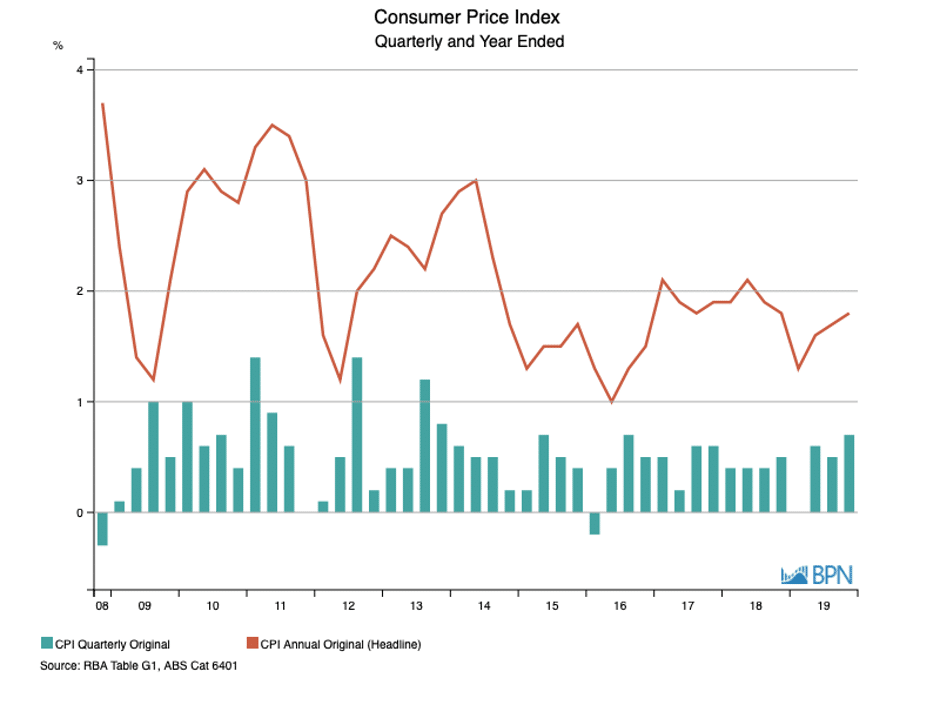

Australia’s inflation rate has not hit its straps for four long years, continuing to languish below the 2.0% that represents the bottom of the RBA’s target band. At 1.8% in 2019, the Consumer Price Index (CPI) was aided by a more solid 0.7% lift in the December quarter, but was unable to bridge the gap and meet the target. At some stage this lower activity level will impact official interest rates.

So to commence, here is the CPI data, noting that the RBA’s target is for CPI to land between 2% and 3% per annum. On an annualised basis (the red line) we can see the last time we ticked into positive territory was the June quarter of 2018. Since then it has all been a bit same-same and more than a little ordinary. Indeed, so much so, some argue that these <2% per annum inflation rates are the new normal. An interesting thought if nothing else.

Fig 26

To go straight to the dashboard and take a closer look at the data, click here.

However, the fact is that the headline inflation growth of 0.7% in the December quarter masks a couple of important factors. As the Guardian’s Greg Jericho wrote:

“…it is clear upon closer inspection that the growth is due to not to an increase in demand, but a reduction in supply – notably among food.”

So, price inflation occurred because we had to pay more due to scarcity of food brought about by the African swine flu on the one hand and the drought on the other. When food supply returns to normal, those price increases will disappear also.

Jericho goes on to identify that there are other factors that weigh into CPI growth and that are having an increasingly magnified impact on the inflation rate as other items remain in the pricing doldrums. His chart is below, showing the effect of the fact that:

“Over the past year tobacco prices grew by 14%. If we exclude alcohol and tobacco, the overall CPI increased in 2019 by just 1.4%:”

Fuel prices also rose strongly (4.4%) in the December quarter, but on the other side of the coin, rents were up just 0.2%, their lowest ever annual growth, while electricity prices fell 3.5% and gas prices rose just 1.4%.

It might be argued – often is in fact – that repeated doses of interest rate cuts do little to add to inflation and grow the economy. That is because for low interest rates to be effective, households have to enjoy sufficient leverage and incomes to commit to more expenditure. With household debt at historic highs and wages growth stagnant, a lower interest rate is a much less potent tool than was once the case.

In short, it is not just the RBA that has to do the heavy lifting in the economy right now. There are repeated calls amongst commentators for fiscal activity – expenditure by government – in particular. On that front, we might anticipate seeing a significant increase in Government outgoings later in 2020 as the nation grapples with the need to rebuild after the ongoing fire season and struggles to defeat inundation linked to massive flooding, while at the same time trying to mitigate the effects of the deep and persistent drought.