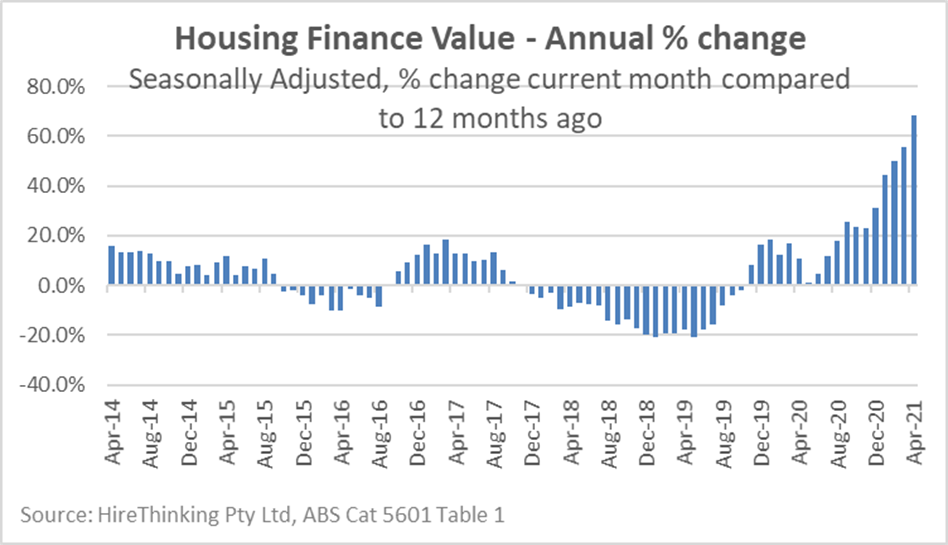

When approvals of new dwellings are at record levels, you can be assured that home lending is also booming. Latest data shows that for the year-ended April, total housing finance increased an incredible 68.2%.

Fuelled by an unprecedented program of fiscal stimulus, approvals for new homes, as well as the churn of housing as established borrowers traded up, saw a year when almost without cessation, annualised lending finance growth kept expanding. It might be that the growth has come to an end – in line with the stimulus – but there could be a month or two of stellar growth left that will play its way through to housing finance data.

We can see in the chart below that prior to the pandemic, housing finance had already turned the corner and was moving up, along with approvals in late 2019. Then came the pandemic, which knocked growth on its head for a month or two. Then came the wall of money and time-dependent stimulus that drove the market onwards and upwards in the most astounding ways.

Fig10

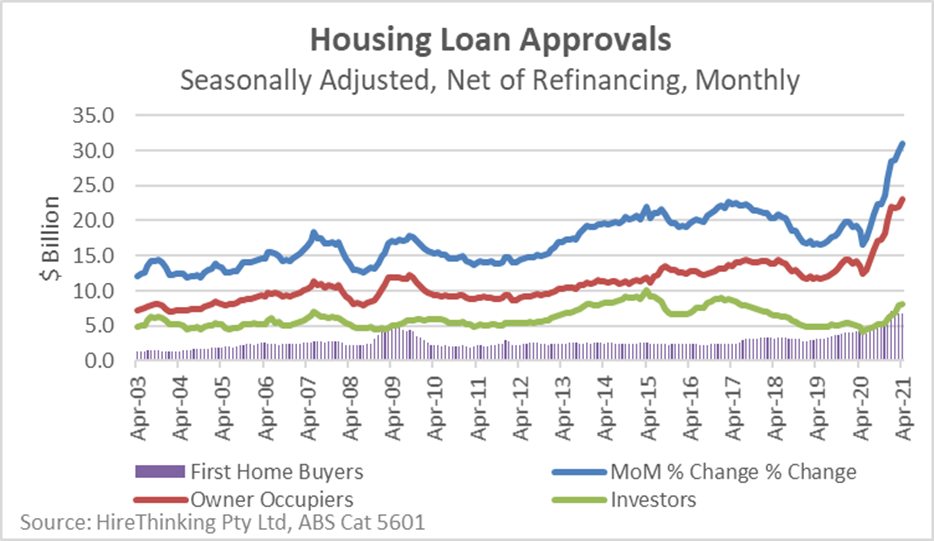

If we just take a moment to consider the month of April itself – this is the first month after the stimulus ended – we can see for new home loans (net of refinancing), April was the biggest month ever. As the ABS confirmed in its media release that accompanies the data:

“New loan commitments for housing rose 3.7 per cent in April 2021 (seasonally adjusted) to a record high of $31.0 billion.”

