Different to the orthodox expectation in a softening market where prices fall, First Home Buyers are being knocked aside by the remarkable rise in dwelling prices. That this coincides with higher interest rates that underscore the affordability question is just adding pain to the housing affordability conundrum.

All housing cycles are different. Each provides new insights into the operation of the market and the interactions of supply and demand.

This current downward trend in approvals and associated lending levels has its genesis in the pandemic. It is linked to the COVID border closures and other restrictions that were then compounded by the dramatic increases in interest rates which commenced in May 2022.

The combined impact was falling house prices and declining building approvals, despite significant and growing unmet demand.

Normally, that would provide first homers with the opportunity to enter the market, leveraging their savings (and the bank of mom and pop) into a first foray onto the property escalator.

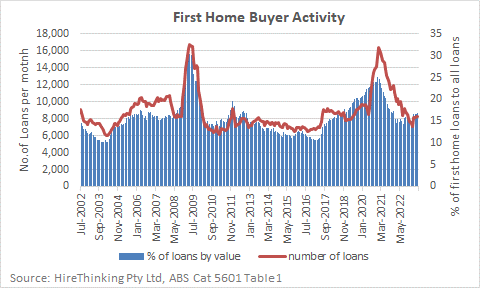

This ‘normal experience’ can be observed with the big upswings in the number and value of First Home Buyer loans that followed the GFC and more recently, the lift during the COVID lockdowns. In both cases, the improvement for First Homers was linked to government stimulus to address the overall market downturn with targeted assistance such as first home buyer grants, and more recently the HomeBuilder scheme.

However, unlike previous cycles where housing prices remained subdued as interest rates rose, this cycle has seen an uptick in house prices as discussed elsewhere in this edition of Statistics Count. This time around, there has only been a small increase in first home buyer activity.

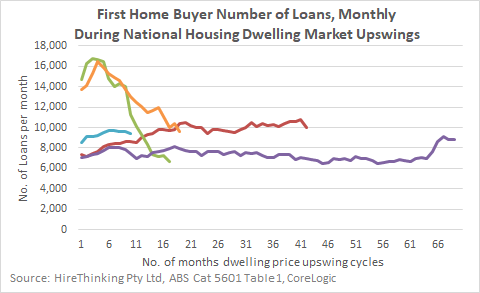

CoreLogic have undertaken an interesting analysis overlaying the ABS lending data with their own house price data to represent market upswings, by showing the number of months in the cycle there was a rise in First Home Buyer activity.

The orange line represents the current cycle. It shows there were just four months in which First Home Buyer opportunities rose. A very short window of opportunity, in which to get invested, assuming you get the timing right.

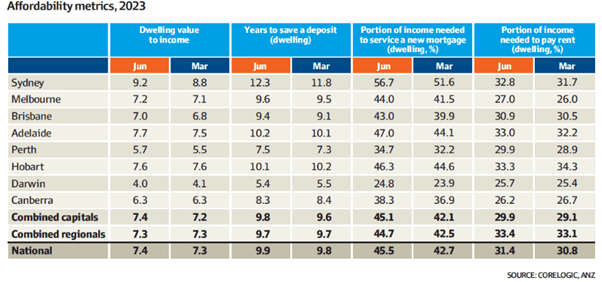

Overall, the key challenge for all potential home buyers is affordability and in June 2023, this had not improved.

As interest rate rises bite into savings, as rents rise and house prices lift, the capacity for people to participate in the property market has worsened on all metrics shown in the following table.

There is little good news for anybody or any part of the economy when first homers are left stranded from participating in the security that comes from having one’s own roof over one’s head. Housing affordability is a multi-headed crisis for the Australian economy and the society it serves right now.