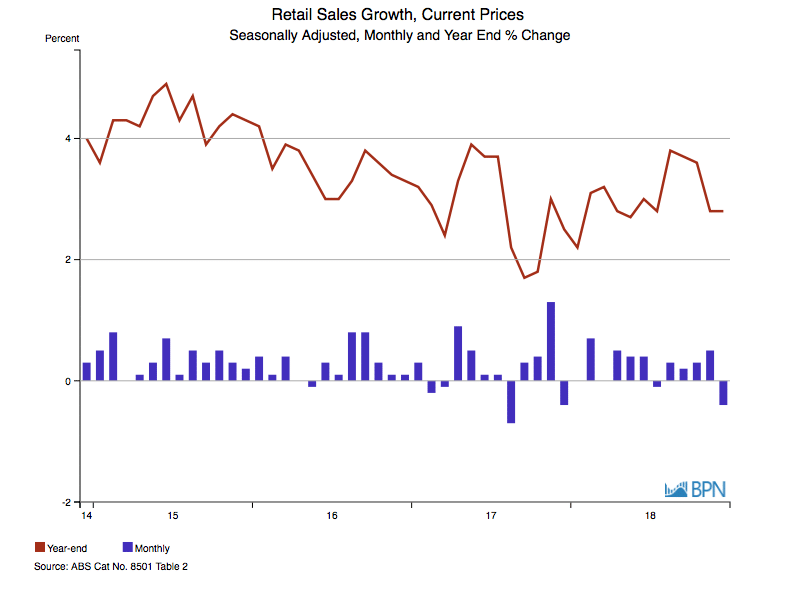

Retail sales declined by 0.4% in December, as Australian consumers shopped early, shopped late or simply didn’t shop at all in the lead up to Christmas 2018. The worse than expected result saw annual retail sales grow just 2.8%, up 0.3% from the equally appalling 2.5% recorded in 2017. Welcome to the world of low growth!

Like most countries, Australia operates an economy in which growth is measured by consumption. Economic growth, prices growth or inflation, retail sales and other measures are all defined by how much (money that is) is expended.

As the chart shows, Australia’s retail sales growth has been tracking down since the end of 2015. It might be that the last year has represented a turn-around of sorts, but at the moment, it seems at best, retail sales have flattened out. Much of the pre-Christmas impetus was soaked up November’s ‘Black Friday’ online sales.

To go straight to the dashboard and take a closer look at the data, click here.

There is a lot to digest in assessing why retail sales would be so continuously low, especially in an economic environment where interest rates have been sustained at historically low levels for a number of years.

One reason referred to regularly is that Australians have never been more indebted, as a proportion of their total income. That means there is less money to spend on new acquisitions.

Especially insidious in this scenario are two factors.

First, the dilemma of low interest rates. When interest rates rise, households will have to pay more to service their loans and so will have less cash to spend on other items. Normally we would think of low interest rates as an advantage, but right now, they represent a growing cause for concern.

Second, the unmet expectation of wages growth over the last few years. If wages had risen by average levels over the last five years, households would most likely have more disposable income, lower levels of indebtedness or both. It is likely that at least some households increased their indebtedness in the expectation of receiving higher (in some cases any) wages increases over the last five years.

Speaking to the House of Representatives Economics Committee, the Reserve Bank of Australia’s Governor, Dr Philip Lowe said in February:

“Aggregate household income used to grow at 6 per cent, it’s growing sub three. That’s a big difference, and you accumulate that over three or four years and income is 8, 10 or 12 per cent lower than it otherwise would have been.

“Many people borrowed assuming their incomes would grow at the old rate and they haven’t.

“They’re having more difficulty, they’ve got less free cash and so they can’t spend, so this is why I’ve put so much emphasis on the need for a pick-up in wage growth.”

Dr Lowe held out hope for increased wages over 2019, describing the 2018 wages increase granted by the Fair Work Commission to the lowest paid workers as ‘sensible and right’. He held out hope there would be a similar decision in 2019.

In focusing on the minimum wages growth required in the economy, Dr Lowe picked 3.5% per annum saying:

“If workers get their normal long-run share of that [productivity increase] then their real wages should rise by 1 per cent a year.

“So 2.5 per cent for inflation plus 1 per cent at least for productivity growth would give 3.5 per cent wage growth, so for me that’s the best steady state.”

As an earlier item in this edition of Statistics Count shows, current wages growth is averaging around 2.3% per annum.

Suppressing runaway wages growth is certainly important, just as halting rapid growth in prices of goods and services is necessary.

But the riposte is that without adequate wages growth, a country risks entering a cycle without virtue. One in which expenditure and consumption continues to be suppressed, holding back business incomes and economic growth, undermining investment and reducing the national income needed for the next wages increase and so on.

That unwelcome spiral is reflected in sub-optimal retail sales growth right now. However, wages are starting to move up, which is good news for the Australian economy.