Australia’s established suburbs are alive with building work, as existing home owners continue to grow their loans. For the year-ended December 2016, the value of construction work completed for alterations and additions rose 3.2% to a thumping AUD8.509 billion. There is little doubt that this sector’s activity has added fuel to the concerns about Australia’s household indebtedness, but at the same time, it’s also true that there is a very long tail of economic activity (and further retail sales) coming after it.

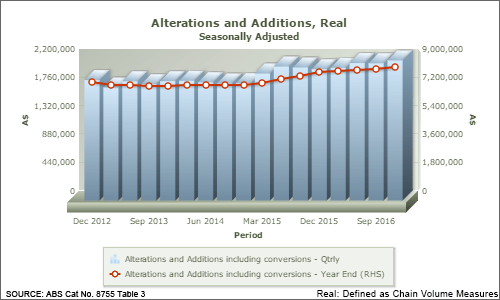

As the chart below shows, Australia’s seasonally adjusted loans for alterations and additions have never been higher, on either a quarterly or a year-end basis.

To go straight to the dashboard and take a closer look at the data, click here.

In the December Quarter, loans totalled AUD2.177 billion, up 6.7% compared with the prior December Quarter’s AUD2.041 billion.

To be balanced, the reality is that expenditure on alterations and additions – or at least loans to fund them – is they are quite stable over time. There are few busts, as the chart indicates. But just as relevantly, the chart also shows there have been few instances in which the growth in loans for this purpose have continued on for more than a year. In this period, the growth is effectively continuous over two years or more.

The implication is that just as we are in a period in which every household seems to be participating in the great purchase, invest or renovate game, we may soon be in a period where housing construction activity slows, at the same time as renovation activity grinds back. That would be a shock for a large portion of Australia’s economy.