ABS head of Finance and Wealth, Katherine Keenan, said:

“The value of new loan commitments for owner occupier housing reached another all-time high in April 2021, up 4.3 per cent to $23.0 billion. New loan commitments for investors rose 2.1 per cent to $8.1 billion, which was the highest level since mid-2017.”

So, the owner occupier cohort saw lending at record levels, and as we can see below, investors have been filling their boots with cheap finance since the pandemic hit, lifting their share of the loan book to just under 26%.

Fig11

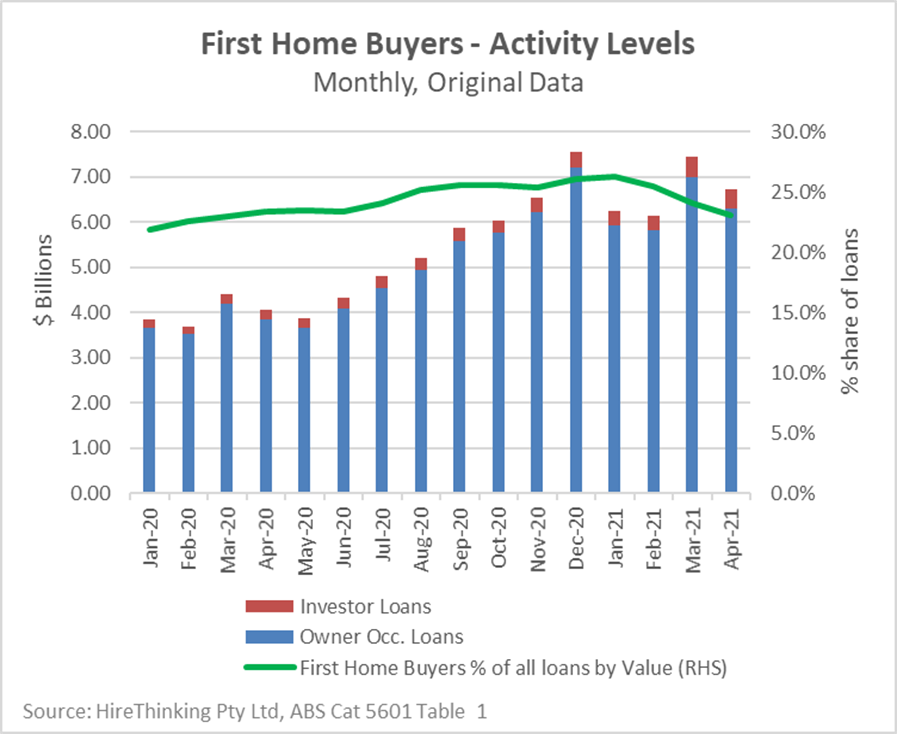

We know from past and sometimes bitter experience that the role of first home buyers often clashes with the role of investors. Through most of 2020 that was not the case. The two borrower groups were expanding their shares at about equal rates.

2021 appears to be a different matter.

From December 2002 to April 2021, investors have grown their monthly loan value by a pretty tidy 35.5%, while first home buyers have seen their monthly loan value increase just 3.1% over the same period. In fact, the value of loans to first-timers has fallen for the last three successive months.

As a result, first-timers have seen their share of the market erode from 26.1% of loan values in December to 23.1% in April.

Oh, what a difference a little stimulus makes to a young couple’s willingness to engage in the housing market!

