In late 2017, RISI released its latest Chinese timber demand study. The study predicts sharply slower growth in demand in coming years. Given the long-term nature of China’s continuous economic growth, and the way it effects every product, RISI’s view was received with interest and even perhaps a little alarm. Bob Flynn, RISI’s Director of International Timber, who authored the publication, agreed to provide Statistics Count with a summary of the main points in the report.

Last month, RISI published an update of its study on the outlook for Chinese timber demand, a report which has been published every two years since 2007. While marketing folks can always be counted on to over-hype the conclusions in this type of multi-client study, I have been a bit surprised at the number of questions I’ve received on the reasons behind our “negative” outlook on Chinese imports over the coming decade.

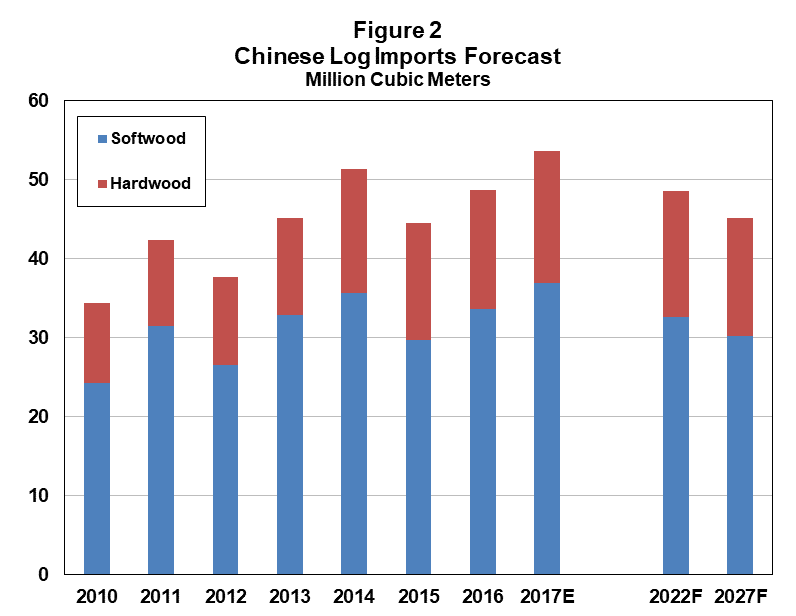

In the first place, I probably would differ with labeling our forecast as “negative”; after all, at the end of our 10-year forecast, China’s total wood fiber imports are projected to be 44 million m3 higher than in 2017 (see Figure 1), and imports of softwood logs and lumber (RWE) in total are projected to be essentially the same as in 2017, which was an all-time record year for softwood log and lumber imports. It is true that we are projecting a decline of about 18% in softwood log imports and 10% in hardwood log imports, relative to 2017 estimated volumes (see Figure 2), and we outline our rationale for this forecast below. But it is interesting to me how difficult it is to expect different market trends in the future, even when we all knew that the rapid growth in Chinese demand simply could not continue. For example, if softwood log and lumber imports continued increasing at the same rate they have been growing over the past 15 years, then in another 19 years China would be importing every single softwood log harvested in the world, leaving nothing at all for the rest of us. Obviously that is never going to happen.

© 2017 RISI, Inc. All Rights Reserved.

For Internal Use Only

© 2017 RISI, Inc. All Rights Reserved.

For Internal Use Only

What will determine the actual volume of Chinese imports of logs and lumber over the next decade?

- Demand for wood for both domestic consumption and production of wood products for export

- Available supply of reasonably priced logs and lumber for export in supplying countries

- Demand for logs and lumber in alternative markets

On the domestic demand side, it is clear that over the past decade China has been on an over-construction binge. Housing starts have far exceeded actual housing sales, by as much as 40% in the bubble period of 2011-2014. Local government officials have been trying hard to out-do each other in funding ever-grander city buildings and other construction projects, to demonstrate their importance and drive local economic growth (and at least in some cases, to line their own pockets with bribes and kick-backs). We point out in our study how President Xi’s consolidation of power (to an extent not really seen since Mao Zedong or Deng Xiaoping) makes it much more likely that his anti-corruption drive will put a freeze on spending excesses by local authorities, and his effort to control the “shadow banking” sector will make it much more difficult for developers to fund wasteful projects. Let’s be clear, we are not anticipating a collapse of the construction industry, by any means, we are simply projecting that future construction will be much more in line with actual demand, and not the orgy of wasteful construction we’ve experienced to date.

