Amidst the descending gloom in Australia’s housing market, there are of course bright spots that represent navigational beacons. Right now, it is difficult to bypass the role and importance of First Home Buyers. In November 2018, their share of total loan value lifted to a six year high at 15.4%, comfortably ahead of the long-term average of 13.5%, and trending up. In a market where the total value of housing loans (net of refinancing) was down 7.7% over the last year, this is one of the few sparks of guiding light.

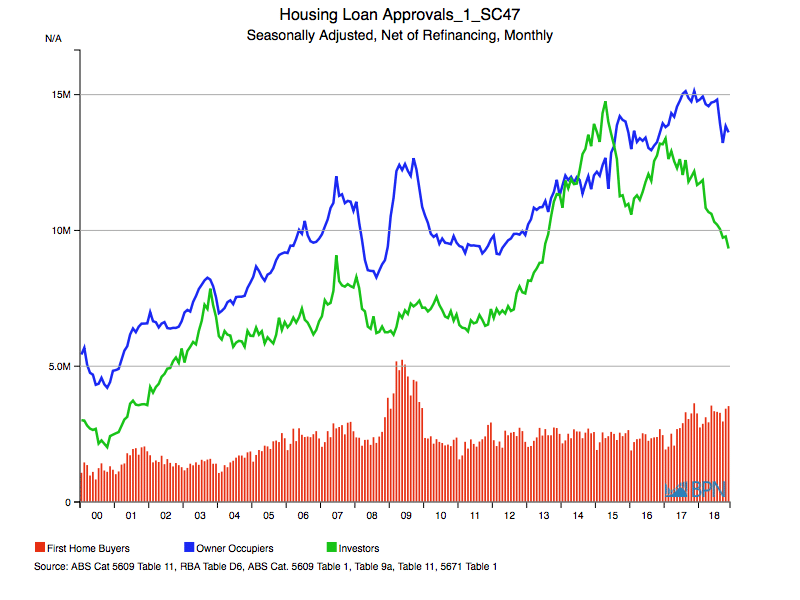

The chart below shows Australia’s new housing loan approvals on a value basis, back to January 2000. The red bars show the value of loans to First Home Buyers, the blue line loan values for Owner Occupiers and the green line the value of loans to Investors. Most of the loans to First Home Buyers are wrapped into the Owner Occupier total.

To go straight to the dashboard and take a closer look at the data, click here.

Loans to First Home Buyers were valued at AUD38.4 billion over the year to the end of November, up 17.7% on the prior year. That is a solid rise in a market that saw total loan values decline 7.7% to 299.4 billion over the same period.

Underscoring the role of First Home Buyers as mainly Owner Occupiers, the total value of loans to Owner Occupiers was down just 1.0% over the year, to AUD172.6 billion. The big pain was felt by loans to Investors, which slumped 15.5% year-on-year to AUD126.8 billion.

Under the combined pressures of relative housing demand equilibrium and significantly tightened credit rules, First Home Buyers are making their way, while Investors cannot. It is not universally true, but unlike Investors, the first time borrowers have actually saved money and are leveraging cash to get loans – not leveraging theoretical value gains on one loan to get another loan.

The long-run chart is useful to examine because it demonstrates that while the role of First Home Buyers has been more significant – in the GFC, a decade ago, to be specific – the recent rise in their contribution appears to be more stable and structural. Back in the GFC, the spike came courtesy of financial support that helped keep Australia out of recession, priming the pump of economic activity, and of course, inflating house prices.

More recently, we can see that the credit pressures on Investors that saw the total value of their loans begin to come down, coincides with the rise of loan values to first-time buyers.

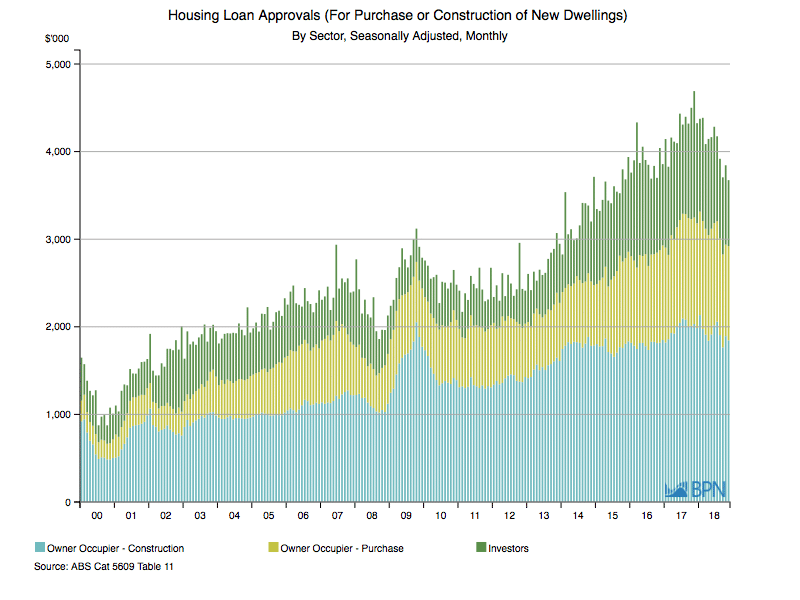

The second chart shows details about where Owner Occupiers (including most First Home Buyers) spend their loans. It shows the value of loans for Construction and separately for Purchase, with the role of Investors laid over the top.

To go straight to the dashboard and take a closer look at the data, click here.

Again, we can see Investors hammered over the last year. The value of loans down 11.0% over the year-ended November. But Owner Occupier loans for Construction were down just 1.7% over the same period, to AUD23.2 billion, but loans for Owner Occupier Purchases of existing housing were up 0.9% to AUD13.8 billion.

How do we read this?

Just as with dwelling approvals data, we have to look beyond the headlines that suggest the fog of despair is descending on Australia’s housing market.

Sure, dwelling approvals are down, and loan values are down with them. But new Free-Standing dwelling approvals are in modest decline and Owner Occupiers – underpinned by solid growth in loans to First Home Buyers – have only seen their total loan values fall modestly. At least compared to Investors.

Dwelling prices may be due for a hard landing as they stumble into the hurdles amidst this current housing market miasma, but meantime, lending continues to those who are new to the market (and have saved cash for deposits), to those switching houses, and are pretty much stable in terms of value for new constructions.

Eventually the gloom will lift from Australia’s housing markets and within a year or two, confidence will return. When that happens, the nation may well be very pleased that it has housed more young families, and might start looking to them even as the next class of investors. The cycle rolls on.