Fig12

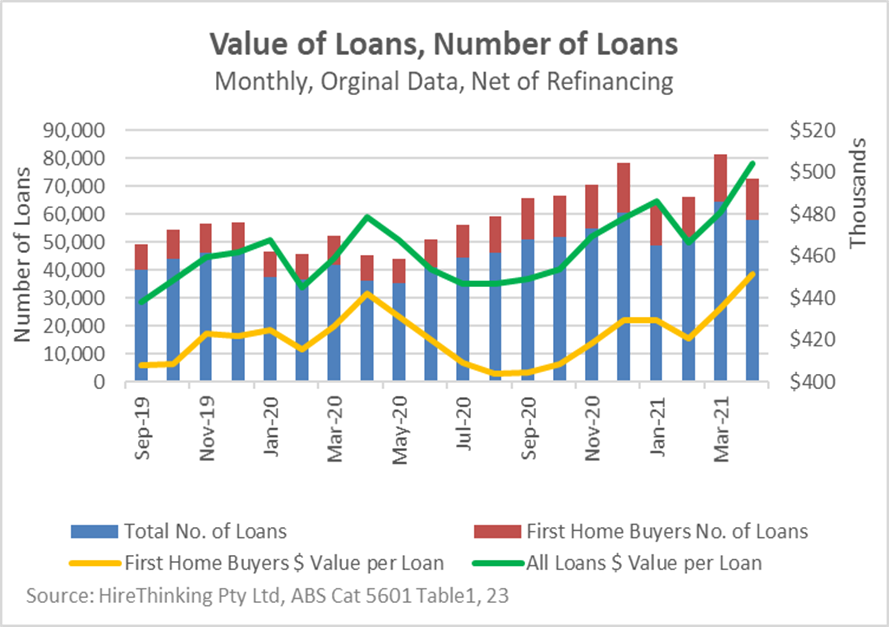

Fig13

Stimulus plays a big part in the housing sector’s fortunes. In April, we saw that when, as the ABS’ Keenan puts it:

“The rise in owner occupier lending was driven by increased loan commitments for existing dwellings, which rose 9.2 per cent. Loan commitments to owner occupiers for the construction of new dwellings fell by 11.4 per cent, following a fall of 14.8 per cent in March. These were the first monthly declines since the Homebuilder grant was introduced in June 2020.”

