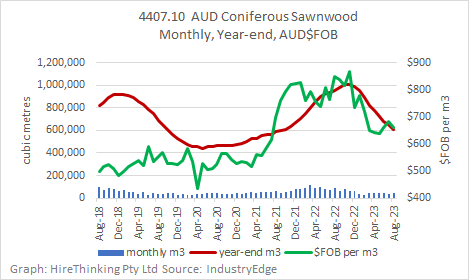

Despite the constant fall in softwood import volumes, prices appear to have been holding up. Year-ended August 2023, imports totalled 603,837 m3 down 52.5% on the prior year. In a pattern similar to that for locally produced sawn softwood, prices have moderated over the same period but hovering between AUDFob640-680/m3.

In August 2023, the weighted average import price was 3.1% lower than the prior month, right in the middle of the recent range, at AUDFob660/m3.

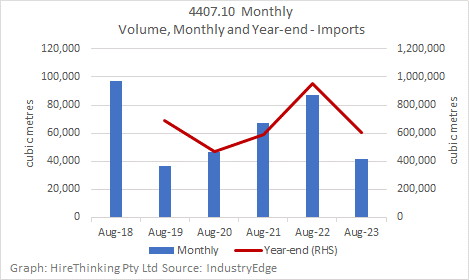

The monthly data provides some insight into the present housing cycle and what stage it has reached. In August, imports totalled 41,310 m3, the lowest August since 2019 when imports totalled 36,248 m3 following the peak of the 2018 housing cycle.

With housing approvals now at their lowest levels since August 2013, demand is (or at least, the drivers of demand should be pointing) lower than the bottom of the last cycle. However, as discussed elsewhere in this edition of Statistics Count, housing price and cost inflation is now moderating and some confidence is returning. Existing home purchase prices growing and some builders noting positive sales growth for new houses.

Returning to a theme in this edition of Statistics Count, the import data appears to be pointing to a market that is at or near its bottom, albeit with a little more ‘at sea’ volume to run into possibly lower imports through to year end.

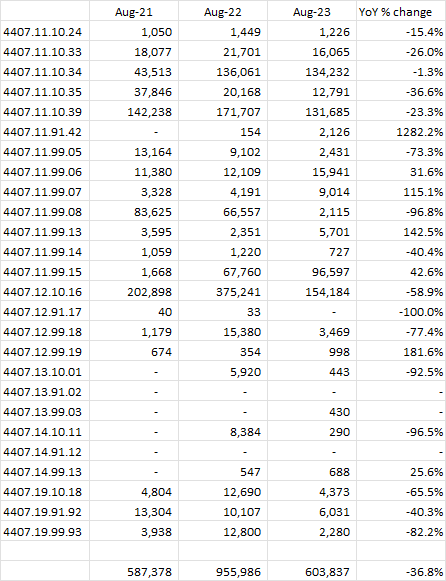

The harmonised tariff classification for sawn softwood (4407.1) covers 26 products or at least classifications.

Of these, four products represent most of the volume, with the year-ended August import volumes and proportional changes each detailed below:

- 11.10.34 (134,232 -1.3%)

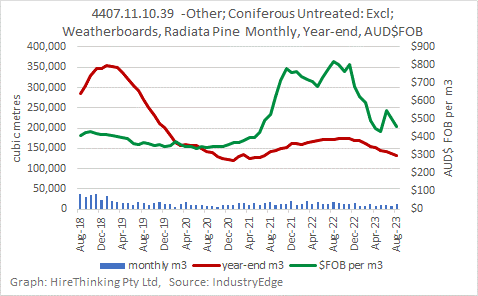

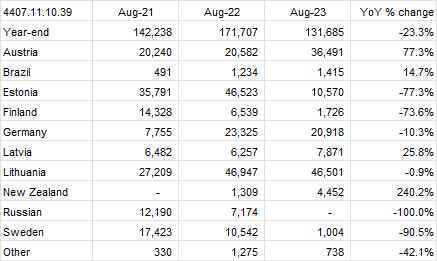

- 11.10.39 (131,685m3 -23.3%)

- 11.99.15 (96,597m3 +42.6%)

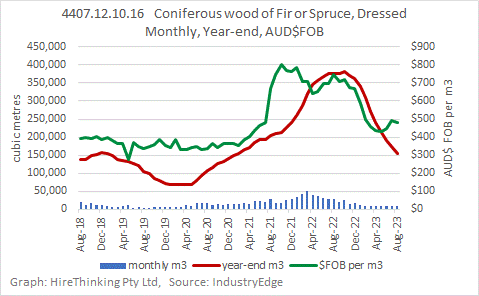

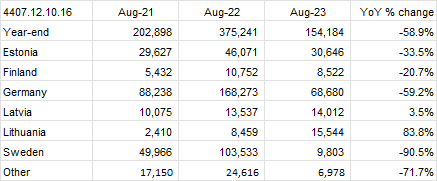

- 12.10.16 (154,184m3 -58.9%)

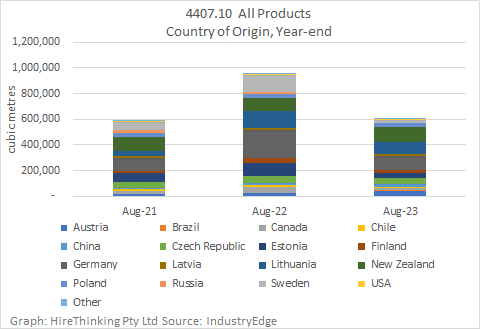

Import source countries continue to evolve, as demand continues to decline. Again, shown on a year-ended August basis, this has seen big reductions in supply from countries such as:

- Canada (11,530m3 -74.6%)

- Estonia (42,145m3 -19.4%)

- Germany (105,778m3 -51.3%)

- Sweden (22,747m3 -82.7%)

By comparison however, some countries have increased their supply over the year-ended August, noting that some are relatively small contributors:

- Austria (39,384 m3 +69.1%

- Brazil (12,009 m3 +288.2%)

- China (23,658 m3 +46.6%)

- New Zealand (119,234 m3 +14.7%)

The biggest imported product remains 4407.12.10.16 Dressed Coniferous wood of Fir or Spruce.

For this grade, Germany continues to be the major country of origin, supplying 68,680 m3 year-ending August 2023. Other supply countries can be seen in the following table.

The second largest import grade is 4407.11.10.39 Untreated Coniferous, other, where the major supplier for the last two years has been Lithuania.

Volumes for this grade are 23.3% lower year-ended August than for the prior year and have been delivered from a wider range of major countries, as the table below shows.

As Australia’s imports of sawn softwood decline to fit a deteriorated market size, there are also changes to the countries delivering product. There is some suggestion the country changes are assisting the market to retain hard won prices and sector value.