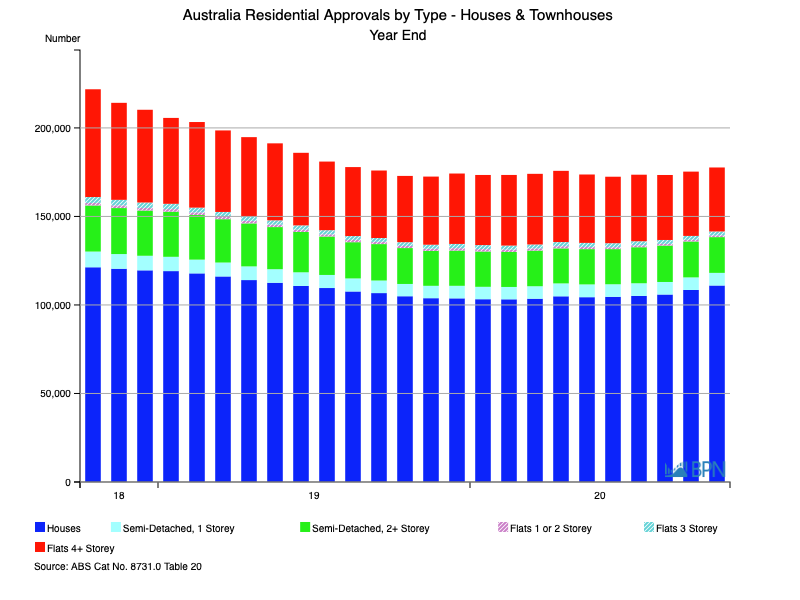

Residential dwelling approvals lifted 2.7% over the year-ended October 2020, with total annual approvals reaching 177,654 separate dwellings. Free-standing dwellings continue to dominate, with annualised approvals hitting 110,988 for the year or 62.5% of the total. Despite the solid result, there are concerns that the housing market is being forever changed, especially with respect to affordability.

While it may be that household expenditure drives the domestic economy, the sector that adds the greatest impetus to economic activity in Australia, is the housing sector. As a barometer of economic health it is not always the right measure, but the nature of the sector’s headline measure, dwelling approvals, is an indicator of future activity that is pretty much unparalleled in the domestic economy.

That is because when we see dwelling approvals rising strongly in the midst of our economic woes, as the chart below demonstrates, we know there is a pipeline of work waiting behind it. Today’s approval is not built for months to come, and the economic power of the supply chain is only just activated at that point.

We can point to many features right now, but the point of showing the long run chart is to display the monthly approvals of free-standing dwellings (the blue bars). In October 2020, there were 11,509 free-standing house approvals. That is just 59 approvals short of the all-time record and the third highest monthly approvals of free-standing houses ever!

To go straight to the dashboard and take a closer look at the data, click here.

Though at so many levels it is hard to fathom, dwelling approvals – especially of houses – is cranking along like there’s no tomorrow.

In part, this is related to stimulus of various types. First home-buyer grants, some confidence among those who have really considered their jobs and seen little impact from the pandemic, having little else (like overseas holidays) to spend on and of course, access to almost free capital because interest rates are so low, and will remain there for some years.

Of course, as the green line on the chart above shows, it is not just free-standing dwellings that are on the rise. The other housing formats are also clipping along now. The mid-November extension of the HomeBuilder program that allows for contracts to be signed to the end of march has obviously had an impact, even with the size of the stimulus declining and the eligibility threshold increasing.

Speaking to the Australian Financial Review, Mirvac reported sales were up 40% and enquiries and new contracts continue to be issued at record pace.

As the chart below shows, though they have a way to go to rival houses, the apartment towers (Flats 4+ Storey) are starting to get their act together. Meantime, fuelled by houses, total approvals are 2.8% higher than a year ago!

To go straight to the dashboard and take a closer look at the data, click here.

Despite the numbers, the entire economy has to be aware of future approvals. It is easy to predict that until mid-2021 at least, there is sufficient work in the building pipeline, but what about the next rounds of approvals?

SQM Research, among the most capable of the housing sector forecasters, suggested in early December that because the sector is ‘too big to fall’ (leave alone fail), stimulus will continue to provide a pipeline of work. As the stimulus continues, SQM argues, price gains will be around the double digit level in 2021, making housing affordability more challenging. In a chilly prediction of the future impact of this strategy, the MD of SQM Research, Louis Christopher told the Australian Financial Review:

“The path they’ve put us on will mean home ownership rates are going to keep falling over the next 10, 15, 20 years. … We don’t have a crash but instead we have a massive gap between those who have a house and those that don’t.”

Perhaps that thinking is one reason – of several – that the Victorian Government has announced a massive $6 billion four-year program to support the housing sector, including the expansion of public housing. For all that this is highly laudable public policy in most eyes – and was widely well received by the sector and most commentators – it was couched as being part of the $50 billion jobs program, aimed at creating around 400,000 new jobs.

Again, there’s nothing wrong with this approach, and in fact it is almost definitely good news. But what it does underscore is the importance of the housing sector to employment and jobs and the importance of jobs to economic growth. In short, as the Victorian government has clearly decided, if you are going to prime the economic pump, you are likely to get more bang for your buck in housing than almost anywhere else.

Another reason the Victorian government has been so decisive in its housing sector support packages is one of the pandemic’s impacts about which little can be done: migration has stalled and will not resume for some time to come. Above all else, it is new household formation that creates housing demand.

In Victoria, net migration (from both interstate and overseas) has long-fuelled the housing market. Latest data shows that flowed through to falling land prices in the September quarter, even as local buyers locked into new contracts as we described above.

Higher unemployment will linger, meaning that combined with lower migration, those who would otherwise have been in the market, will not be able to join the housing party. Little wonder state Governments are pulling out the cheque book, as they seek to underwrite the future economic growth of their states.

A surging housing sector might well run out of steam come the middle of 2021.