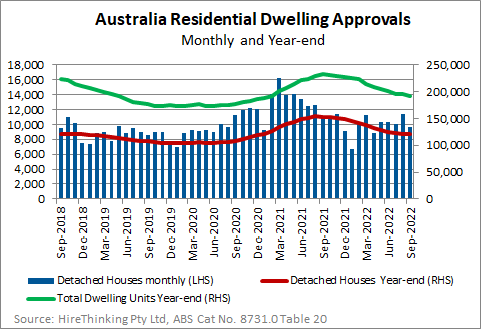

Annual dwelling approvals continued to decline in September, falling 17.1% compared to the year-ended September 2021 and totalling 192,458 approvals. All formats have now turned negative on an annualised basis, with approvals set to drop further as large house and apartment builders report a slump in sales.

After the slump of 2019, the chart here probably doesn’t do full justice to the magnitude of the approval declines to date, and certainly not to those set to come over the next year. The chart focusses mainly on detached dwelling approvals, but the total annual approvals are also shown.

The pain for home buyers is going to become a lot worse as the RBA goes about its successive rounds of interest rate rises. We have addressed this elsewhere in this edition of Stats Count, but it’s important to underscore that the same interest rate rises also cool the jets of those considering a new build.

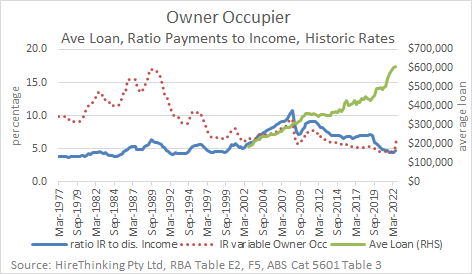

As the chart below shows, this is more complex than the level of the interest rate. At its simplest, what matters is the interplay between the interest rate you have to cover and the size of the loan to which that is applied. So, if the interest rate is 5% and you owe $100,000 it doesn’t have anywhere near as much as if you the interest rate is 2% and you owe $500,000. What then has to be considered is the ratio of interest rates (and thus repayments) to disposable income.

When interest rates peaked at 17% about 32 years ago, the ratio was 6.0%. It was 4.7% in June 2022 and is tracking up quickly.

Here’s the thing to think about from a policy standpoint. When fiscal policy (managed by politicians for the most part) super-heats the housing market to get spending moving and keep the economy rolling along, at some point, monetary policy (managed by pointy heads like the RBA) will be applied to the same sector to rein it back in. We are seeing that now, in the sector that is one of the most responsive – that means sensitive – to intervention.

The very real risk is interest rate rises beat the economy so hard it lapses into a recessionary coma, led lower by a housing sector played to a boom-bust disaster zone.

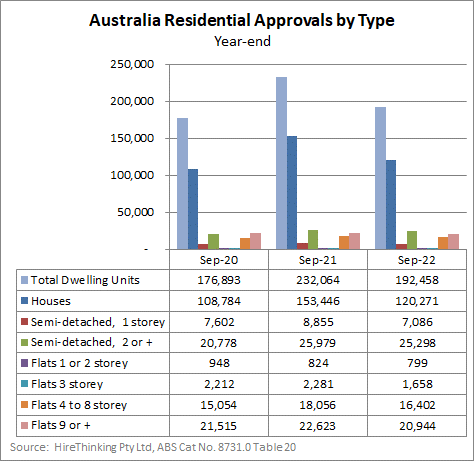

Meantime, back in the current numbers, overall, houses continue to rule the approvals of new dwellings, accounting for 62.5% of total approvals over the year-ended September 2022. For all that dominance, approvals were down 21.6% over the year, compared with a 9.2% decline in approvals of Flats 4-8 Storeys and a 7.4% fall for Flats 9+ Storeys.

This data is displayed in the chart and table below.

A trend that often goes unnoticed in the current approvals discussion is the role of Semi-detached 2+ Storey dwellings. These are Townhouses by another name and despite approvals being down 2.6% year-ended September, at 25,298 approvals, they are the second largest volume of approvals and the most resilient to date.

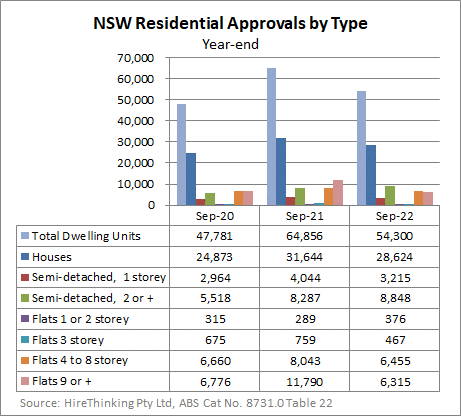

Could it be that land prices, land use considerations, material prices and long-awaited expansion of prefabricated housing componentry is really coming into its own? Perhaps so when we look at data for New South Wales specifically, where land prices and the price of established dwellings are frankly bonkers. In the Premier State, total approvals are down an aggregate 16.3%, but Semi-Detached 2+ Storey approvals are up 6.8% (houses are down 9.5% for comparative purposes), bucking the trends big time.

The situation for the Semi-detached 2+ Storey dwellings is not a lot different around the country. Sure, this could be a moment in time, but perhaps there’s something more to it than meets the eye.

Meantime, back in crystal ball gazing land, the expectations of a serious slump in dwelling construction once the enormous pipeline is built out are gathering momentum. Morgan Stanley for instance is particularly bearish, suggesting building materials companies will begin to be challenged by the middle of 2023. That seems an aggressive forecast given the pace building has slowed, but even if it’s the outlier, it is worth taking note.

If it were not for the stupendous pipeline of work, the magnitude of the current downturn would make it time to worry now, not just in six to twelve months time.