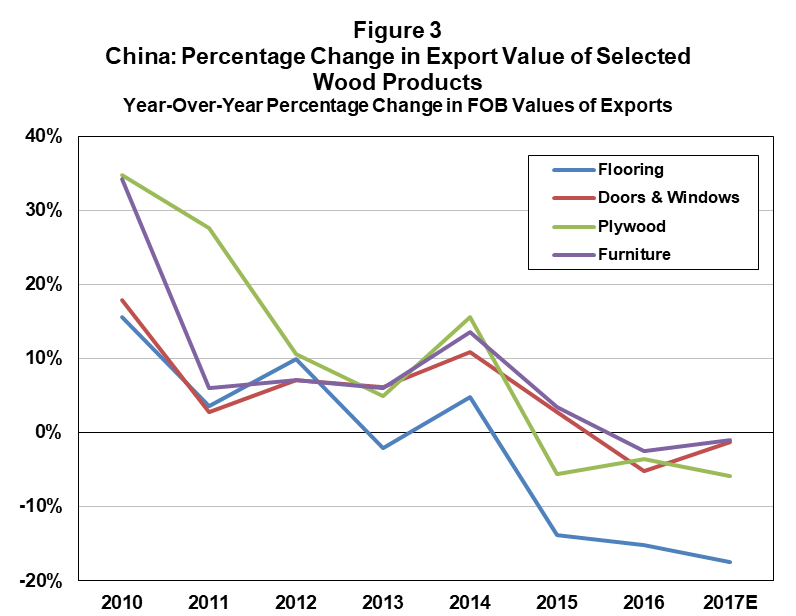

A significant share of logs and lumber are imported in China to make value-added products for export, and it has seemed like China’s exports of furniture, plywood, flooring, etc. have been doing nothing but increasing for more than a decade. But recently this picture has also changed. The trend in exports hasn’t just slowed, it’s actually gone negative in a number of cases (see Figure 3). Export values of plywood and flooring began shrinking in 2015, and continued on their downward trend last year, when they were joined in retreat by wooden furniture and door and window exports. Even China’s exports of paper and paperboard, which had been growing at a 19% CAGR from 2000-2015, have had zero growth over the past two years. Increasing labor rates in China, as well as various trade restrictions by importing countries, have largely been to blame, but the point is that the period of never-ending growth in forest products exports looks to be over.

© 2017 RISI, Inc. All Rights Reserved.

For Internal Use Only

But demand is only one side of the coin. If you believe that Chinese imports are going to continue to increase, then there will have to be an increasing supply of logs available. On the hardwood side, our report discusses the rapidly declining availability of logs from tropical natural forests. Imports of plantation grown hardwood in China have increased, e.g. eucalyptus logs from Australia, but over the next decade it is doubtful that this supply can be maintained. On the softwood side, we expect supply to tighten in Russia, with an increasing share of the available timber directed to lumber, rather than log exports. The decline in timber harvest in western Canada is well documented and long-expected, and record log prices in the US Pacific Northwest have meant that an increasing share of US log exports to China are actually coming from the US South (in containers). We do expect a relatively minor increase in log exports from New Zealand, although the recent election at least raises the possibility that some effort will be made there to increase domestic processing, at the expense of log exports. In Australia, pine log exports should continue, but further growth will be constrained by the supply issues that FWPA has documented previously.

Finally, any forecast of imports in China has to take account of the fact that over the past decade, the rest of the world went through a major financial collapse, demand for wood products plunged, and demand today is still on the road to recovery (e.g., softwood lumber demand in the US has been rising and is forecast to expand significantly in the years ahead.) Our forecast also assumes that over the next decade India becomes a much larger market for radiata pine logs; while it will still be very small compared with China’s market, growth in Indian demand will siphon off volume that otherwise would have been directed to China.

As a last point on our forecast of China’s log and lumber demand, we emphasize that while the future growth trend looks markedly different than the past decade, by the end of our forecast period, for example, softwood log imports will still be above 30 million m3, and softwood lumber imports will continue to expand to new record levels. Given other risks to the global economy over the next decade, on balance we would argue that our forecast is far from “negative”.

One quick point on China’s woodchip import demand, as this is so important for Australian forest owners: while we again forecast a significant slow-down in growth of hardwood chip demand in China (see Figure 4), let’s be clear that the limitation is primarily on the supply side, not a lack of demand. There is no question in our minds that Australian hardwood chip suppliers will find a ready market in China for all the chips they are able to supply over the next decade. Tightening supply has already led to the largest price increases in more than 5 years in 2018, and we expect this to continue.

© 2017 RISI, Inc. All Rights Reserved.

For Internal Use Only

Bob Flynn is Director, International Timber for RISI, and is author of the recently published China Timber Supply Outlook (www.risi.com/chinatimber). He can be reached at rflynn@risi.com