Although not yet observable on an annualized basis, Australian dwelling approvals are progressively softening. Over the year-ended September, Australia’s total approvals reached 227,143, up 3.4% on the prior year. However, annualized approvals were down 1.7% compared with the year-ending August. Further softening can be expected in coming months, as lower monthly approvals begin to take hold.

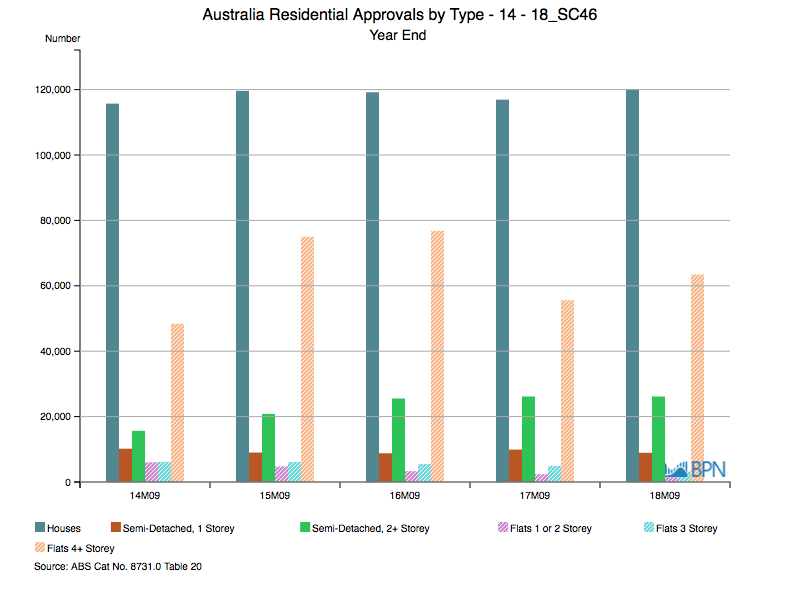

Given the length of the building boom, it is a little surprising to be observing continuing annualized growth in approvals. It is therefore worth examining which housing formats have delivered the recent growth. The chart below shows dwelling approvals for each of the last five years, to the end of September.

To go straight to the dashboard and take a closer look at the data, click here.

It is plain to see that the major contributor to aggregated growth rates has been Four+ Storey Flats (the tan or light orange coloured line). Compared with 2014, for the year-ended September 2018, approvals were 31% higher at 63,446 separate dwellings. While that is a long way behind the corresponding period in both 2015 and 2016, the bulk of the growth in dwelling approvals clearly comes from the high-rise (and the mid-rise for that matter) phenomenon sweeping our capital cities. The return to growth over the last year is notable.

In addition, some notice should be taken of the light-green line, representing Two+ Storey Semi-Detached dwellings or Townhouses. Their growth over the same period is a stellar 67%, with approvals totalling 26,143 dwellings year-ended September 2018. This housing format grew during the peak of the boom, but at least for the time being, exhibits more stability than its taller cousins.

All of this analysis is of interest, but it is important not to be side-lined from the main game. Freestanding dwellings – houses – remain the strength in Australia’s housing economy. With approximately 4% growth from 2014, by the year-ended September 2018, free-standing dwelling approvals totalled 120,100 dwellings. This accounts for 53.8% of total dwelling approvals over the year, and is higher than any of the corresponding periods shown in the chart.

That is important to keep sight of when considering the next year’s likely activity in the forestry, wood products and general building supplies sectors.

Usually in the context of housing prices, it is often said that Australia has more than one housing market. That is absolutely true, and nowhere more evident than in the State level data, displayed in the chart below.

To go straight to the dashboard and take a closer look at the data, click here.

If we want to observe two housing markets that are performing differently – for approvals – we need look no further than NSW (grey band at the bottom) and Victoria (orange band directly above NSW).

Dwelling approvals in NSW are down 5% over the year-ended September, falling to 67,515 separate approvals. Meanwhile, in Victoria, approvals are up 16.9% to 74,986 separate approvals. Those differences are widely considered to be a function of two main factors. Victoria’s strong population growth, and the general cost of living, especially housing in NSW.

We fall easy victim to the desire to fixate on the two most populous states, and for some reason, we focus attention on Queensland approvals in the depths of winter. However, other states are also instructive, especially because they can help us understand how general economic trends impact housing markets.

This month, it is the turn of Western Australia, the housing market of which is still absorbing dwellings constructed during the height of the mining construction boom. The chart below shows dwelling approvals for WA, for the year-ended September for each of the last five years.

To go straight to the dashboard and take a closer look at the data, click here.

There are two inescapable observations that arise from the WA dwelling approvals data: It is all about houses, and the decline has been severe.

In the year-ended September 2014, WA’s dwelling approvals totalled 31,911 separate approvals. By the year-ended September 2018, approvals had fallen 45.2% to 17,502. That is a large decline, commensurate with the hit to the WA economy arising from the end of the mining construction boom. Unsurprisingly, houses took the brunt of the pain, with approvals declining 47% over the same period, and plunging to 13,032 separate approvals year-ended September 2018.

With the exception of the still modest contribution from Four+ storey dwellings, the decline of the other housing formats was similar to that of houses, although for Flats of 1 or 2 Storey, the decline over the same four years is a massive 86.7%! Four+ Storey apartments saw approvals drop just 5.4% year-ended September 2018, compared with four years earlier.

But thinking about what this must mean for land availability relative to demand for new housing, we turn attention to the ratio of free-standing dwellings in WA. In 2014, they accounted for 77% of the total, which slipped to 74.5% in 2018 – not much of a difference.

More than one housing market in Australia? The data tells us so.