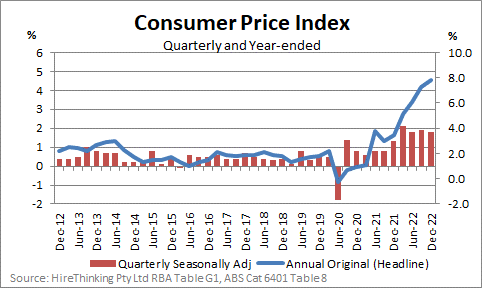

Australia’s headline inflation rate was 7.8% in 2022, driven to the annual number by a 1.9% lift in the Consumer Price Index (CPI) in the December quarter. This is the fastest rate of prices growth since March 1990, when the annual increase was 8.7%.

As outlined in earlier issues of Stats Count, we are monitoring the CPI closely because of the implications for interest rates and the knock-on effect on demand for established and new housing.

Inflation can impact housing markets in several ways:

- Increased construction costs: Inflation can lead to an increase in the cost of building materials, labour, and other expenses associated with construction, making it more expensive to build new homes.

- Rising mortgage rates: When inflation is high, central banks may raise interest rates to curb inflation, which makes borrowing more expensive, including mortgage loans.

- Affordability issues: With rising home prices and mortgage rates, housing may become less affordable for many people, especially those on fixed incomes or with lower wages.

- Reduced investment: In a high-inflation environment, investors may become wary of investing in real estate due to uncertainty and reduced returns.

These factors can lead to a slowdown in the housing market, making it harder for people to buy homes, and potentially reducing the value of existing homes.

The significance of this bout of local inflation can be seen in the chart below.

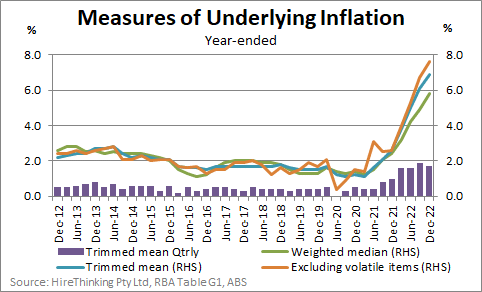

Core inflation, which is what the RBA looks at most closely when making interest rate decisions, saw the Trimmed Mean up 1.7% in the Dec quarter, recording a year-on-year increase of 6.9%.

We have discussed this previously, but essentially, what the RBA is seeking to do is use a measure of inflation that excludes certain volatile items such as food and energy prices. This is a more reliable indicator of underlying inflation trends because food and energy prices can fluctuate greatly from month to month and are influenced by factors such as weather, crop yields, and geopolitical events.

Core inflation provides a better sense of the underlying pressure on prices and helps policymakers – like Central bankers – assess the need for monetary policy actions, like raising interest rates.

Commentators appear divided on what the latest inflation data means for future interest rates, however, the expectation is a further rise at the next meeting of the RBA, to be conducted on Tuesday 7th February. Some suggest this will definitely be the last rise for some time, while others are more sanguine.

Now, once we get past the headline numbers, there is every possibility that Australia will avoid further prices pain, because the underlying data points to some positive trends on the prices and inflation front.

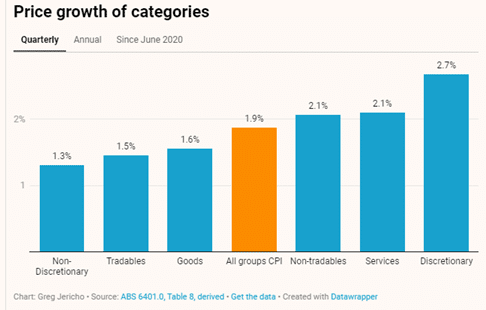

First, as Greg Jericho pointed out in The Guardian, non-discretionary spending was the smallest rise in the quarter, at 1.3%, while discretionary spending was the largest at 2.7%. This is good news, because it means the cost of the stuff you have to buy is growing slower than the stuff you want to buy. Holidays were the big mover in discretionary expenditure, unsurprisingly.

We can see this in Jericho’s chart below.

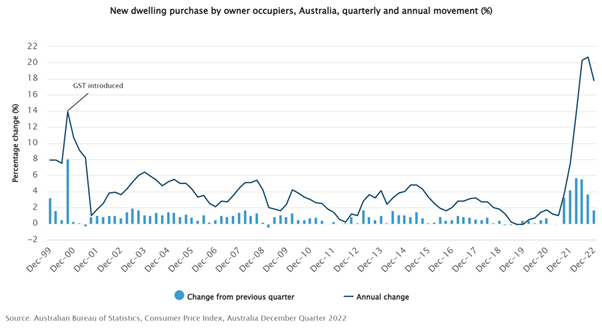

Second, the prices growth of new dwellings has begun to ease, as the ABS’ chart below shows. That draws quite a deal of inflationary pressure from the economy because it means building material costs are stabilising or falling. On the flipside however, the cost of renting is on the rise. It is not like the housing market doesn’t have underlying demand, it just cannot afford the marginal cost of supply right now.

Further good news on that front was reported by Nila Sweeney in the Australian Financial Review (AFR), to whom Core Logic’s Tim Lawless said the slowdown in housing construction costs would show through in inflation numbers before the middle of the year and construction costs would continue to fall.

Our third point of reflection is news reported by Christopher Joye – again in the AFR – that the US inflation rate is slowing, with headline inflation falling 0.1% in December. The hope is that may cause the US Federal Reserve to halt its interest rate increases and at least slow down the cycle of tightening. Good news for other central bankers and with luck, by mid-year, good news for all of us as higher prices begin to dissipate across the economy.