Ongoing challenges in the residential construction sector, particularly rising material and labour costs, supply chain disruptions, and capacity constraints, have shifted household activity away from new builds towards alterations and additions (A&A). Renovating and extending existing homes has become a more attractive option for many households, allowing them to improve or expand their living spaces without the higher costs, delays, and risks associated with new construction.

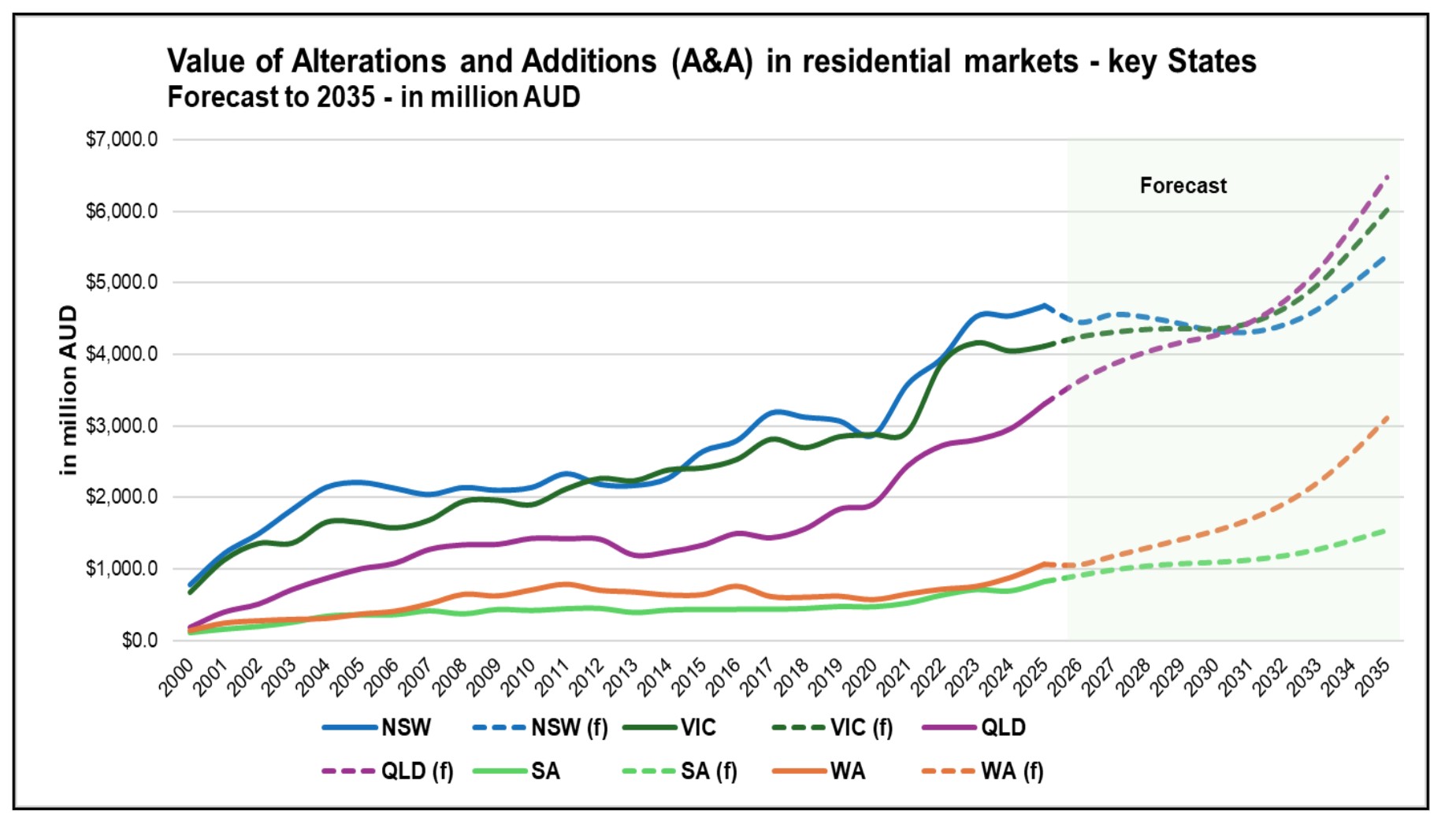

- The value of A&A work increased significantly during the COVID-19 pandemic after a long period of relatively stable growth from 2004 to 2019. In key states, Western Australia recorded the strongest growth between 2020 and 2025, with annual growth of 13.4%, and total value rising from $570 million in 2020 to $1.1 billion in 2025.

- South Australia and Queensland followed, with annual growth rates of 12.0% (from $469 million to $822 million) and 11.6% (from $1.9 billion to $3.3 billion), respectively.

- New South Wales and Victoria remained the two largest states by total A&A value. In NSW, activity grew by 10.2% per year from 2020 to 2025, increasing from $2.9 billion to $4.7 billion. In Victoria, values rose by 7.4% per year, from $2.9 billion to $4.1 billion over the same period.

Overall, the rapid growth in alterations and additions reflects a structural shift in the housing market, where upgrading existing homes has become a more cost-effective and practical response to affordability pressures in new housing construction (Figure 1).

