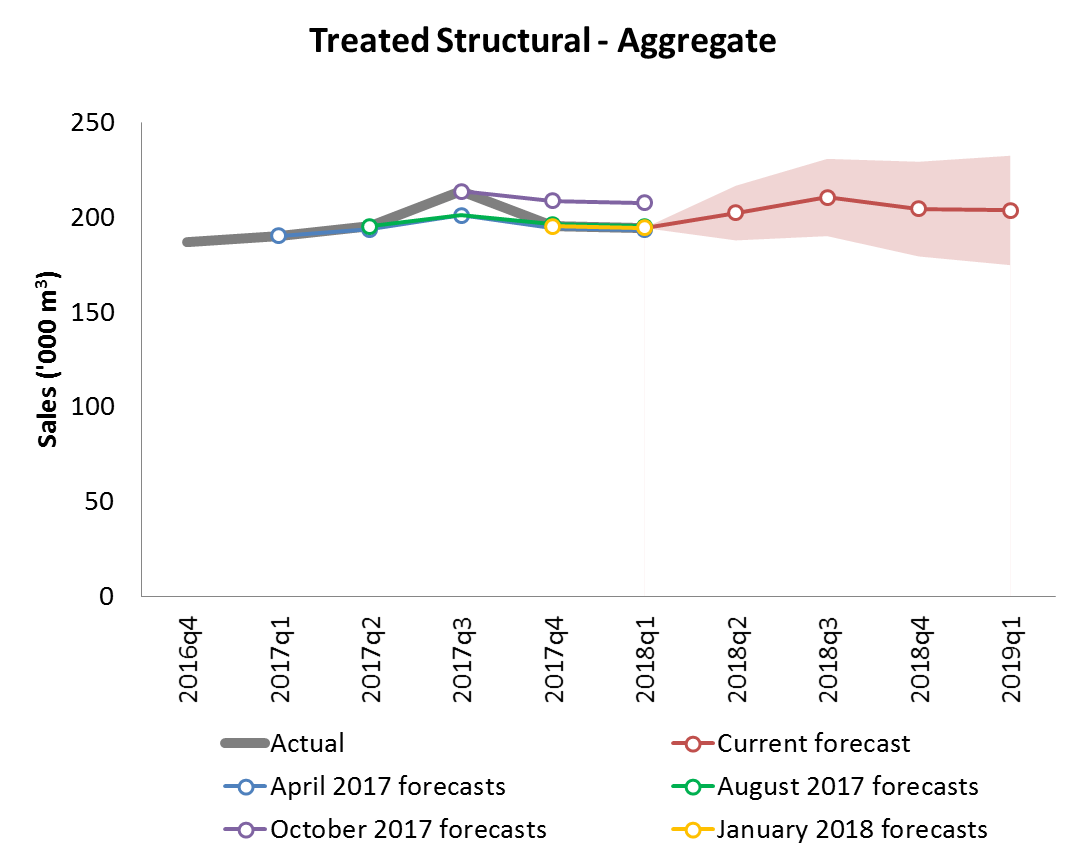

Treated Structural

Actual sales of aggregate (both of the grades) treated structural pine in the March 2018 quarter (194,390 m3) closely matched the January 2018 forecast (194,321 m3) and only differ from actual sales by a minuscule of 0.0 per cent or 69 m3. Sales volumes for March 2018 were well within the 95 per cent prediction intervals for all previous forecasts.

Looking forward, the updated forecasts for the June 2018 quarter onwards have been revised upwards slightly. Sales are forecast to increase in the June 2018 quarter by 4.0 per cent to 202,246 m3, followed by a further increase in the September 2018 quarter by 4.1 per cent, to peak at 210,440 m3. Sales are forecast to drop by 2.9 per cent in the December 2018 quarter and by a further 0.3 per cent in the March 2018 quarter, ending at 203,618 m3 (4.7 per cent higher than current sales).

