Most Australians now know very well how the price and volume interest from China for iron ore and coal affects their well-being. This ranges from being able (or not) to buy a new Holden, through to deciding which private (or public) school they end up sending their children to.

They also know feel the pain when China decides that the Australian price is too high, and/or it can buy some of its needs from elsewhere.

This is the case in 2015.

Some Australians are now also starting to understand what happens when the massively oversupplied Chinese aluminium industry starts to export serious volumes of low cost aluminium offshore.

And finally, before we tackle wood and China, the world will soon wake up to the massively oversupplied Chinese steel industry taking on every global steel producer with huge tonnages of ultra-low cost steel exports. This has already started. One observer suggested recently that if one has shares in any steel company around the world, one might consider selling them, pronto.

On a smaller scale, increasing demand for imports of Australian hardwood woodchips, softwood logs and perhaps hardwood logs into China is also having its (still small) influence on the Australian economy, but especially on its forest industry sector.

Hardwood Woodchips

In recent years Australian hardwood woodchip exports have been affected by strong price and volume competition from South East Asian countries; particularly Vietnam. But, at the same time, increased demand in China has allowed Australia’s shipments of hardwood woodchips to China had grown from only 200,000 Bone Dry Metric Tons (BDMT) in 2002, to 600,000 BDMT in 2012.

However, since then imports have increased substantially, to reach 2.0 million BDMT in 2014 (including an 88% increase from 2013 which equated to 23% of total imports). Chart 1 illustrates the volume of China’s hardwood woodchip imports from Australia from 2006 to 2014.

Chart 1

DANA’s view is that a “quintuple” set of factors may further favour Australia in 2015 and beyond. These include:

- The distinct possibility that Vietnam’s climate change woes may worsen,

- The Vietnam government’s increasing irritation over large volumes of woodchips being exported (which hit a peak of 7.4 million BDMT in 2013, but dropped last year)

- A belated recognition by Chinese pulpmills of the superior qualities of both E. globulus and E. nitens woodchips relative to lower yielding and lower quality South East Asian woodchips

- A big new pulp mill due to start up in China in late-2015 which will need high quality woodchips; and

- The rapid change in Australia’s competitiveness due to a weakened AUD.

DANA has co-written a Review on the international pulpwood trade, annually for more than two decades. RISI will soon publish the 23rd edition, including projections of Australian demand out to 2019.

Softwood Logs

As a net timber importer, Australia’s log softwood log production has traditionally (and is largely still) directed to domestic wood processing mills. However, two factors have contributed to an increase in log exports. These are:

- Low domestic lumber demand for some years with weak housing starts (exacerbated by large imports of European lumber); and

- A change in ownership of a number of State- owned softwood plantation forests to log export savvy institutional owners.

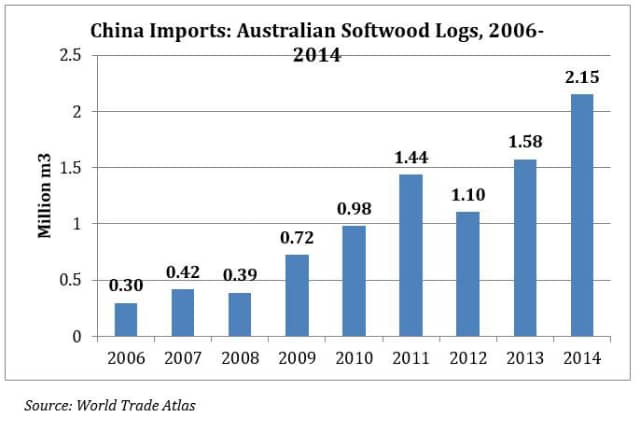

Australian softwood log exports have risen rapidly in the last few years, especially to China. While still considerably less than imports from New Zealand and Russia (both at around 10-11 million m3 in 2013 and 2014), Australian imports have grown from only 300,000 m3 in 2006 to 2.15 million in 2014. These now form an important and integral part of the Australian softwood forest sector. Chart 2 illustrates annual imports from 2006 to 2014.

Chart 2

In early 2015, DANA predicted that Australian shipments to China might slow from 2015 as China demand allows, and as Australian housing starts reach record levels. However a sharp drop in the value of the Euro in recent weeks (and perhaps more to be expected if the Greek “issue” goes from crisis to worse) may again encourage large imports of European lumber into Australia and provide an incentive for Australian softwood forest owners to keep export volumes up.

DANA is organising a six day tour of Chinese ports, saw mills and ply mills in mid-March to help tour delegates better understand the international softwood log and lumber supply chain, including for Australian logs. Import costs, in China processing costs, and product prices will be analysed. Already four Australians have signed up, with (at the time of writing) only two places left.

Also DANA has just completed a major Review of the Chinese softwood log resources, it processing industry; its log and lumber imports and supply and demand predictions – including a prediction of Australian softwood log/lumber imports annually from 2015 to 2020.

Hardwood Logs

Australian “second growth indigenous” log exports have been a very minor feature of the industry for some years, but until recently, exports of plantation hardwood logs have very much played second fiddle to woodchip exports, and still do.

However, there is a lot of “low key” activity occurring in Asia, and again especially in China in testing commercial volumes of Australian hardwood plantation logs. Even Chinese players in the huge native, tropical forest log and lumber import business – which totalled a record volume of 38 million m3 “roundwood equivalent” in 2014 – realise that their wood supplies will almost certainly decline in the next 5-10 years.

DANA is unsure of the “actual” Chinese import volume of Australian hardwood logs in 2014, as there is a major difference between the Australian Customs export volume claim (75,000 m3) and the Chinese import volume claim (200,000 m3). This begs all sorts of questions in its own right. However, whatever the true shipment volume was last year, it is expected to grow. The March DANA tour above will visit at least one plywood mill in China processing Australian plantation hardwood logs.

* DANA is a New Zealand based international advisory, publication and conference/tour organising company. Its website is www.dana.co.nz, and its Director Dennis Neilson can be contacted at dana@dana.co.nz