The monthly approvals data for May continues to show progress being made compared to April with total approvals of 15,212, up 3.2% from the previous month. Confirming that the trend year on year for approvals is up 6.5%.

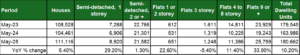

Housing Table 1

Source: ABS Cat 8731 Table 6

Importantly for the timber industry, detached house approvals were up 0.1% for the month and 3.2% when comparing the May 2025 to May 2024.

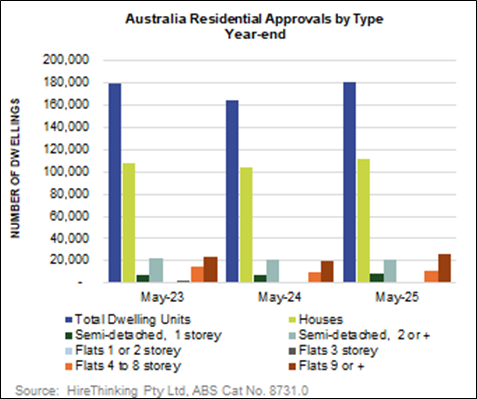

Housing Chart 1

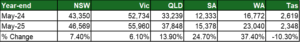

Housing Table 2

Source: ABS Cat 8731

As we can see from the data, the big contributors over the year were Flats 4 to 8 storey which, year-ending May 2025, were up 11,386 (+11.4%) and Flats 9 or more storey up 33.9% to 25,759. Also, on a year-ending basis, detached housing was 111,116, up a promising 6.4% compared to the year-ending May 2024.

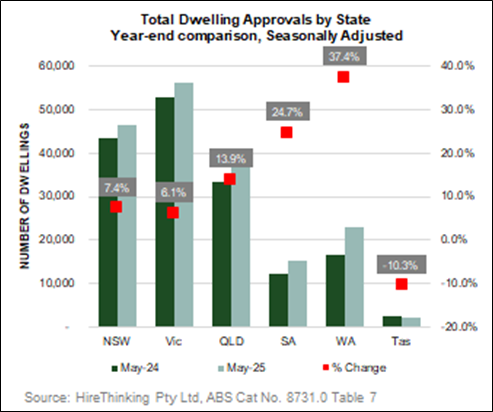

The state data shows that all states experienced positive growth for the year ending May 2025, except Tasmania.

Housing Chart 2

Housing Table 3

Source: ABS Cat 8731 Table 7

In a national context, Victoria’s approvals process appears to be gaining momentum. A podcast in the AFR by Myriam Robin states that “Victoria is projected to hit 98% of its national housing target, compared to 65% for NSW. All other states except Tasmania are expected to be slightly better NSW.”

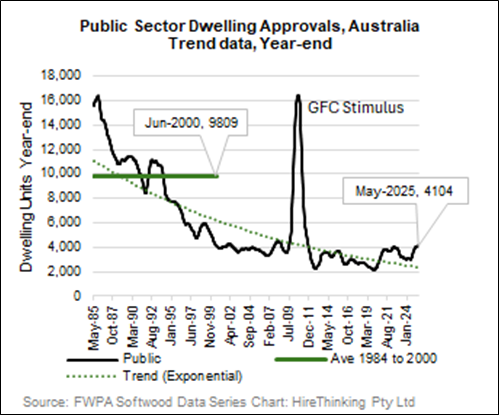

It’s also interesting to note that public housing approvals are also moving upwards off a low base.

Link to the podcast <https://www.afr.com/politics/federal/crazy-stuff-taking-apart-both-sides-diabolical-housing-policies-20250415-p5lrzt>

Housing Chart 3

The average up to the year 2000 was 9808 approvals per year. As at May 2025 this was 4104 which is now above the long-term trend line.

It will be the combination of the private sector facilitated through improved planning process and also direct government investment which will be needed to achieve the National Housing Accord target of 1.2 million homes over 5 years. Time will tell, but at least progress is now being made.

Interest Rates on Hold

The surprise news to market observers was the RBA decided to hold interest rates steady during its meeting on 8 July 2025. RBA Governor, in announcing the decision emphasised that the recent monthly inflation data was very positive, but the Board wanted to see that confirmed in the June quarter CPI results.

This is clearly a more conservative approach than mortgage holders would have liked but it appears that if the June CPI data and other international factors remaining stable, a reduction at the next meeting would be likely.

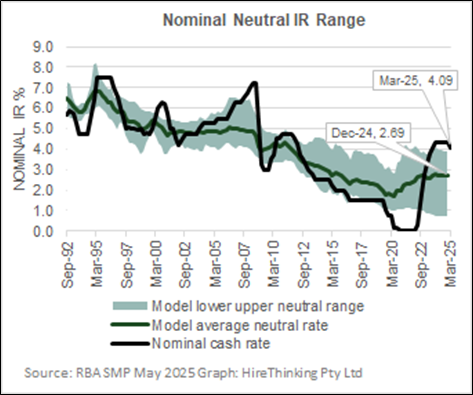

The current cash rate at 3.80% is still restrictive in terms of the RBA perspective on the “neutral interest rate” which is achieved when the interest rate settings are neither encouraging nor restricting growth.

Whilst the view on the “neutral rate” may change over time, a recent presentation in the May Statement of Monetary Policy suggests the nominal “average neutral rate” based on RBA modelling is 2.69% as at December 2024 compared to a nominal cash rate as at 1 March 2025 of 4.09%.

Housing Table 4

So, there is still plenty of room to move on interest rates in this cycle.

The AFWP Data Dashboard provided the Australian Dwelling Forecast Dataset, which is updated monthly.

Link to subscribe: FWPA Data Dashboard – Forest & Wood Products Australia.