Latest data shows that the number of people in employment is rising, the unemployment rate is falling and the participation rate has climbed to near record levels. That is good news. However, there is a ‘but’, as there always is with economic news. Wages growth, which flows directly into household consumption growth, has been well below par for the last few years. For an economy that would find the normalization of its interest rates useful, sluggish wages growth is decidedly unhelpful.

April employment data released on 17th May shows the unemployment rate grew 0.1% to 5.6%, 11,000 more people were in work and the participation rate at 65.6%, up 0.6 points over the course of the last year. That is a large rise for a participation rate that was already tracking towards the top of its potential.

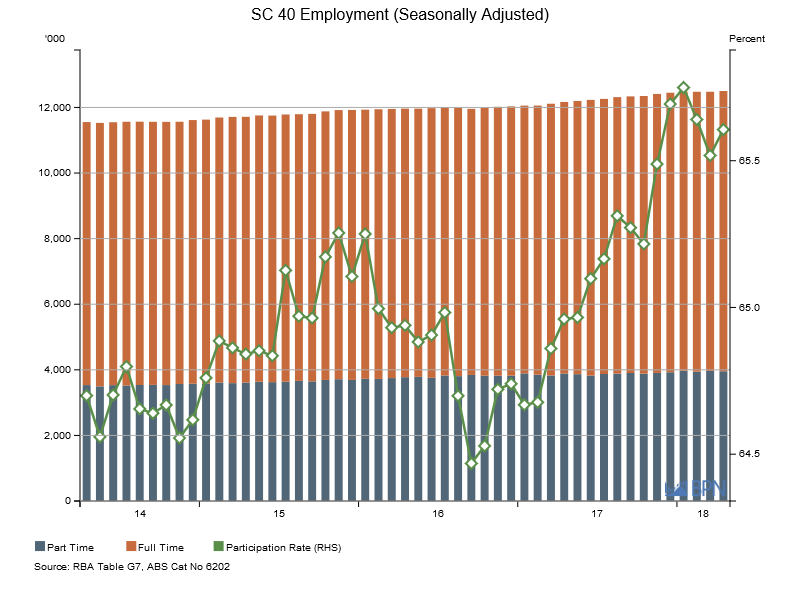

The chart below shows the employment data up to and including March 2018. Although it is a little difficult to see the Participation rate (the green line) it dipped slightly in March, but returned to near record levels in April at 65.6%.

To go straight to the dashboard and take a closer look at the data, click here.

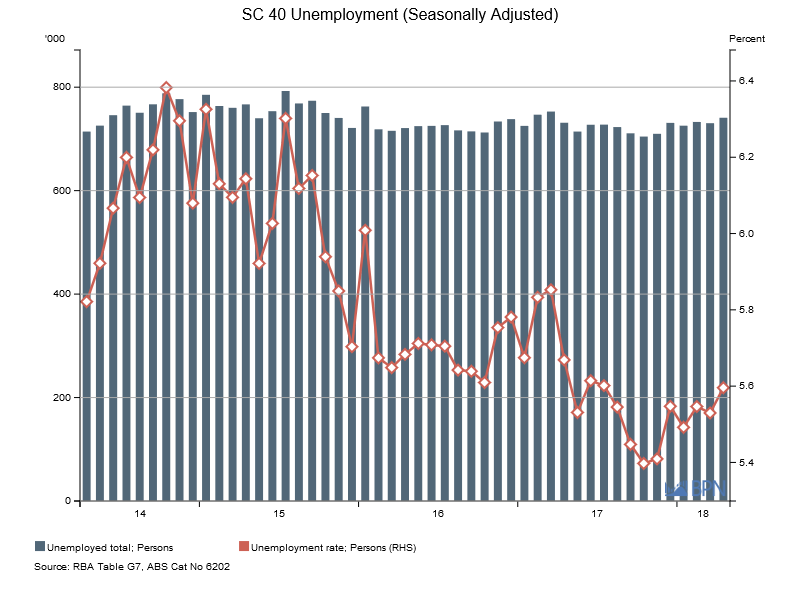

This second chart shows the unemployment data up to and including March 2018.

To go straight to the dashboard and take a closer look at the data, click here.

Though it is difficult to see how the economy will manage this, Federal Budget expectations are that the unemployment rate will fall to 5.25% in just a year’s time. Most of the employment growth will come from population growth, but it is still a challenge to achieve this objective.

It is conceivable that more people will be in work and the unemployment rate will be lower, but that under-employment could rise. Under-employment is the condition that sees employed people have less hours of work than they would prefer.

As Morgan Stanley economist Daniel Blake commented to the Australian Financial Review on 18th May:

“The labour market has clearly weakened since the start of the year, with wage growth lower, full-time jobs declining and hours worked also falling,”

Employment levels, participation rates and related unemployment levels are doubly relevant right now, for the Australian economy. There is an emerging consensus among economic commentators and managers that wages growth will continue to be sub-optimal into the future, unless the interest rate is significantly lower than its stubborn 5.6%.

The Reserve Bank of Australia’s Deputy Governor Guy Debelle was out early on the topic saying:

“There is a risk that it may take a lower unemployment rate than we currently expect to generate a sustained move higher than the 2 per cent focal point evident in May wage outcomes today.”

The RBA’s view has been that wages growth will only be forced upwards by labour shortages where the unemployment rate is below 5%. Mr Debelle may be calling even that unemployment rate as too high, such is the impact of under-employment.

Writing in the Australian Financial Review on 18th May, Jacob Greber referenced a number of economists who confirmed the view expressed by Mr Debelle.

By sub-optimal wages growth, we refer to wages growth that is not sufficient to at least retain the same level of inflation adjusted household expenditure as before, let alone being sufficient to increase household expenditure and consumption. The particular concern is that with more people in work than ever before and a record high participation rate, there should be upwards pressure on wages.

As noted in the item on the Federal Budget in this edition of Statistics Count, wages growth is expected to average a still anaemic 2.25% through 2017-18 and only reach 3.25% (above the expected rate of inflation by around 0.5%) in 2019-20. There are plenty of factors that could get in the way of that wages growth in the meantime.

As David Scutt wrote in Business Insider Australia on 15th May:

“By continually offering low pay increases, it reinforces the low inflation landscape that’s been seen in Australia in recent years, an outcome that will filter back into wage negotiations in the future, keeping the linkage between low wage growth and low inflation in place.”

Looking past the headline employment data, examining the real impact of a high participation rate and under-employment of productive labour resources appears to demonstrate that the suppression of wages growth is holding back the Australian economy.