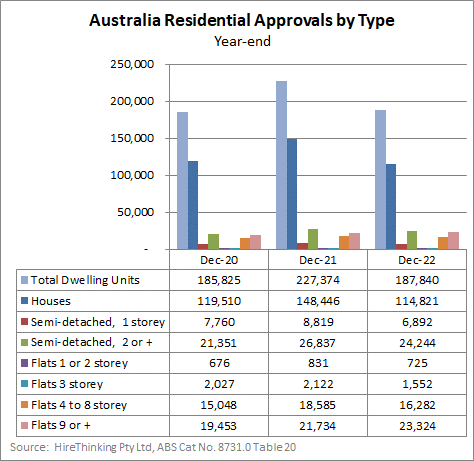

Australia’s new dwelling sector continued to cool in December, with annual approvals for 2022 down 17.4% compared with 2021, declining to 187,840 total approvals. The only bright spark in the market is for 9+ Storey Flats, with approvals up a healthy 7.3% to 23,324, with houses down 22.7% to 114,821 approvals.

In aggregate, Australia’s new dwelling approvals are still above recent experience, but successive interest rate rises – and more to come – are clearly impacting new home sales and therefore approvals.

The last three years’ experience – covering the whole of the pandemic – is shown in the chart below.

Although on an annualised basis, the emphasis has been on the ‘ends’ of the market – Houses at one end and 9+ Storey Flats on the other – the forestry and wood products industries could do well to keep the attention on Semi-Detached dwellings or Townhouses. They have been growing their share for more than a decade and with the 2+ Storey Townhouse format losing just 9.7% in 2022, it may be worth remembering they are the second largest format by volume, even now.

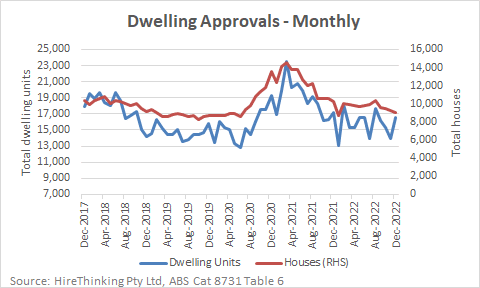

Overall, the cooling of the market can best be observed in the chart below, which shows monthly dwelling approvals – the total on one axis and Houses on the other. In December itself, approvals of Houses totalled 8,989, down 2.4% on the prior month.

If there is a consensus on the housing market right now, it is that the decline has been driven by one factor: interest rate rises. It is bad enough, as Nila Sweeney wrote in the Australian Financial Review, that some households who bought in the midst of the pandemic are now facing negative equity as rate rises quell prices. Around 120,000 households are in that position right now and there are others not far from it.

Sweeney reported an S&P Global Ratings Director saying negative equity experiences are impacting first home buyers under particular mortgage stress. Those experiences will be played back to other potential first home buyers in the same demographic cohorts. That will have a large impact on demand.

Adding fuel to this argument is the specific experience of major home builders. AV Jennings reported there was little doubt that in the short term, interest rate rises are directly linked to enquiry levels declining by half of the peak reached just one year ago.

Essentially, those sensitive to rising interest rates are stepping out of the new dwelling market until such time as conditions improve. That could be a little while, but as AV Jennings commented, its unlikely to be too long.

Over the medium to longer term, the significant housing shortage and the return to more complete inbound foreign migration will ensure building activity kicks back up in the relatively near future.

In that context, it is worth noting the Federal Government has progressed the Housing Australia Future Fund through the lower house of the Parliament. Once enacted, the vehicle for the National Housing Accord should provide a solid base level demand for housing in years to come.

Meantime, the ride could be bumpy once the current pipeline of building work reduces as completions start to overtake new commencements.