Trend and Forecast of Alterations and Additions in Key States.

Source: ABS. FWPA Data Dashboard (AUS Dwelling Forecast Dataset)

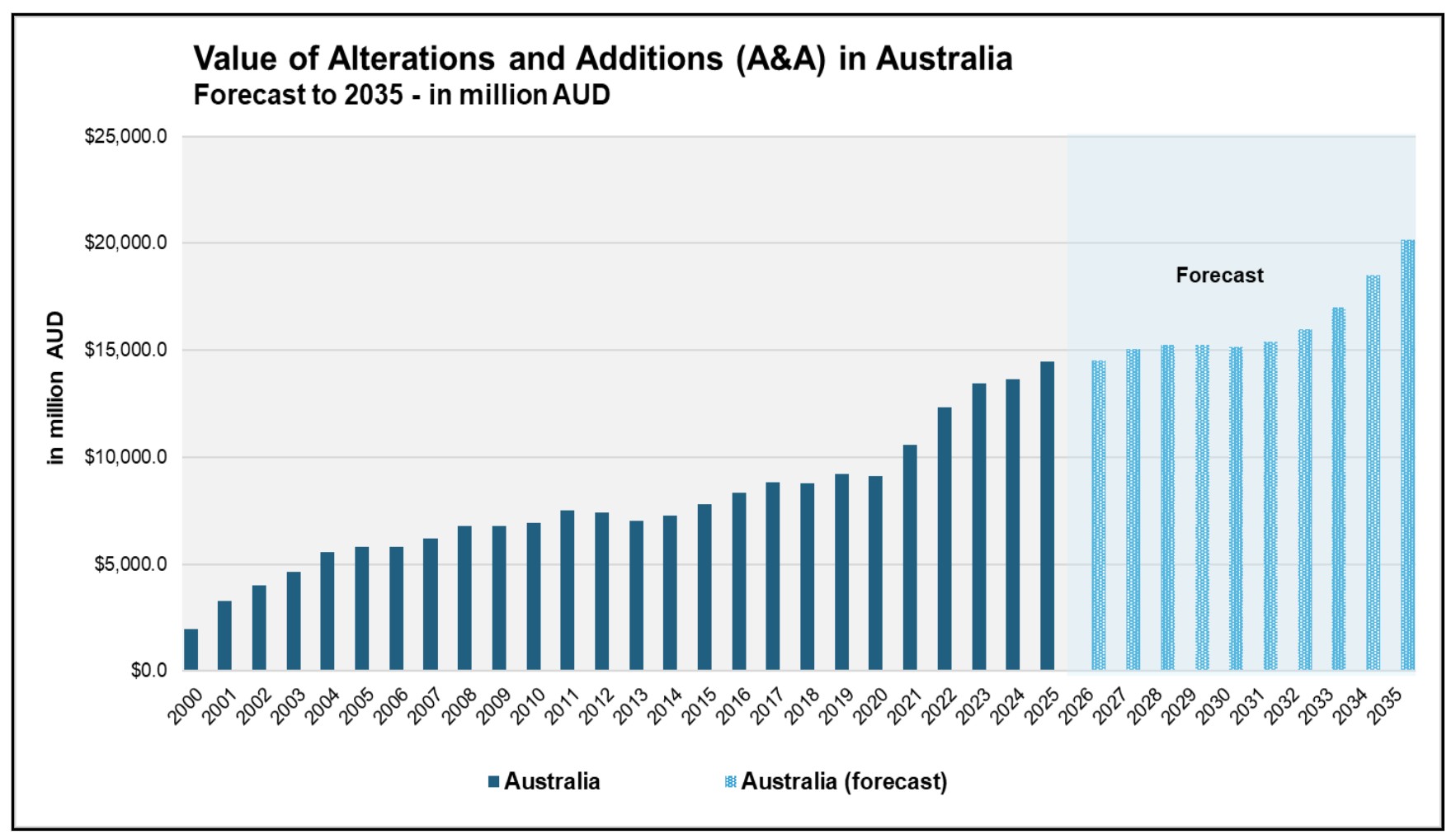

At the national level, the value of alterations and additions (A&A) increased strongly between 2020 and 2025, growing at an average annual rate of 9.7% %, from $9.1 billion to $14.5 billion. As mentioned above, this surge reflected shifting household preferences toward renovating existing homes in response to higher construction costs, labour shortages, and supply chain disruptions.

Looking ahead, A&A activity is expected to continue expanding, although at a more moderate pace. From 2025 to 2035, the value of A&A work is forecast to grow by around 3.7% per year, increasing from $14.5 billion in 2025 to $20.2 billion by 2035 (Figure 2).

Trend and Forecast of Alterations and Additions at the National Level

Source: ABS. FWPA Data Dashboard (AUS Dwelling Forecast Dataset)

While the rapid growth seen during the pandemic period is unlikely to be repeated, the long-term outlook remains positive. Alterations and additions are expected to remain a key segment of the residential construction market, supported by an ageing housing stock, population growth, and ongoing pressure on the affordability of new housing. Overall, A&A activity is becoming a structurally important part of the housing sector, providing steady demand for building materials and construction services over the coming decade.