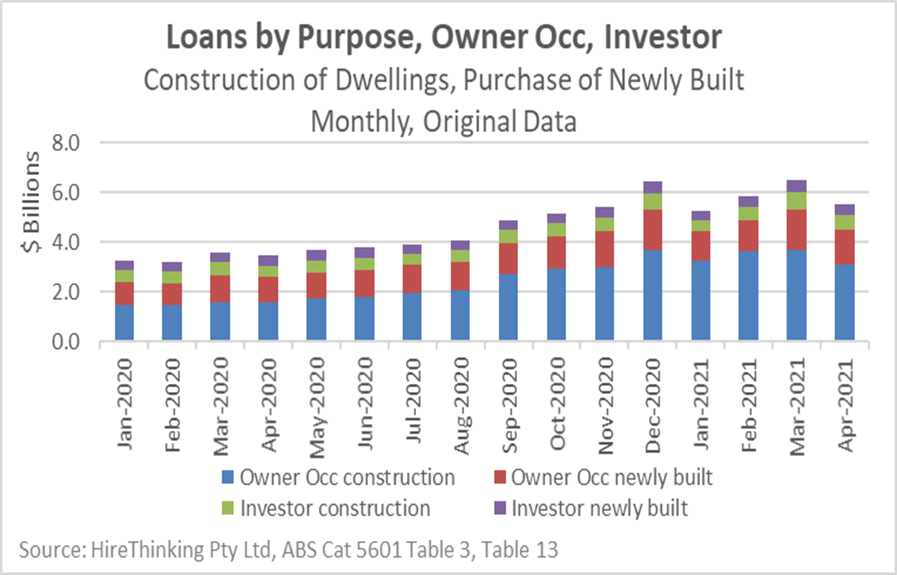

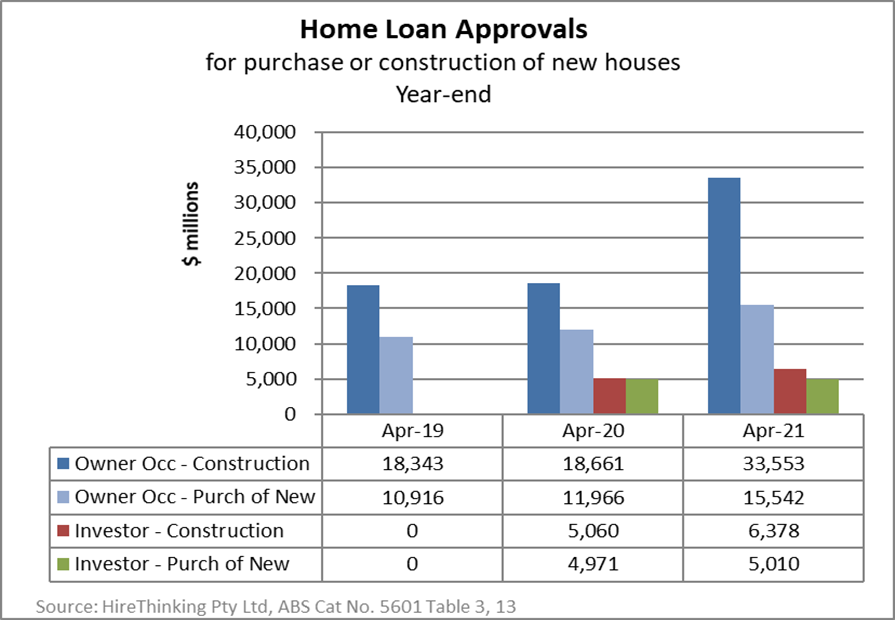

So, there has been some softness for new dwellings as soon as the stimulus came off – and that included first-timers. But interestingly, the ‘churn’ money is continuing to splash through the loan books, and might have a while left to run, given the lag between commitments and borrowing. The two charts here tell the same story, from different perspectives.

Fig14

Fig15

The year-end values in the second chart are simply staggering, while the monthly details are just beginning to stagger a little, so to speak.

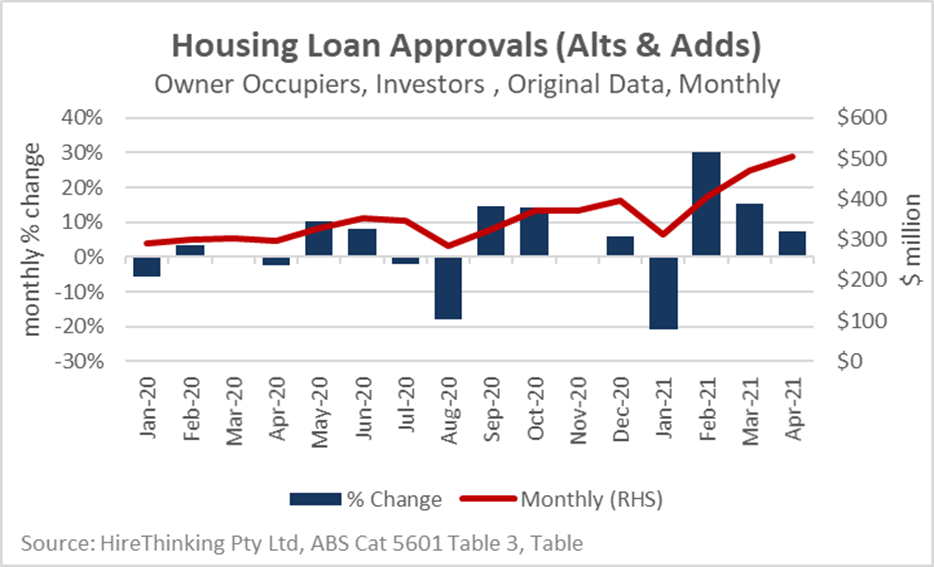

It is also worth taking a look at lending for Alterations & Additions. Shown below for the last eighteen months, we can see monthly growth has been a little patchy, month-on-month, but still there is growth. With the value of loans lifting 7.5% in April to $A504.5 million, there is a lot of activity underway in ‘reno land’, just like there is in ‘new homeville’.

Fig16

Because of interest rates being so low and buckets of fiscal stimulus flying out the door, the regulators don’t yet appear to be nervous about debt levels and the extent to which a debt bubble might be waiting to burst over the housing market. It could be that pent up demand has been soaked up and some moderation will return to the market.

But if something did go a little bit awry, there are a lot of households, with a huge amount of exposure to the housing sector right now. As the pipeline of work that the bank of nation saving has funded continues to be built, we need to keep our attention on borrowers and their commitments. They could yet bring us unstuck.