The trading activities (exports and imports) of wood products, classified under Chapter 44 of the Harmonized Commodity Coding System (HS), have shown some fluctuations over the past decade, particularly during the pandemic years. Overall, exports of Australian wood products remained relatively stable, despite experiencing a sharp decline of almost 25% in 2021. The latest figures for 2025 indicate a recovery, with exports rising by 9% compared to the previous year, reaching a total value of $2 billion.

On the import side, the trend also reflects volatility. After falling from its peak in 2022, imports have rebounded, with 2025 figures showing an upward movement with a total value of $2.7 billion. This growth highlights the continued demand for wood-based materials in the domestic market, particularly in the construction and manufacturing sectors.

China continues as Australia’s dominant trading partner for wood products, reflecting its role across other commodities. The composition of trade is also distinct – key Australian exports to China include broadleaved hardwood logs, roundwood, and builders’ joinery, while imports from China to Australia are largely manufactured wood products such as plywood, veneer, MDF, and particleboard.

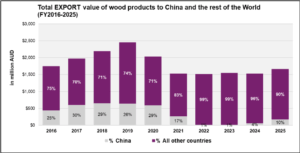

Export to China compared to all other countries

Before the pandemic, Australia’s export value of wood products to China consistently represented around 25% of total wood product exports, averaging between $550 million and $600 million per year. This share reflected China’s importance as a major and stable market for Australian forestry products. However, from 2022 to 2024, exports to China declined sharply. During this period, the share of exports to China fell to as low as 1–4% of total wood product exports, representing a significant shift in the trade relationship.

The latest figures for FY2025 indicate a substantial recovery. Exports to China rebounded to $170 million, accounting for 10% of Australia’s total wood product exports. While this remains well below pre-pandemic levels, the recovery signals renewed demand and an improving trade dynamic with China. Table 1 and Figure 1 provide a detailed view of Australia’s wood product exports to China over the past decade, illustrating both the long-term fluctuations and the more recent rebound.

Table 1: Total Export Value of Wood Products

Sources: ABS, ABARES, S&P Global, FWPA analysis

Figure 1: Total Export Value of Wood Products in %

Sources: ABS, ABARES, S&P Global, FWPA analysis

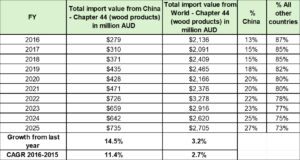

Import from China compared to all other countries

While the total import value of wood products has fluctuated over the past decade, the proportion from China has shown a steady upward trend. Prior to the pandemic, China accounted for around 20% of Australia’s wood product imports. In the last financial year, this share had increased to 27%.

In terms of overall value, total imports declined significantly between 2022 and 2024, falling from $3.2 billion to $2.6 billion. Despite this decline, China’s share of imports continued to rise, moving from 22% to 25% over the same period. Import activity rebounded in the 2025 financial year, with total values increasing by 3.2%, from $2.6 billion in 2024 to $2.7 billion in 2025.

Although further data and analysis are required, this increase appears to be broadly consistent with other economic indicators, particularly the gradual recovery in residential construction activity. For China specifically, import values to Australia have remained strong and resilient, growing at an average annual rate of around 11% between 2016 and 2025 (see Table 2 and Figure 2).

Table 2: Total Import Value of Wood Products

Sources: ABS, ABARES, S&P Global, FWPA analysis

Figure 2: Total Import Value of Wood Products in %

Sources: ABS, ABARES, S&P Global, FWPA analysis

In conclusion, although Australia’s export activity to China has declined significantly in recent years, China continues to play a dominant role as our primary trading partner on the import side. The steady increase in China’s share of total wood product imports highlights the strong dependence of the Australian market on Chinese supply, particularly for products such as plywood, veneer, MDF, and particleboard. While this reliance provides Australian businesses with access to competitively priced inputs, it is also important to monitor potential risks, such as supply chain disruptions or changes in trade policy, including the impact of US tariffs. The data suggests that China will remain central to Australia’s wood product trade balance, particularly as domestic demand gradually recovers in the construction sector.