Date: 31 July 2023

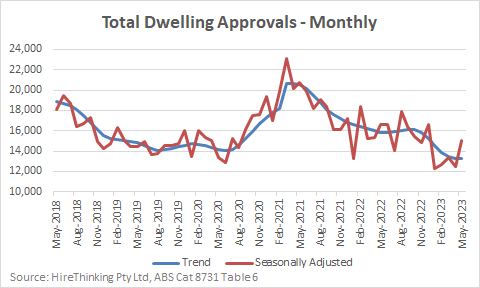

Soft landings are a much-desired aspect of modern economies, and there are early signs that the Australian housing market is headed for just such a miracle moment. In a surprise result, approvals for May 2023 totalled 15,032 separate dwellings, up 20.6% compared with the prior month.

For now at least, the trend appears to have plateaued, with a general view and expectation that rising house prices are another indicator of a return to at least stability, if not growth, in the housing market.

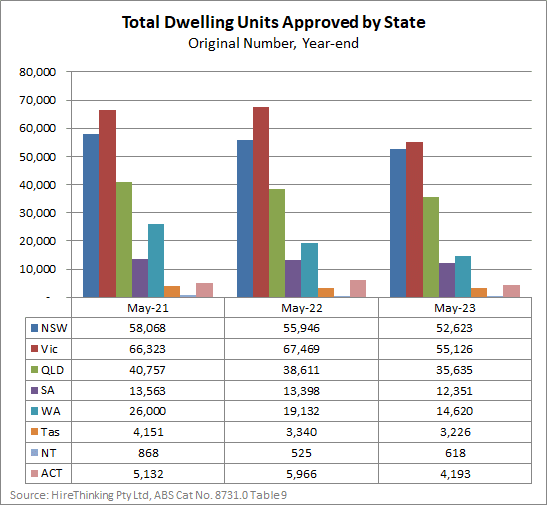

On a state-by-state basis Victoria retains first position in terms of total approvals, with total dwellings at 55,126 year-ending May 2023, a decline of -18.3%. However, NSW approvals are not far behind and are down just -6.4%, and those in Queensland are down -8.0%. NSW will take the market lead in coming months, with Queensland not far behind.

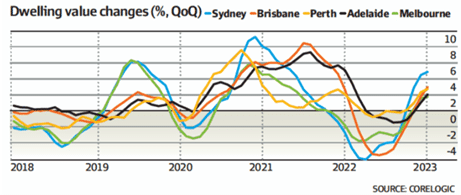

It is difficult to know if this is the bottom of the cycle or simply a ‘dead cat bounce’. Historically, we know there is a link between movements in house prices and movements in housing approvals. In recent months house prices have been increasing.

House price increases are not entirely logical as interest rates continue to rise. It may be, as Nila Sweeney in the AFR observes, these price rises are associated with very limited stock on offer.

Another possibility that should not be instantly discounted is the increasing expectation interest rates are near their peak, and with wages increases in the offing, more households are able to make a commitment that, albeit marginal, is more sustainable than previously.

Another factor reported by ABC News’ Michael Janda is that in the high end property market, many buyers are paying cash. Quoting Matthew Smythe, a real estate in agent in Mosman and Neutral Bay, Janda wrote: “typically buyers are debt free, mortgage free, so they have the capacity to buy no matter what interest rates do”.

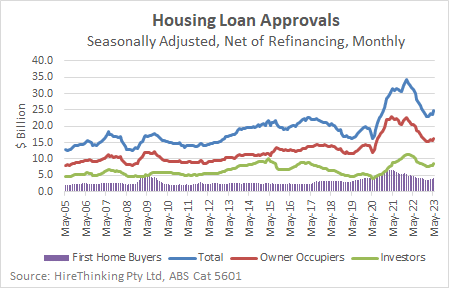

For most though, it’s a mortgage, and here we can see that lending approvals bounced back in May.

