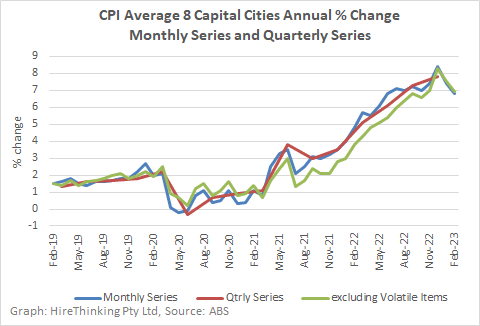

Monthly inflation data saw the Consumer Price Index (CPI) fall to 6.8% in February 2023, down from 7.4% a month earlier. The welcome and expected downturn plays into expectations that the related interest rate rise cycle may have peaked. For all that, at least one further rate rise is expected.

The dip in monthly inflation was matched, as the chart shows, by a fall in the volatile items measure, which removes those things that are perpetually changing. The decline in that measure is probably more telling than headline inflation.

ABS reported across the year that the drivers of inflation were mainly Housing (+9.9%), but lower than in January, Food and non-alcoholic beverages (+8.0%), Transport (+5.6%) and Recreation and culture (+6.4%).

There are other indicators that prices and inflation may have peaked. Fuel price measures in the CPI were up 5.6% year-ended February for instance, but that was lower than the 7.5% reported for year-ended January.

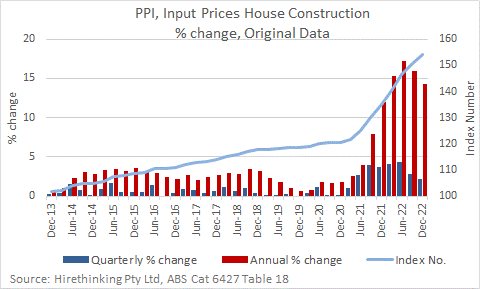

From a Housing and Construction perspective – of vital importance to the forestry and wood products sector – input price growth measured in the Producer Price Index (PPI) for houses continued to ease in the December quarter. Year-ended December, input costs were up 14.2%, which is still significant, but were down from the peak in the June quarter of 17.3%.

March quarter data may be a way off, but the anecdotal signs are the input costs for housing construction are continuing to moderate, feeding into lower inflation.

We cannot have a crystal ball, but all the signs and most of the data are pointing to inflation having peaked around about Christmas 2022. We can anticipate seeing the CPI moderate in coming months, relieving some of the pressures evident in the economy and on households.