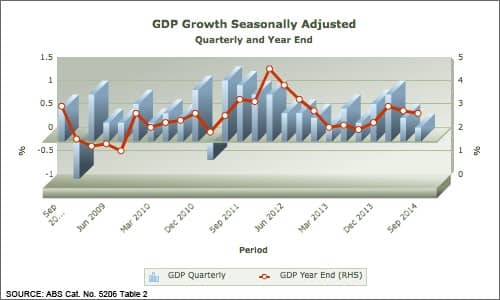

Australia’s economic growth, measured by Gross Domestic Product, (GDP) declined to 2.5% for the year to the end of December 2014. Seasonally adjusted December Quarter GDP was just 0.5%, contrasting with the December Quarter in 2013, when quarterly growth was recorded at 0.7%.

The chart below, from the FWPA Data Dashboard, displays Australia’s economic growth since December Quarter 2010.

Though arguable, it now seems clear that the rise in economic growth in the September Quarter 2013 and in particular, the December Quarter of that year, was linked to renewed confidence after the election of the current Australian Government.

Underlying economic data has been the primary driver for record low interest rates, with poor demand and low levels of economic activity forcing the hand of the Reserve Bank of Australia (RBA), as they continue to reduce interest rates in early 2015.

In March, the RBA kept interest rates on hold, having reduced them to 2.25% in February. The RBA’s minutes – more a description of the observations, perspective and analysis of the RBA – summarised their views as:

“…members saw benefit in allowing some time for the structure of interest rates and the economy to adjust to the earlier change. They also saw advantages in receiving more data to indicate whether or not the economy was on the previously forecast path.”

The full text is available at www.rba.gov.au.

The continuation of the ‘watch’ stance of the RBA suggests concerns at fragility remaining in the Australian economy in early 2015. Underlying economic growth data provides some of the evidence relied upon by the central bank.

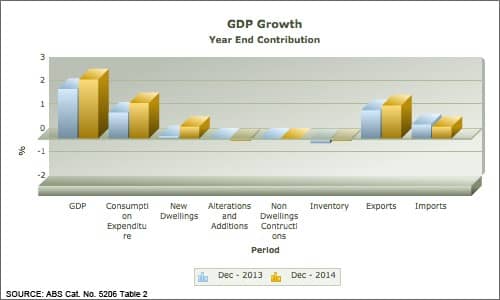

Considered from the point of view of major drivers of economic growth, the sectors continuing to show some strength in the December Quarter were Consumption Expenditure (adding 0.5%) and Imports (adding 0.5%). Though seasonally adjusted, these results are both higher than average.

The major detractor from economic growth was Inventory (detracting 0.6%), suggesting a further slackening of demand that in part, may have caught industries around Australia by surprise.

This data is displayed in the following chart for the year to the end of December 2014 and compared with the year to the end of December 2013.

Although in some respects, lower interest rates are welcome by businesses and makes investment nominally easier, it does seem that the rates are reasonably consistent with the modern challenges of doing business, reflected in the lower demand and consumption evidenced in the latest GDP data.

For further details, go to the FWPA Data Dashboard.