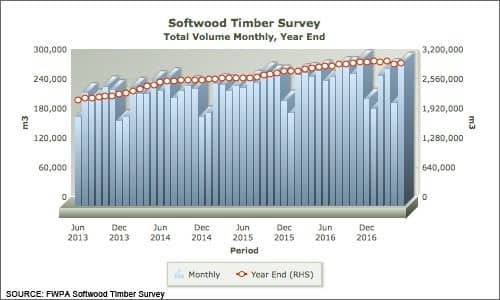

In what many may consider to be a surprise, sales of domestically produced sawn softwood products rose strongly in May, pushing year-end sales higher, in defiance of expectations. Sales in May totaled 291,916 m3, up 5.6% on May 2016 and a massive 38.4% on April. On a year-end basis, sales totaled 3,116,412 m3 which was 2.6% higher than a year earlier.

The surprise result is shown in the chart below. It is easy to see why, after the slump in April, sales were expected to hold a sharply contractionary position for some months, possibly until the summer building period commenced.

To go straight to the dashboard and take a closer look at the data, click here

May’s growth may reflect, at least to some extent, factors like the number of days worked in April being reduced by Easter, Anzac Day and School Holidays across the nation, plus any inventory effects. Regardless, the sales data is strong.

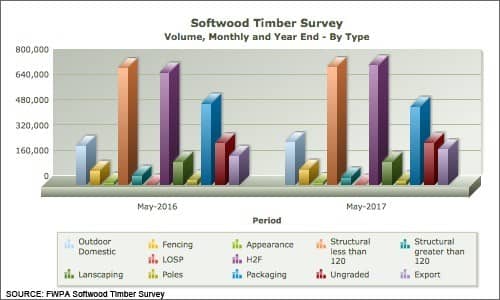

As has been the case for some months, and as displayed in the chart below, it is the main structural grades (Treated/Seasoned H2F and Structural <120mm) that remain the frame upon which all softwood timber sales hang. In the year-ended May 2017, sales of Structural <120mm rose a gentle 0.8% to 747,706 m3. However, H2F products experienced a 6.4% rise over the same period, with sales totaling 759,520 m3. The two grades between them added 50,000 m3 to total sales.

To go straight to the dashboard and take a closer look at the data, click here

While the main grades have done their job, three other grades of sawn softwood have contributed significantly. Outdoor Domestic saw sales increase 8.7% to 272,718 m3 and Fencing sales rose a similar 8.1% to 98,787 m3. The largest rise was recorded for Export grade, sales of which leaped 22.6% for the year-ended May, totaling 227,942 m3.

There were grades that recorded declines, but other than those in low single digits, the falls over the last year have been for grades that are mainly falling out of favour. Look no further than the Appearance grade, which once lined the walls of every TV room in the nation, but in the most recent year, declined 7.1% to record sales of just 15,097 m3.

Poles, primarily a treated product, recorded a steep fall of 19.4% to 25,862 m3. There is substitution effect in those numbers, supplier decision making about target markets and cyclical patterns to contend with.

The point of the details is that they demonstrate where the strength is softwood sales lies. Its house frames, trusses and related items, with decent sales growth still being recorded for the must-have add-ons of fencing and decks.

We do not need to say it, but for softwood sales, housing rules!