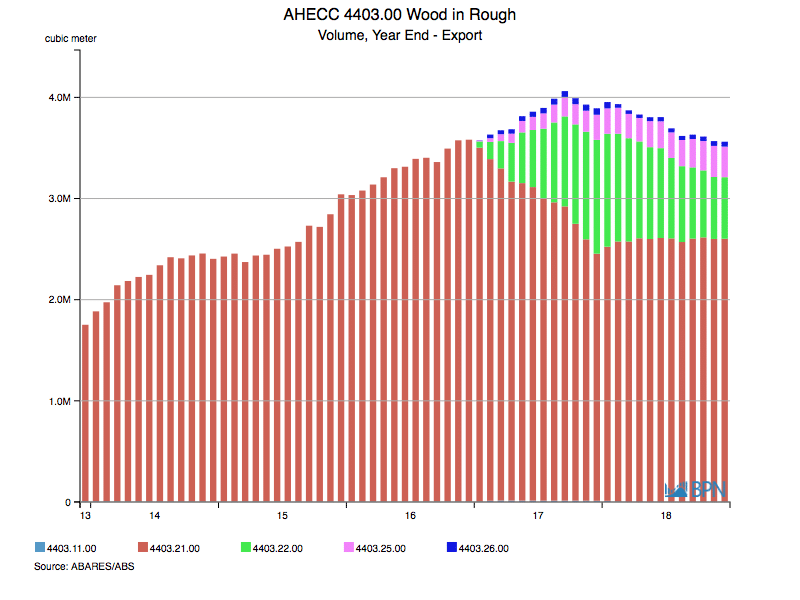

Exports of softwood logs from Australia continued to soften throughout the second half of 2018, with total exports of 3.562 million m3 for the full calendar year. This was down 8.5% on 2017 and a little more than 500,000 m3 lower than the annualized peak achieved in September 2017.

The first chart shows annualized exports since mid-2013. The peak and the subsequent and orderly decline of the last year and more is plain to see.

To go straight to the dashboard and take a closer look at the data, click here.

Perhaps more importantly, since January 2017, export product categories have become more detailed in respect to size of logs and type. Logs are now recorded as ‘Treated’, ‘Pine’ or ‘Other’ and for the Pine and Other, by whether they are greater or lesser than 15cm diameter at the small-end (>15 cm SED or <15 cm SED). Please note ‘other’ represents softwood species other than Pinus spp. (pines). Although it remains a somewhat crude tool for breaking down exports, this approach does distinguish logs that may be more suitable for solid wood utilization.

The table below shows Australia’s softwood log exports by type over the two years since this data series commenced. This is the first time the data can be compared on a year-by-year basis.

| 2017 | 2018 | YoY % Change | |

| 4403.11.00 – Treated | 11,756 | 2,434 | -79.3% |

| 4403.21.00 – Pine >15 cm | 2,443,015 | 2,600,010 | 6.4% |

| 4403.22.00 – Pine <15 cm | 1,125,370 | 608,287 | -45.9% |

| 4403.25.00 – Other >15 cm | 248,308 | 302,700 | 21.9% |

| 4403.26.00 – Other <15 cm | 63,709 | 48,273 | -24.2% |

| Total | 3,892,158 | 3,561,704 | -8.5% |

Pine logs provide the greatest volume and interest, and we can see that for the >15 cm diameter volume, their growth of 6.4% to 2.600 million m3 was more than offset by the 45.9% decline in exports of the <15 cm diameter Pine logs. Though there was some movement in the other log grades, they are significantly less relevant to the total market.

Although the data provides clues and not necessarily firm answers, it does appear that across 2017, the larger export of smaller dimension Pine logs was linked to extensive thinning exercises in the Australian softwood plantation estate. That process was on the wane and appears to have slowed by the end of 2018.

Whether the diminution of the propensity to export the smaller dimension logs has anything to do with specific demand profiles is less certain. For instance, it could be that from some regions it was more efficient to export smaller dimension logs, over a short period of time, for chipping at destination, than establishing short-term chipping and export facilities. The data does not provide sufficient information for the drivers to be evident.

In 2018, almost 73% of softwood log exports were Pine >15 cm diameter. These are logs clearly destined for solid wood production, whether as sawlogs or peeler logs. Exports are almost entirely to China, with miniscule volumes going to Korea and very occasionally to India.

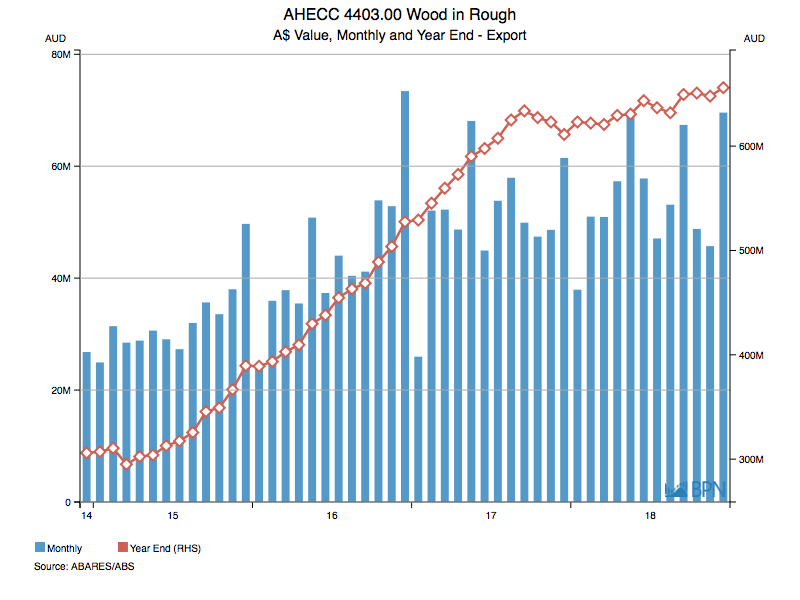

In aggregate, despite the Australian export volume decline, the value of exports rose 7.3% over 2018, to reach a new record of AUD656.0 million on a free-on-board basis. The value of this substantial export trade can be observed in the chart below.

To go straight to the dashboard and take a closer look at the data, click here.