Carefully watched housing finance data offers some mixed messages from the outlook perspective at the moment, with first home-buyer lending continuing to grow, the value of investor loans down, and overall the decline in total lending improving for the second successive month (ie an easing in the rate of annual decline). In many respects, the best news is the growth in the value of loans for first home-buyers, whose share of loan value rose to a six year high at 17.8%.

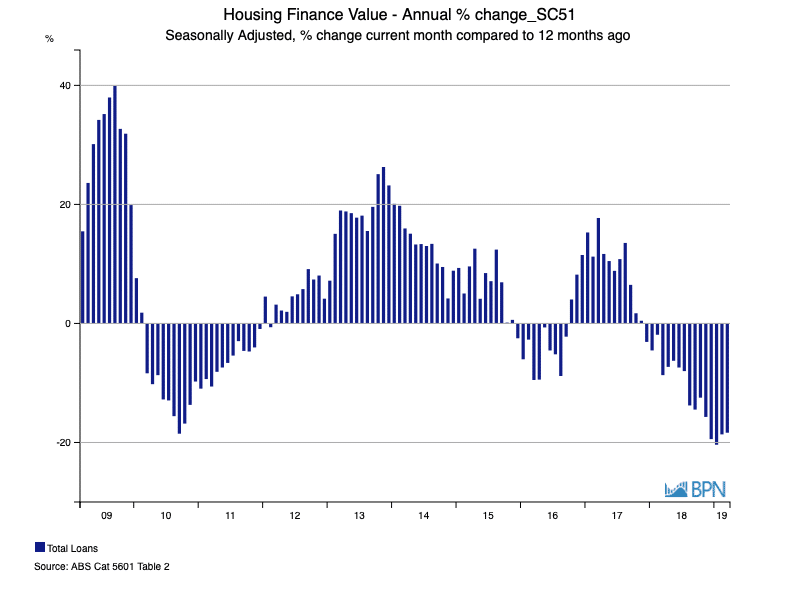

First, to set the scene, we can see in the chart below that growth in the annualised total value of loans has been negative for 16 consecutive months. That hasn’t altered much and in fact, compared to a year earlier, the total value of loans was 18.4% lower over the year-ended March 2019.

The bright point in the chart above is that total loan values are declining a little less sharply than was previously the case.

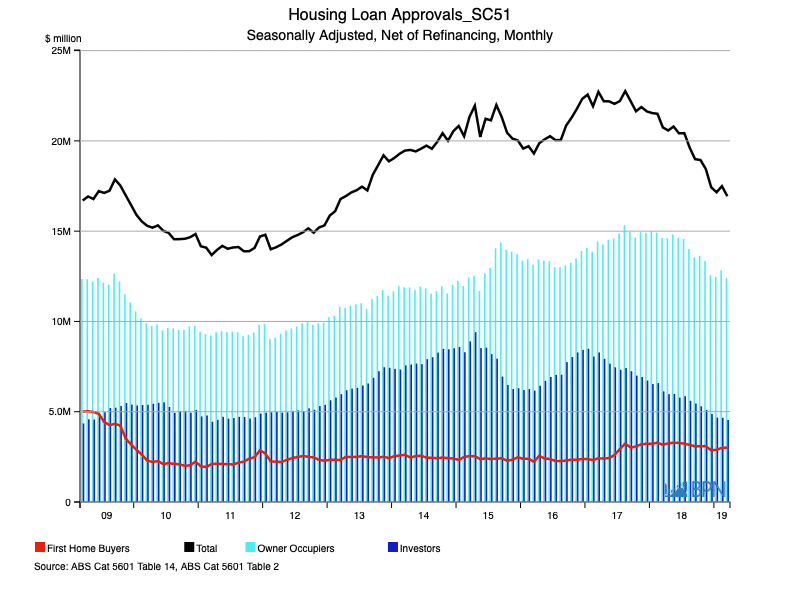

The second chart shows the monthly value of loans. The total value (black line) has declined more or less continuously since early 2017, falling to AUD16.936 billion in March 2019. Owner-occupiers are driving the market now. At AUD12.396 billion in March, they accounted for 73.2% of the value of new loans. Within that, (red line) are most of the loans to first home-buyers. Although they are down 4.8% in value compared with March 2018, at AUD3.014 billion, they have softened far less than loans to all the other participants, accounting for 17.8% of total loan value.

We will return to the first home-buyers in a moment, but meantime, it is worth examining the role of investors in the market right now. The dark blue bars show their decline, and demonstrates it is faster than that (by value) for owner-occupiers shown in the light blue bars. At AUD4.540 billion in March 2019, the value of loans to investors was 25.9% lower than in March 2018.

