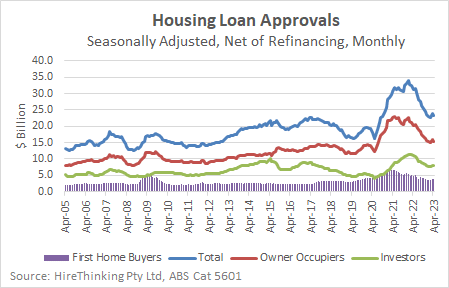

The value of loans for housing fell for the twelfth consecutive month in April, exactly consistent with the period over which interest rates have been increasing. The sole group continuing to stand tough are investors, whose reliance on finance and risk of over-extension is lower. Further pain appears likely as major banks prepare themselves for an onslaught of underperforming loans.

It is no coincidence that the decline in the value of housing loans commenced exactly when the RBA tightening cycle commenced in May 2022. Since then, the value of housing loans has fallen 25.8% from April 2022 to April 2023.

Overall it is Owner Occupiers who have taken the brunt of the pain, with their loan values falling 3.8% in April compared to March and totalling $15.40 billion, while Investor loans were down 0.9% on the prior month and were valued at $7.85 billion. That is, Investors are accounting for around one third of all housing loans, by value currently.

Within the Owner Occupier group, loans to First Home Buyers were down 2.1% on the prior month, valued at $3.86 billion.

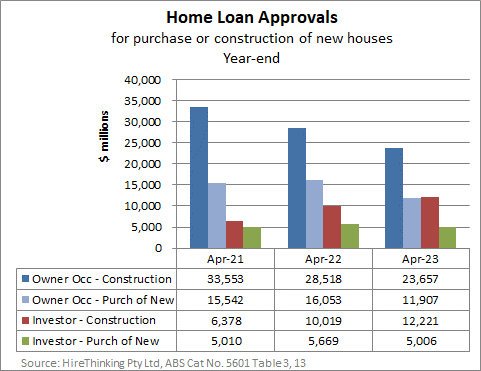

Probably in part a reflection of the appallingly slow rate at which building occurs in Australia right now – see elsewhere in this edition of Stats Count – lending to Owner Occupiers for construction of a new dwelling was down 34.9% year-ended April, while for an already built new dwelling, lending was down a more modest 20.8%. By contrast, Investor construction loans fell just 2.5% and for an already built new dwelling, was down by 8.7%.

Those investing are more prepared to engage in the construction process right now, relative to a year ago, than those buying the family home. That trend is likely to be cyclical and is of course linked to credit exposure risks.

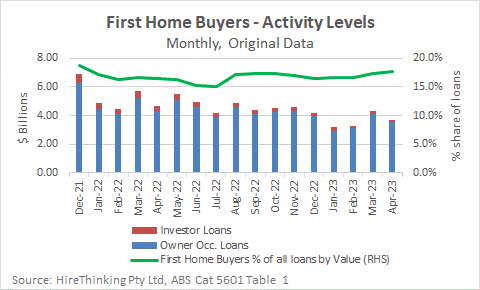

First Home Buyers are barely investing now, focussed instead on Owner Occupancy, as the next chart shows. They are holding up satisfactorily in an expensive market, in proportional terms, with their share clocking in at 17.7% in April and the average size of loans growing only marginally over the year, rising to $494,205 in April 2023.

Perhaps the relative health of the market for first timers is a reflection of the pent-up demand that still resides in the Australian housing economy.

The storm clouds are however hovering over the entirety of the housing sector, including the financing of loans.

Recent weeks has seen a cacophony of cockatoo-like commentators calling the mortgage cliff out as the next big worry. The ‘cliff’ is facing borrowers due to the continuing increase in interest rates, especially as many come off preferential fixed interest rates and have to start paying a much-higher standard variable rate.

In turn, this raises the prospect of bad debts for the banks and as a minimum, tighter margins for banks. That would occur because many of the loan roll overs have resulted in borrowers refinancing with other banks at more competitive rates than on offer at current bank.

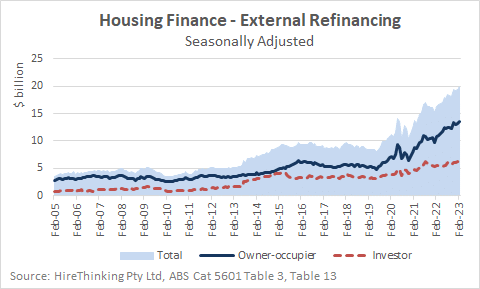

Hence, Australia has seen record levels of refinancing.

However, not everyone is able to move financiers, because their level of debt and capacity to service the loan has deteriorated as a result of the rate rises. Consequently, borrowers caught in that trap have to suck it up, remaining with their current bank and being largely unable to refinance. Little wonder they are being categorised as “mortgage prisoners”.

For all that refinancing has become a national past time, there are still plenty of fixed interest loans still in operation.

Writing in the AFR, Westpac’s Chief Economist, Bill Evans, described the impact of the current high level of fixed interest loans. He commented that the RBA calculated that since April 2022, average mortgage rates had increased 225 basis points, compared with the cash rate of 375 basis points. The gap is largely the impact of fixed interest rate loans that are yet to expire.

That means there is already a lag of loan changes to hit the economy, that could be as much as 150 basis points (1.5%) on average, across the total national housing loan book. Notably, that doesn’t account for the May and June interest rate increases, which combined represent another 50 basis points (0.5%).

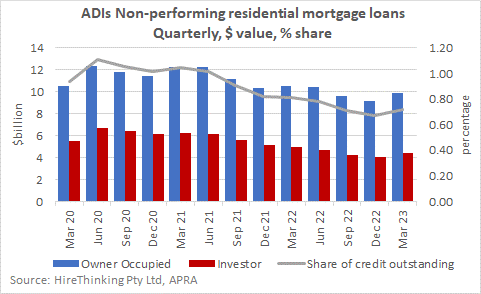

In sum, this suggests there is a mountain of pain on the way, which we can expect to flow into non-performing loans.

However, reflecting the conservative stress testing of the Australian Prudential Regulatory Authority (APRA) prudential measures applied to writing new loans in recent years, non-performing loans have only moved up slightly in the most recent quarter. In its March quarter report, APRA commented that there were “…no signs of systemic stress in ADIs mortgage portfolios”. ADIs are Authorised Deposit-taking Institutions, sometimes called ‘banks’.

For all that APRA is seemingly watchful and the data is not showing any significant additional stress. However, a recent analysis by UBS shows plenty of higher-income households are burning through their spare cash to cover the mortgage repayments. Nila Sweeney addressed this in the AFR in early June, reporting senior lending economists as saying that if the higher rates persist, for many, the current situation would become untenable, potentially pulling forward distressed sales.

Declining net household savings seem to point to this effect already be well in evidence.

If its hurting at the upper income level, it must be agony for those on lower or fixed incomes right now. For housing finance and the market overall, this is probably the significant topic of the next year.