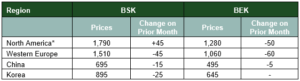

- China’s BEK price fell to USD495/t, while BSK prices slid to USD695/t in June as pulp prices struggled with global uncertainties and demand weakness.

- North America was the sole market to see prices increase, as a direct result of local tariffs.

- Australian pulp imports totaled 27.8kt in May 2025, in line with expectations.

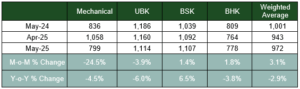

- Australia’s weighted average pulp import price was AUDFob972/t in May 2025, up 3.1% on the prior month.

Global pulp prices fell further in June – pressures mounting on the global system

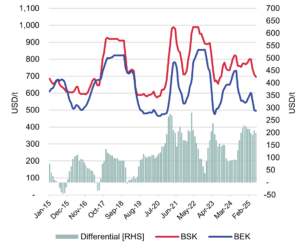

In June, the Chinese Bleached Softwood Kraft (BSK) price fell USD15/t to USD695/t, while the Bleached Eucalypt Kraft (BEK) price was down USD5/t to USD495/t. In China, the pulp price differential was USD200/t.

All main global pulp markets saw prices fall, with Hawkins Wright describing the falls as a result of macro-economic pressures, weak seasonal paper demand and over-capacity. They report pulp producer inventories are rising, with little prospect of buyers rushing to enter the market when their downstream paper markets are also experiencing difficulties.

In China, it must be of increasing interest that local BSK and BHK (including BEK) mills are price competitive with imported pulp. The pitched battle in global pulp supply – at least as it relates to China and to Asia more generally – was represented by China’s domestic producers on the one hand and South American producers on the other.

Pulp mills in South America were routinely able to deliver BEK pulp into China, at prices cheaper than local producers could provide supply. The local producers import woodchips and, in many cases, have operating costs that are higher than the fully-integrated South American mills.

That thesis of South American price supremacy probably holds true when market demand is buoyant and inventories are low with few global disruptions to wrestle with. That is a less certain proposition when market demand is structurally low and global producer capacity is high.

For many years, the least efficient Chinese pulp mills have (quite rapidly in global context) been closed or shuttered. The remaining mills are more efficient and some can produce more cheaply than the South Americans. Vietnamese hardwood chip supply is very close to China and seemingly endlessly abundant. China’s own plantations are reportedly delivering wood in growing volumes.

When the market is soft, very large South American pulp mills have significant capacity with literally no other home in an over-capacity market.

It can be anticipated that this is driving pulp price deflation.

As a result, the big question for the global market is when will the market and therefore the price of BEK pulp recover? The short answer is the market does not know that pulp markets will recover, at least not while the main end-use is in the faltering printing papers sector.

Examine the chart below closely. A decade of Chinese pulp data shows the price of BEK has been trending lower, has fewer and shorter peaks and rapid declines. The ‘spread’ or differential to BSK is clearly trending higher, having effectively doubled over the last decade.

The growing use of hardwood pulps in packaging applications in China and elsewhere is a positive trend and a basis for robust demand within China, including for global hardwood chip suppliers. Whether that will provide a future as buoyant for the South American mega mills is uncertain.

China Chemical Pulp Prices by Grade and Spread: Jan ’15 – June ’25 (USD/t)

Global Chemical Pulp Prices: Jun ‘25 (USDCif/t)

Source: Hawkins Wright, TTOBMA, Pachem and IndustryEdge research

* Delivered

Australia’s pulp market retains its stability

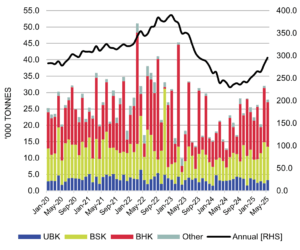

Australia’s pulp imports totaled 295.3 kt year-ended May 2025, up 23.1% on the previous year. Annual imports are very settled, with demand being impacted mainly by decisions to cease production on paper machines or entire mills.

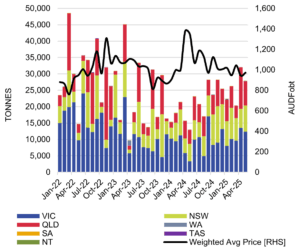

In May, imports totaled 27.8 kt, down 13.2% on the prior month. Shipments of BSK totalled 10.2 kt and those of Bleached Hardwood Kraft (BHK) landed at 13.6 kt.

The monthly weighted average pulp import price was AUDFob972/t in May up 3.1% on the prior month.

The trending down of pulp imports – in line with tissue production capacity closures – can be seen below.

Australian Pulp Imports by Grade: Jan ’20 – May ‘25 (‘000 tpm)

Source: ABS, derived and IndustryEdge

Imports are perpetually dominated by three grades: Unbleached Softwood Kraft (UBK), used mainly as cement board stabiliser and potentially in the production of Kraftliner for corrugated boxes, Bleached Softwood Kraft (BSK) and Bleached Hardwood Kraft (BHK), that despite their versatility are imported into Australia primarily for tissue production.

Pulp imports have largely stabilized in recent months, with paper and paperboard production also returning to stability after capacity was reduced.

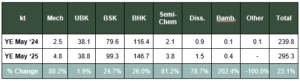

Australian Pulp Imports by Grade: YE May ’24 v YE May ‘25 (kt & %)

*Diss. = Dissolving Pulp, Bamb = Bamboo

Bleached Softwood Kraft (BSK) imports will remain around 90.0 kt per annum for the foreseeable future, with Bleached Hardwood Kraft (BHK) imports expected to remain around or just below 130 kt per annum.

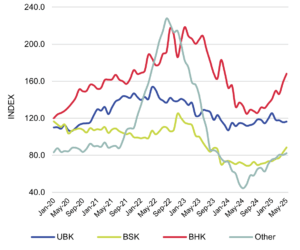

Annualised Australian Pulp Imports by Main Grade: Jan ’20 – May ‘25 (INDEX: Base = Jan ’12)

Source: ABS, derived and IndustryEdge

Imports by state

Data showing imports by state of delivery indicates almost all shipments are received into the Eastern states, with Victoria receiving most pulp. Shipments into Victoria (43%), New South Wales (30%) and Queensland (26.8%) accounted for almost all total imports for the year, as the chart below shows.

Australian Pulp Imports by State: Jan ’22 – May ‘25 (Tonnes & AUDFob/t)

Source: ABS, derived and IndustryEdge

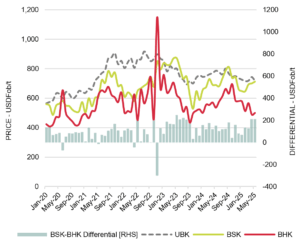

Australian pulp price differential

In May 2025, the average BSK price was AUDFob1,107/t while the BHK price was AUDFob778/t, with the differential operating at AUD329/t for the month. In US dollars, the differential was USD212/t.

The recent price experience is shown below, noting that the chart is in US dollars.

Source: ABS, RBA and IndustryEdge

The table below shows import prices in Australian dollars, for the main grades of pulp.

Source: ABS, RBA and IndustryEdge