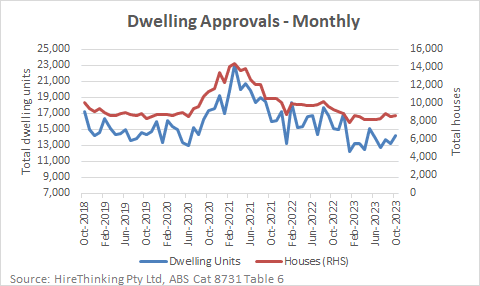

Australian dwelling approvals lifted 7.5% in October, rising to 14,223 for the month, the first positive month since May 2023. On a year-ended basis, approvals were 165,210 for the period ending October 2023 down 13.9% on the previous year. The prospect is that housing approvals could have turned the corner, though a few birds singing does not mean its spring.

Demand for dwellings appears to be coming from migration-fuelled population growth and also new investors starting to appear in the market as institutions look to participate in Build to Rent projects and other forms of housing related capital structures. The investor interest makes more sense because a significant proportion of the increased resident population is students, who are more likely to be renters than buyers: someone has to fund their dwellings.

As noted economist Gerard Minnack continues to observe, migration is not all upside and is currently hurting the economy, deflecting its efforts to house and occupy the established population.

There is already plenty of demand for housing as higher prices demonstrate, but as the economist Jo Masters identified, there is huge risk in affordability just sucking the life out of any new demand. Meantime, as the way over-stocked pipeline of unbuilt housing demonstrates, we cannot build the housing already committed, such is the labour market and contractor challenge right now.

In any event, examining the approvals by type identifies a remarkable comeback in approvals of dwellings in 9+ Storey apartments. In total, 21,739 dwellings were approved over the year-ended October 2023, which was just -0.2% lower, compared with the previous period.

While a long way below the peak of the last housing cycle, when approvals of 9+ Storey apartment reached 37,524 year-ended July 2018, it is still a sign there is life in some pockets of the market.

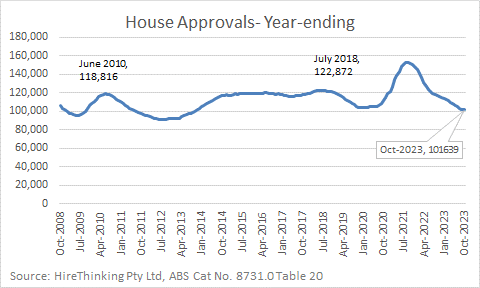

The other notable area is detached housing approvals totalled 101,639 for the year-ended October, a decline of 13.4%. While this is well below the peak of 153,133 year-ended August 2021, it is broadly consistent with the troughs in recent cycles in 2009, 2012 and more recently 2020.

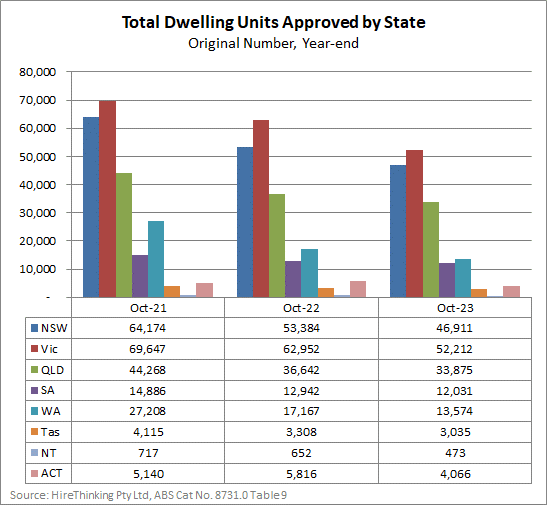

The response at the state level varies on a year-end basis, with Victoria holding up reasonably well, followed by NSW and Queensland.

On a monthly basis, which is more volatile, the picture is more varied.

The ABS comments that total dwelling approvals were driven by increases in Western Australia (11.0 per cent), Queensland (10.7 per cent), and New South Wales (9.6 per cent). Falls were recorded in Tasmania (-14.4 per cent), South Australia (-7.2 per cent), and Victoria (-1.4 per cent).

Approvals for private sector houses rose in Western Australia (+11.7 per cent), Victoria (+6.5 per cent), and South Australia (+0.8 per cent). New South Wales (-4.9 per cent) and Queensland (-3.4 per cent) dropped in October.

Approvals may have turned the corner in October, but even so, that work will not be in the market until February or March. Conditions are slowly improving on the demand side, but the supply side is a different matter.