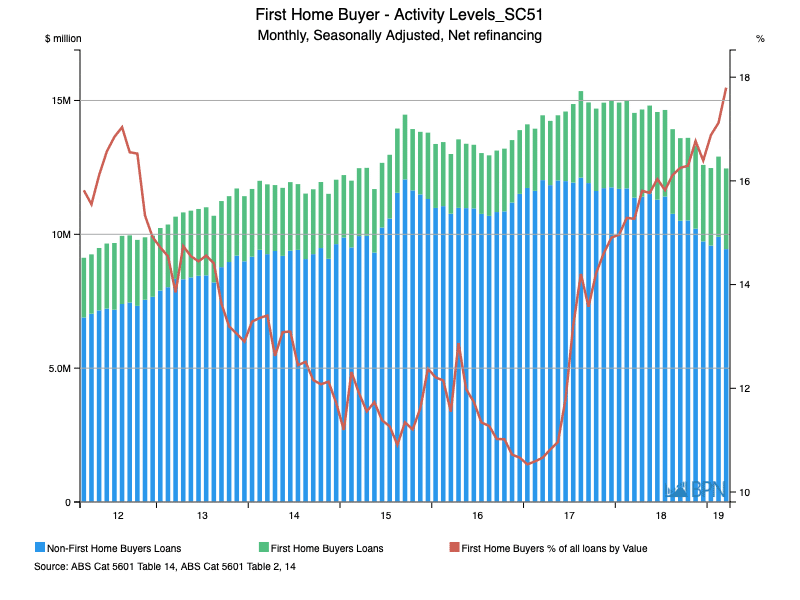

Another way to look at this is shown in the chart below, where the value of loans to first home-buyers is shown relative to all other loans and the proportion of the loans to first-timers is also displayed. We might be pleased to see solid proportions for first home-buyers, but it is the consistency in the growth in loan values that bodes most for the future.

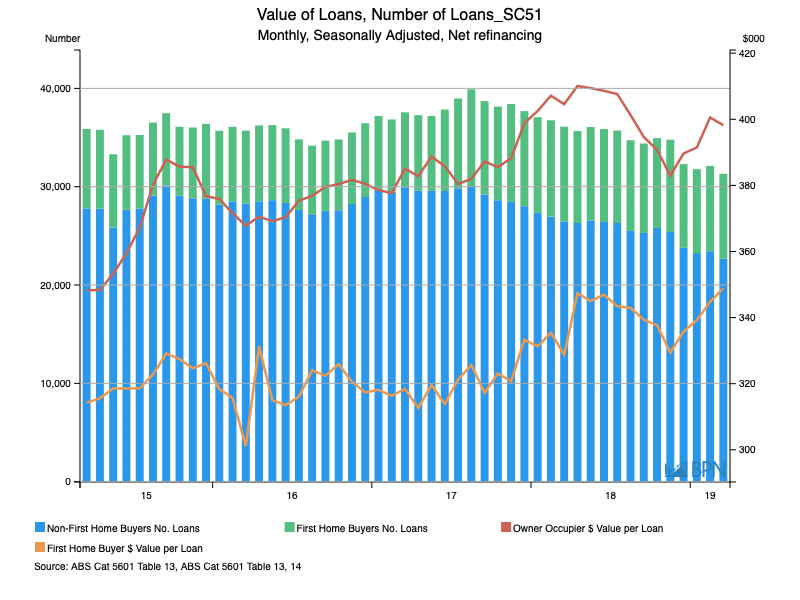

Finally, the chart below shows the number of loans for first home-buyers compared with all other home-buyers, as well as the average value of those loans. What the chart demonstrates is that while the proportional representation of first home-buyers is growing, their total number declined 1.4% over the year-ended March (falling to 108,924). This was, however, significantly ahead of the 12.5% decline in the number of loans issues to all other borrowers (300,735) over the same period.

Depending on your view, it is equally good news that the average value of loans to first home-buyers in March 2019 was 6.1% higher than in March 2018, and hit a new peak of AUD348,834 in the most recent month. Conversely, the average value of loans for all other lenders fell 1.6% over the same period, to AUD398,212. The differential of almost exactly AUD50,000 or 12.4% is continuing to narrow.

Good news for first home-buyers is good news for the housing economy in general.

With monetary stimulus in the form of interest rate cuts on the way and fiscal stimulus in the form of tax cuts and first home-buyer support apparently headed our way, we can expect first home-buyers to play a bigger role in the near future.