Australia’s housing approvals keep stacking on record after record. For the year to the end of June 2015, total approvals leapt 12.8% compared with the prior year, rising to 217,872 dwelling approvals. Yet there is no one who believes that the housing market will continue to grow, without significant cessation and decline, at some point in the future. There is however an alternative story, one in which Australia’s pent up demand for housing is being met, but with just a passing nod to tradition.

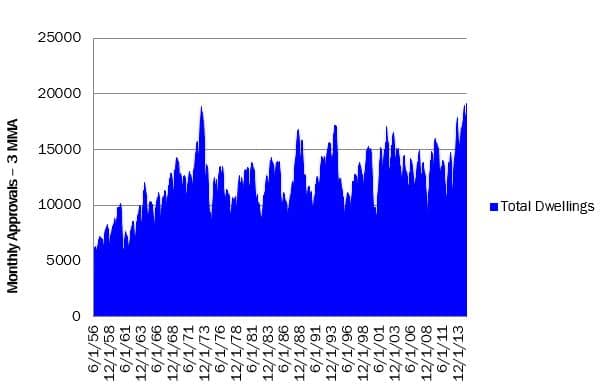

There should be little if any argument that Australian housing has operated on a history of short booms, followed by deep busts. The chart below provides the evidence. Booms almost invariably build up over two years or more and then, when the slump comes, it arrives almost instantly, with, for a time, approvals often falling to below the starting point of the boom.

fig 2

Despite the booms and busts, across this almost sixty years of national data, there is an upwards trend line. Until, that is, the period that started around 1994 when housing approvals simply stagnated (in aggregate) until the middle of 2012, when the current boom commenced. It is true that this boom is fuelled by lower interest rates, but it is also a response to long-standing, pent up demand.

That is why this boom is approaching the longest in Australia’s history and why, despite some concerns about prices, it is likely to continue into the future. This is an altogether different boom, as the following data shows.

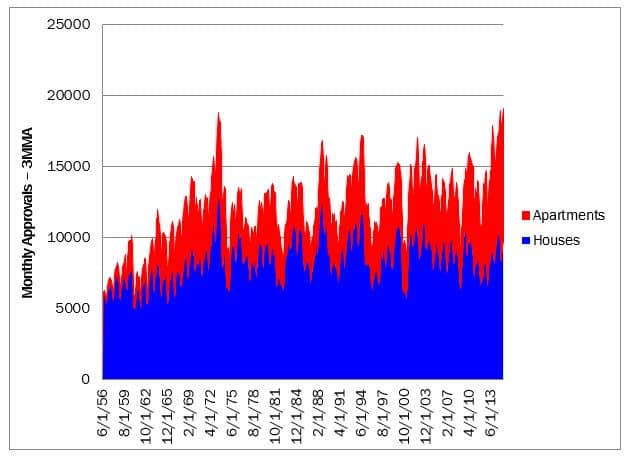

First, the share of total housing approvals taken up by apartments is growing. In some months, total apartment approvals have exceeded free-standing housing approvals, as the chart below shows. For the year-ended June 2015, total approvals consisted of 53.1% free-standing houses and 46.9% some form of apartment, flat or semi-detached building.

As the table below demonstrates, it is Australia’s larger cities where apartments dominate. The data is for the year to the end of June 2015.

State |

Houses |

Apartments |

Apartments |

| Number | Number | Percent | |

| NSW | 25,428 | 31,316 | 55.2% |

| VIC | 33,053 | 33,403 | 50.3% |

| QLD | 21,813 | 21,281 | 49.4% |

| SA | 7,612 | 3,201 | 29.6% |

| WA | 23,155 | 8,631 | 27.2% |

| TAS | 2,322 | 553 | 19.2% |

| ACT | 1,334 | 2,912 | 68.6% |

| NT | 887 | 918 | 50.9% |

| Total | 115,604 | 102,150 | 46.9% |

Perhaps inevitably, the temptation has been to assume that all new apartments (especially those of 4 or more storeys) are city centric high-rise towers. But that is not the case and it will not be the case in the future. The truth of this lies, in part, in the table above. The dominance of apartments in the ACT and the Northern Territory specifically excludes high-rise towers.

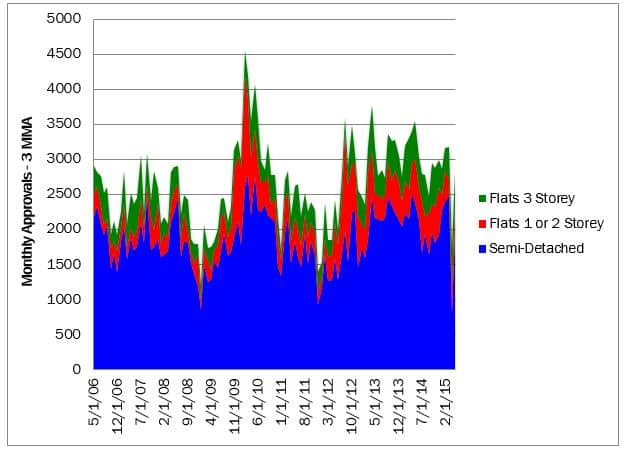

So, the second point is that a range of housing types is emerging into the ‘apartment’ space that no better fit the high-rise definition than they do the free-standing. What is rapidly becoming known as the ‘mid-rise multi-residential dwelling complex’ is already in evidence in Australia, as the next chart shows.

It may mainly be apartments of 4+ Storeys being built, but the much- discussed urban infill of medium to high density living does not accommodate the giant towers that increasingly populate our cities. In the latest boom, semi-detached dwellings (including townhouses) have grown strongly, as have Flats of 3 Storeys, while Flats of 1 or 2 Storeys appear to be under pressure.

The third new driver, from a genuine housing demand perspective at least, is that dwellings are becoming observably smaller. Whether this is a function of demand or is driven by economic necessity is unclear, but regardless, the rise in apartments is reflecting changing housing consumption patterns. As our cities have grown and sprawled further, each new wave of home-owners has been pushed by affordability issues further and further away from the places they work. It is a regularly observed social phenomenon.

The mid-rise infill opportunities in existing urban centres allow new home owners at least some of the amenity of the urban and suburban life, without the deadly commute.

This filling of pent up demand with affordable housing options may well be the driver of a sustained housing boom, especially if it remains fuelled by low interest rates. The astute will have noticed there is little reference here to the sustainability of prices, but read the next two items for more complete discussion on all things housing.