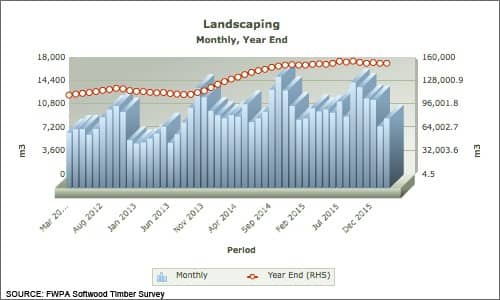

Over the year to the end of February 2016, sales of Landscaping grade softwood (sleepers and ??) were 151,465 m3, up just 1.72% on the prior year. Since growing in 2014 as the housing approvals boom turned into a house-finishing and garden building frenzy, year-end sales have operated within a tight band that never exceeded 154,417 m3 (Sept 2015) and 147,810 m3 (October 2014).

The long tail of the longest run housing boom in Australia’s history is evident in the chart below.

To go straight to the dashboard and take a closer look at the data, click here.

Underscoring the stability, in February 2016, monthly sales were just 3.0 m3 lower than they were in February 2015.

Just as there are leading indicators of impending events – sales of printing papers rise just prior to elections for instance – there are also indicators (usually lagging) of the strength of an economic event.

The latest data on Landscaping grade sales demonstrates a stubborn robustness that could belie impressions that home-owners are over-extended financially or that they all live in gardenless apartments.

To give this point some more meaning, the chart below shows sales of the Landscaping grade since the Softwood Timber Survey was introduced. It demonstrates solid and consistent growth over time. But it also shows that since the latest housing boom commenced, there has been both a decided lift in year-end sales and some unparalleled symmetry between volumes solid in each month of the last two years.

To go straight to the dashboard and take a closer look at the data, click here.

The Landscaping sales data demonstrates the strength of the housing boom and shows its resilience over time. For the end of the housing expansion, we might do well to look to these ‘later stage’ products before calling the boom over as soon as housing approvals dip.