An update from the desk of FWPA’s Statistics and Economics Program Manager, Erick Hansnata.

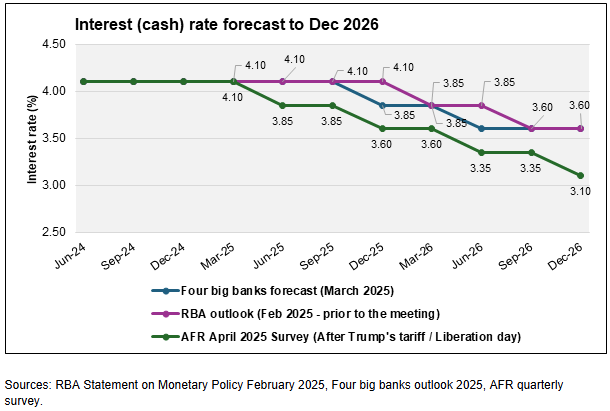

The RBA decided to lower the cash rate to 4.10% on 18 February 2025. The key factor was based on the underlying inflation of 3.2% in December 2024 and suggests that inflationary pressures will be easing toward the mid-point target of 2-3%.

The RBA highlighted that the outlook after cutting the cash rate remains uncertain, as output growth has been weak and the recovery of private domestic demand is slow. On the other hand, labour market indicators remain tight, where the unemployment rate is still around 4%.

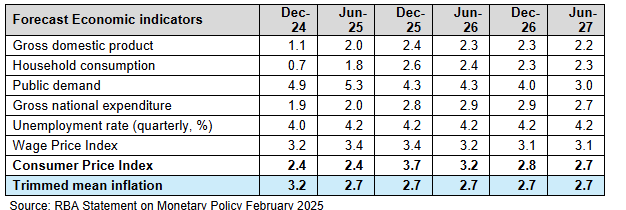

However, the outlook for 2025 and 2026 looks positive following the interest rate cut. Household consumption and public demand will increase before stabilising from the end of 2026 to mid-2027. Other indicators, such as the unemployment rate, wage price index, and CPI, also follow this trend. The general CPI is expected to increase by the end of 2025 due to energy subsidies that no longer apply. However, the trimmed inflation is projected to remain below 3% (Table 1).

Table 1. RBA outlook – selected economic indicators

In terms of the interest rate, the RBA projection —note that the cash rate is assumed to move in line with expectations derived from financial market pricing—is conservative. Meanwhile, the four big banks (CommBank, NAB, Westpac, ANZ) projected the interest rate to lower by 3.85% by March 2026 (the RBA projected at 3.85% by June 2026).

The projection was revised after Trump’s tariff announcement on 2nd April 2025 (Liberation Day) to all US trading partners, including Australia. The global market responded by adjusting their risk portfolios and inflationary effects in the short and medium terms. This external shock and the escalating global trade war – as China responded with the same tariff for US imports – will trigger a movement from equities to more secure government bonds portfolios.

The latest Australian Financial Review (AFR) quarterly survey of 40 market economists shows that most of them projected that the RBA would bring forward the interest rate cuts this year to 3.85% in May 2025 and 3.60% at the end of the year (Figure 1).

However, the projection could change at any time, given the uncertainty of Trump’s policy in the next 12 months.

Figure 1: The projection of interest rate