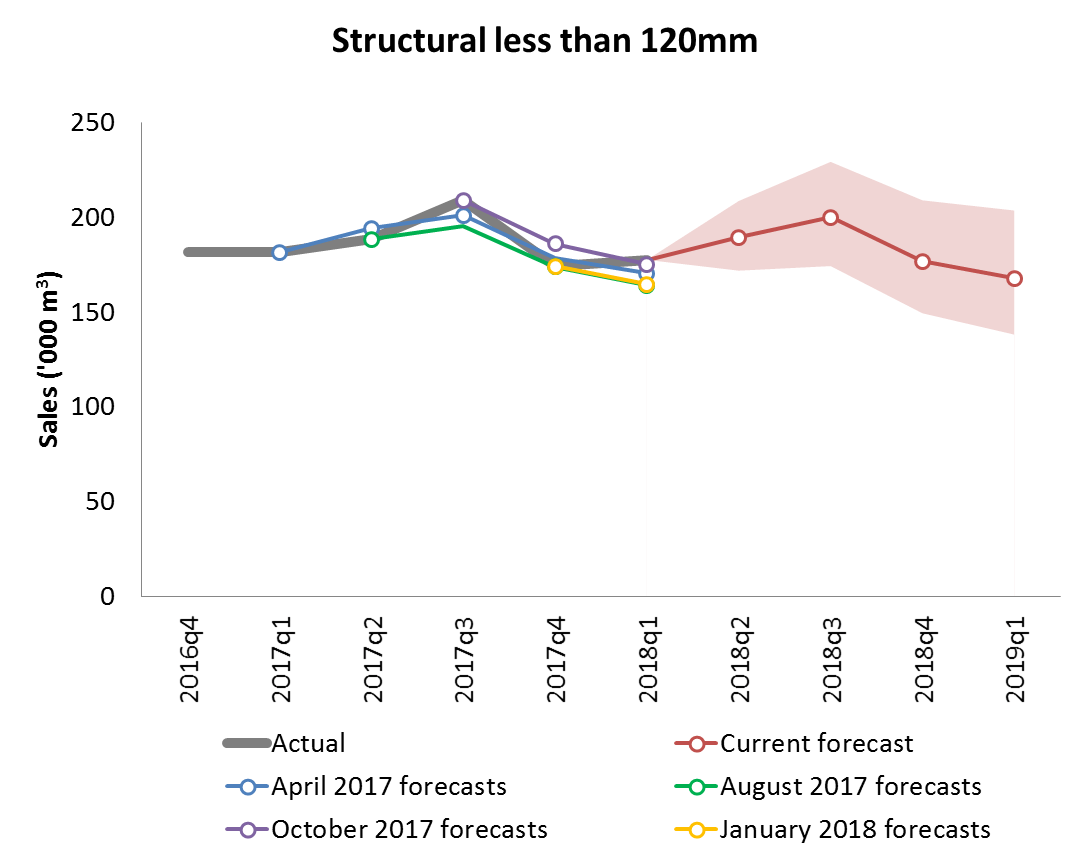

Structural less than 120mm

Actual sales of structural pine less than 120mm in the March 2018 quarter (177,562 m3) were stronger than expected, exceeding the January 2018 forecast (164,666 m3) by 7.8 per cent or 12,896 m3. The actual sales during March 2018 fell within the 95 per cent prediction interval for all previous forecasts.

Looking forward, the forecasts for June 2018 quarter have been revised upwards, with sales expected to increase by 6.6 per cent to 189,347 m3. Sales are expected to grow in the September 2018 quarter by 5.6 per cent. This is expected to be followed by two periods of negative growth, with sales forecast to drop by 11.6 per cent in the December 2019 quarter, and then by a further 5.1 per cent in the March 2019 quarter, ending at 167,723 m3 (5.5% lower than current sales).

