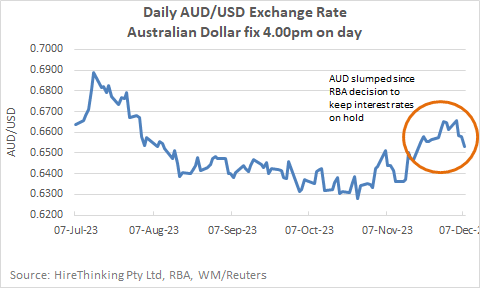

Always one of the most traded currencies in the world, the Australian dollar has lived up to its reputation as a theme park attraction once again in 2023, offering a couple of big climbs and a really choppy trend down, before chugging up the track again, only to be flung down again thanks to the RBA’s December halt of interest rate rises.

Here at Stats Count, we had almost felt the ride was over at the start of December. Our thesis was that markets had factored in the RBA not increasing rates at its December meeting. We expected to be coasting to year-end on a little uptick that saved the brakes.

We were wrong as it appears that was not factored into the value of the Australian dollar.

The moment Governor Bullock left rates at 4.35%, the Australian dollar plunged again, offering one last thrill before the year ends.

By leaving rates on hold, international investors were better off shifting at least some of their ‘safe money’ from Australian dollars to US dollars.

Overnight trade was fast and furious after the RBA decision, evidenced by the rapid sell-off of Australian dollars.

The month prior, the Australian dollar appreciated almost 5% against the US dollar, pushing up to trade at USD0.6648 at the end of November, reaching a four-month high and arresting much of the trend decline that was delivered since the middle of the year. In fact, it even looked like some of the choppiness was out of the market.

Speaking to Cecile LeFort from the Australian Financial Review, a currency market trader implied the uptick in November had been due to ‘hawkish’ expectations of Micheel Bullock that had gone rogue and become ‘dovish’, with expectations now that the RBA has rates on hold.

Probably right and certainly seems appropriate, but we cannot help feeling a bit annoyed that the hawk and dove metaphor cuts across our own roller coaster metaphor for the Australian dollar.

Never fear, like the currency market, the metaphors to describe it will be back in 2024.