Although the rate of growth has slowed in recent months, the value of imported Builders’ Joinery rose 3.5% in the year-ended November 2016, reaching AUD463.742 million. Despite this, monthly imports remain below their peak, reached in late 2015, and the data indicates year-end import values will decline in coming months.

The chart below shows the details, including that in November 2016, imports were valued at AUD40.546 million, down a significant 10.5% on November 2015.

To go straight to the dashboard and take a closer look at the data, click here.

Fuelled by a significant rise in import values from September to November 2015, year-end imports of Builders’ Joinery rose to a record AUD477.610 million in August 2016. That was 16.2% higher than a year earlier. Although imports have remained strong, they have come off their year-end peak, despite individual months (August 2016 saw imports at their second highest level) recording strong imports.

It does seem that the housing construction boom is into its mid to latter stages, with Builders’ Joinery imports – which includes LVL and I Beam imports, as well as Doors and Windows – falling right into the middle of this phase of the market’s development.

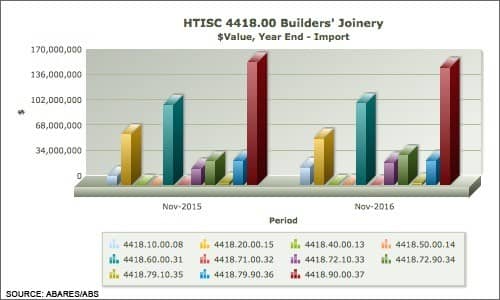

This can be observed in the chart below, which shows the value of imports, by specific product, for the year-ended November 2016, compared with the year-ended November 2015.

To go straight to the dashboard and take a closer look at the data, click here.

There are four products worthy of more detailed consideration.

In particular, imports of Wooden Posts & Beams (I Beams, LVL etc) – 4418.60.00.31 – rose modestly over the period, their value of AUD110.246 million being 1.9% higher than a year earlier. These feed directly into housing construction (and additions) and are regularly an early part of a home build.

Imports of ‘Other’ Builders’ Joinery – 4418.90.00.37 – fell 4.2% over the same period, to AUD158.344 million. There really is a huge range of potential products that can be imported under this code – from furnishing joinery to cross-laminated timber potentially, so movements are to be expected as markets change, as well as rise and fall.

Imports of Windows – 4418.10.00.08 – are displayed in the chart below and have grown dramatically over the last year.

To go straight to the dashboard and take a closer look at the data, click here.

Windows are deployed at a late stage in housing, which may account for some of the 99.1% rise in imports to AUD23.658 million for the year-ended November 2016. However, some other market dynamic must also be at play for such a significant rise to be recorded consistently over the last year.

In particular, imports from China rose more than five-fold to a record AUD7.388 million, while the USA continues to dominate imports, having grown the value of their supplies by 48.2% to AUD12.681 million.

Imports of Doors – 48118.20.00.15 – have declined, even as the window imports have grown. Essentially, as the chart below shows, these imports have come off their peaks of late 2015 and appear to be behaving on expected seasonal patterns.

To go straight to the dashboard and take a closer look at the data, click here.

Imports of Doors appear to be following patterns that would be expected of products that are deployed in the late-stage of a gradually declining housing construction market. For all that stability, as the chart below shows, there has been some churn in the supplier countries, with Malaysia and China growing their share of the market at the expense of other suppliers, including New Zealand.

To go straight to the dashboard and take a closer look at the data, click here.

The value of New Zealand’s supplies declined 56.2% over the year-ended November 2016, tumbling to AUD3.568 million, while those from Malaysia rose a modest 5.6% to AUD24.123 million.

Imports of Builders’ Joinery continue to display strength, albeit more patchy than in the past. Despite some conflicting data, it does seem that these imports are playing a part in a gradually declining housing construction market.