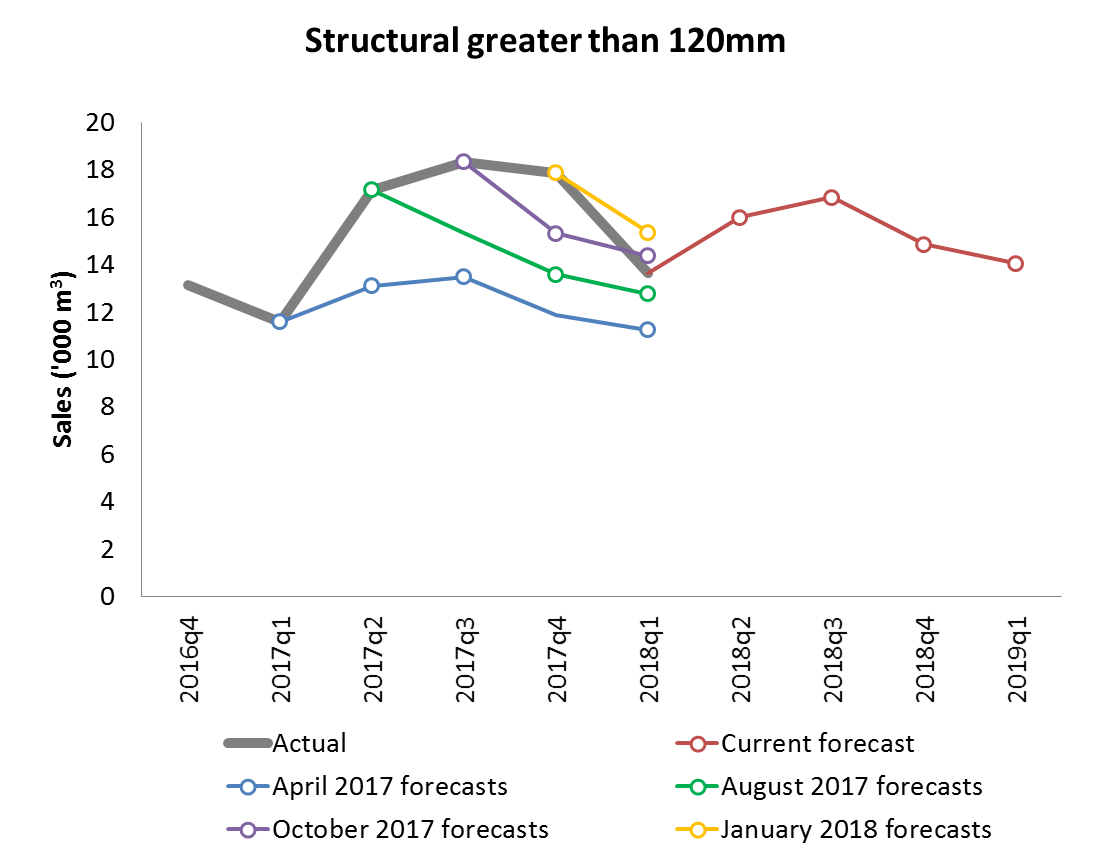

Structural greater than 120mm

Actual sales of structural pine greater than 120mm in the March 2018 quarter (13,641 m3) fell short of the January 2018 forecast (15,369 m3) by 11.2 per cent or 1,728 m3.fig13

Looking forward, the updated forecasts for the June 2018 quarter have been revised downwards. Sales in the June 2018 quarter are forecast to increase by 17.3 per cent to 16,002 m3. This is expected to be continued in the September 2018 quarter with sales growing by 5.3 per cent to reach a peak of 16,847 m3. Sales are expected to fall in the December 2018 and March 2019 quarters by 11.8 per cent and 5.3 per cent respectively, with sales volumes ending at 14,062 m3, 3.1 per cent above current sales.

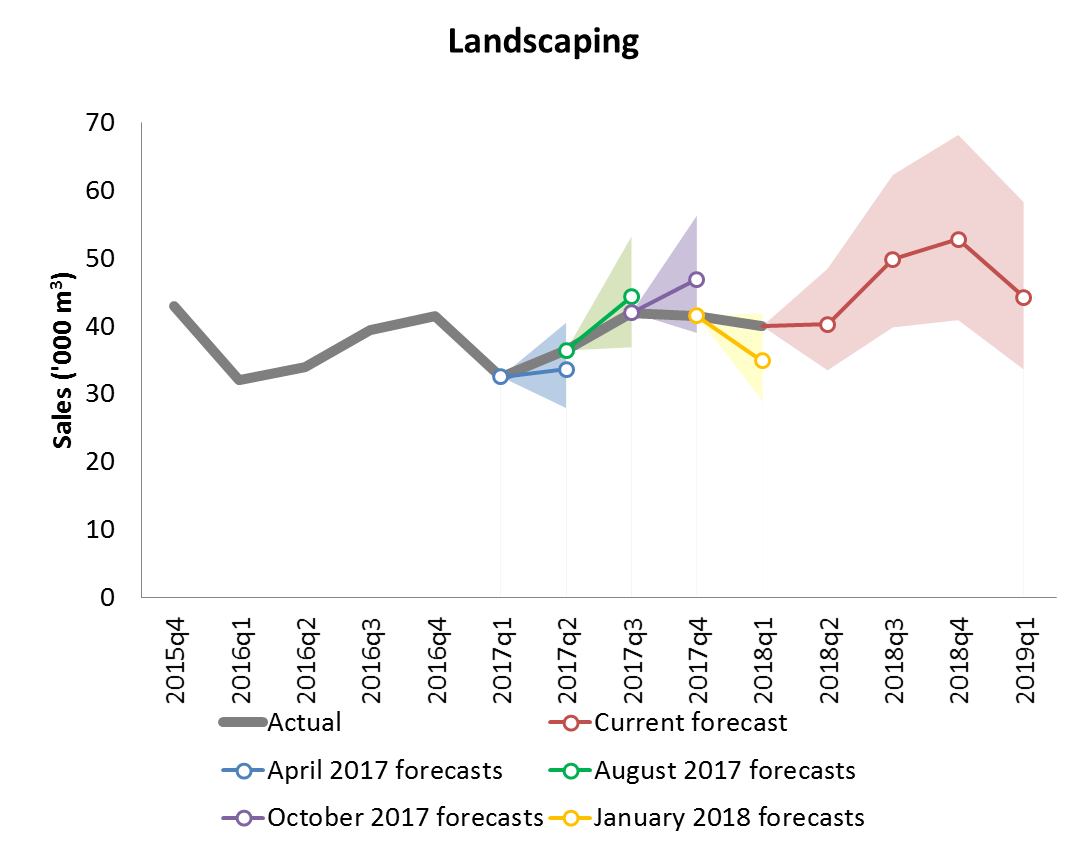

Landscaping products

Actual sales of landscaping products in the March 2018 quarter (40,000 m3) were stronger than expected, exceeding the January 2018 forecasts (34,865 m3) by 11.5 per cent, or 5,136 m3. Actual sales volumes for March 2018 were within the 95 per cent prediction intervals for all previous forecasts.

Looking forward, the updated forecasts for the June 2018 quarter onwards have been revised upwards with sales expected to increase by 0.7 per cent, followed by in the September 2018 quarter by a further 23.7 per cent increase. This is expected to be followed by further growth in sales in the December 2018 quarter of 6 per cent, with peak sales predicted to be 52,821 m3. Sales are expected fall sharply in the March 2019 quarter, falling by 16.2 per cent to 44,279 m3, which is still 10.7 per cent higher than current sales volumes.