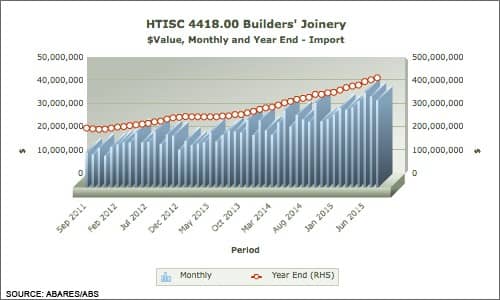

The value of imports of Builder’s Joinery increased 27.1% for the year-ended August 2015. Total imports were valued at AUD410.7M, up from AUD323.2M for the year-ended August 2014. Over the same period, the Australian Dollar depreciated approximately 21%, raising the possibility that the amount of actual product entering the country did not change near as much.

The chart below shows the long and sustained lift in imports, through to August 2015. On a month to monthly comparison basis, imports in August 2015 were valued at AUD37.5M, up 28.4% from August 2014.

To go straight to the dashboard and take a closer look at the data, click here.

The simplest conclusions can be drawn from this data alone. The long and sustained residential dwelling boom is fuelling the need for various forms of builder’s joinery, at least some of which is imported.

However, there is more detailed analysis available, via the FWPA Data Dashboard. The chart below shows imports for August 2015, compared against those for August 2014, for each of the eleven main products/sub-grades that make up builder’s joinery.

To go straight to the dashboard and take a closer look at the data, click here.

This data appears to show that most of the grades of builder’s joinery experienced growth for the year-ended August 2015, compared with the prior corresponding period.

While that is broadly true, the value of imports of some joinery products have exploded, albeit off some lower bases, as the table below shows.

| YE Aug ’14 (AUD’000) | YE Aug ’15 (AUD’000) | YoY % Change | |

| Windows | 10,522.0 | 11,080.1 | 5.3 |

| Doors | 50,864.6 | 63,931.7 | 25.7 |

| Shuttering | 6.0 | 492.9 | 8,115.0 |

| Shingles & Shakes | 376.0 | 438.6 | 16.6 |

| Wooden Posts & Beams (LVL, I Beams) | 71,467.3 | 99,173.4 | 38.8 |

| Wooden Flooring Panels (Mosaic) | 3.9 | 106.2 | 2,623.1 |

| Wooden Flooring Panels (Parquet) | 5,974.5 | 16,273.0 | 172.4 |

* Excludes some products (mainly parquetry types)

It is tempting to examine those products that have experienced the strongest import growth over the year ended August 2015, but they really do not tell the full story. The increase in the value of imported ‘Shuttering’ might look amazing, but the product still saw imports worth less and AUD0.5 million.

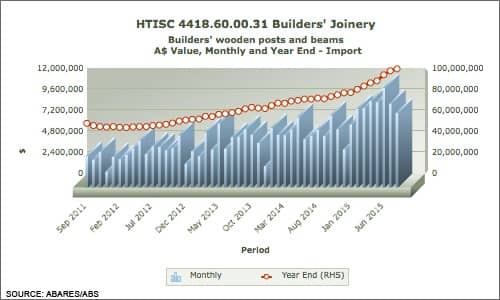

The biggest changes in a total value sense were for Wooden Posts & Beams such as LVL and I Beams. Imports came within a shipment load of AUD100 million for the year, growing at a very solid 38.8% compared with the prior year. The result was similar for Doors, the value of imports of which rose 25.7% over the same period.

The simple conclusion is that following on from sustained record housing approvals, Australia has experienced sustained record house building and therefore, imports of structural posts and beams, doors and in fact, every type of building product.

An examination of the imports of Wooden Posts & Beams shows, as the chart below details, quite comprehensive and consistent growth since around the end of 2013.

To go straight to the dashboard and take a closer look at the data, click here.

Leaving aside inevitable cycles, the value of imports have grown strongly, as the year-end data line shows, with the largest ever month of imports was June 2015, when imports totaled AUD11,328.9 million.

Supplies of these increasingly engineered products are, unsurprisingly, largely from developed countries. The USA dominates, supplying AUD66,197.9 million of product for the year ended August 2015, dwarfing all other countries. Supplies from the USA accounted for exactly two-thirds (66.7%) of the total for the year.

Well behind that was New Zealand, which supplied AUD8.1 million and Canada, AUD7.7 million over the same period.

What will be of interest over the coming months is the extent to which the value of Builder’s Joinery imports continue to grow. It is not a leading indicator, but its clearly important to the total built environment sector.