In May 2023, in seasonally adjusted terms, the value of new loan commitments for:

- Total housing, rose 4.8% to $24.9 billion, after a fall of 1.0% in April. The May result was 20.5% lower compared to a year ago;

- Owner-occupier housing rose 4.0% to $16.4 billion but was 20.2% lower compared to a year ago, and

- Investor housing rose 6.2% to $8.5 billion but was 20.9% lower compared to a year ago.

While there have been steep declines over the last year, it is pertinent that housing finance levels are still well above pre-pandemic levels. That might feed into our thinking about a soft landing.

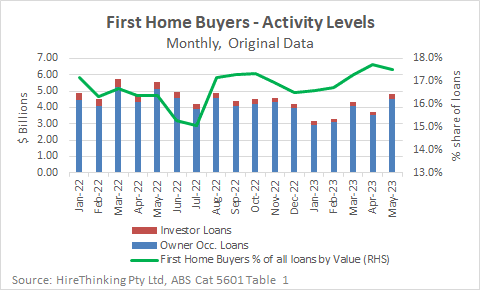

Equally, First Home Buyers are not out of the market, by any means. By value in May, they still accounted for 17.5% of loans written, stable with the recent experience.

In May 2023, in seasonally adjusted terms for owner-occupier First Home Buyers, the number of new loan commitments rose 2.7% to 8,352, after a fall of 0.3% in April. This was 17.4% lower compared to a year ago, but again, is not disastrous by any measure.

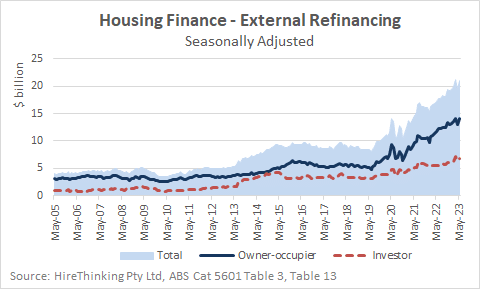

Reflecting concerns about the ‘mortgage cliff’ arising as home-owners refinance from fixed interest loans to variable interest loans struck at current interest rates, refinancing continued at record levels.

The chart below shows this fairly graphically, especially for owner-occupiers, where the greater stress can be anticipated.

In May 2023 in seasonally adjusted terms, the value of external refinancing changed as follows:

- Total housing rose 8.1% to $21.0 billion and was 22.4% higher compared to a year ago;

- Owner-occupier housing rose 8.6% to $14.1 billion, reaching a new high. This was 21.0% higher compared to a year ago, and

- Investor housing rose 7.2% to $6.8 billion and was 25.6% higher compared to a year ago.

There is little surprise therefore, as James Eyers wrote in the AFR, that Roy Morgan estimates 1.43 million borrowers are suffering mortgage stress of one form or another. Alarmingly, those who pay more than 45% of their income on a mortgage increased to 922,000 households, accounting for 19.3%, well above the long-term average of 15.9%.

Calculations suggest just 0.5% higher interest rates would see 30% of households under some level of mortgage stress.

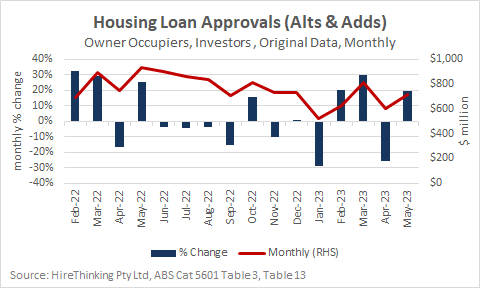

Despite the challenges faced by many in the mortgage market, there were also positive signs for renovators. Loans for Alterations & Additions were up 19.2% in May, reaching $719.2 million.

While the market continues on, with insufficient stock, low sales volumes and rental properties as scarce as various proverbial scarce things, the Australian Parliament remains deadlocked on the Government’s National Housing Development Fund which would free up billions to build more housing from the middle of next year.

Some policy alignment with the market is grimly awaited.