The total value of home loans is continuing to tumble, falling to AUD17.1 billion over the year-ended January, down 20.6% on the prior year. Underscoring the increasing intensity of the falls, the value of loans was 2.1% lower in January than in December.

The ABS has introduced a revised Housing Finance data series from January 2019 with historic data back to July 2002. The data series generally aligns with the earlier data with the exception of financing for investors. This has now been categorised under Business lending and has been enhanced with separate identification of refinancing loans. As a consequence more accurate net of refinancing data is now available. The net of refinancing data is more important for the housing industry because it generally represents new activity.

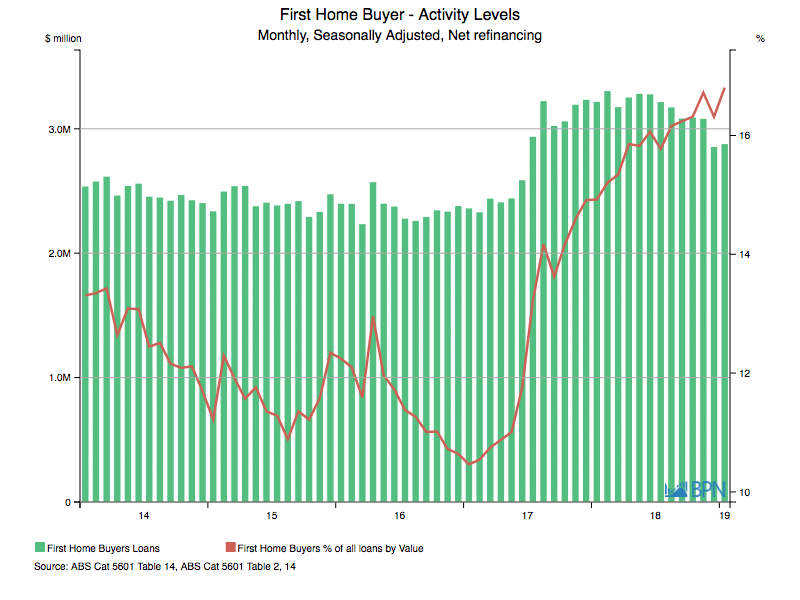

The chart below shows total loans, net of refinancing over the last decade, along with loans to first home buyers.

To go straight to the dashboard and take a closer look at the data, click here.

The continued decline in the value of loans is a significant concern because whilst work in the pipeline remains strong, it means it is not being refilled at the same rate.

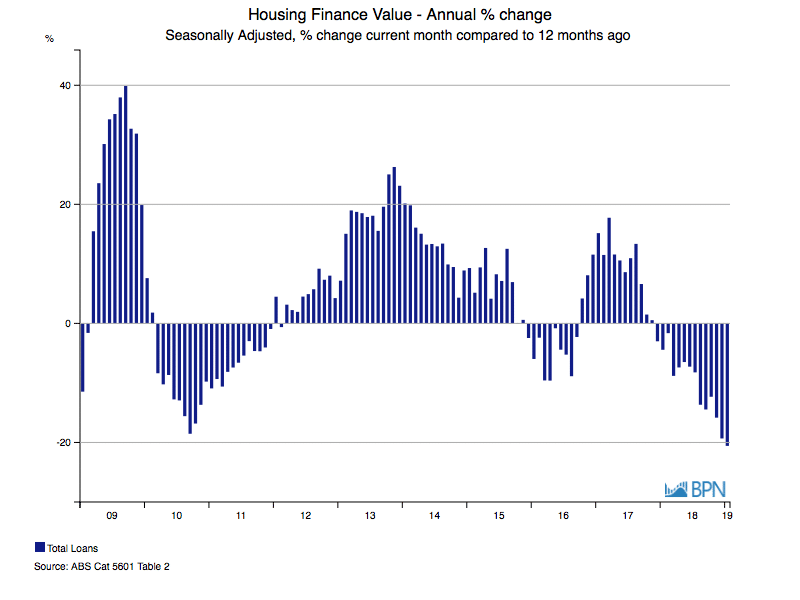

We can see how significant the decline is in the annualised percentage change chart shown below.

To go straight to the dashboard and take a closer look at the data, click here.

Over the year-ended January, the value of housing finance fell 20.6%, its steepest declines of the last decade. The annualised declines are set to continue as dwelling approvals continue to soften, and as established house prices continue to soften, especially in major capital cities.

One feature of the decline in loan values that is not entirely unwelcome is that it has allowed First Home-Buyers to increase their share of the market, both in volume and value terms. The chart below shows that over the year-ended January 2019, the total value of loans to first-time buyers rose 10.5% compared with the prior year, to reach AUD37.657 billion.

To go straight to the dashboard and take a closer look at the data, click here.

The chart also shows that over the year, First home-buyers have grown their share of total loans to 12.6%. Although those without current leverage in the form of debt should find it easier to get loans, that has to be tempered with the experience of the current tight lending restrictions. The average size of loans to First timers was $339,070 over the year, against a total average of $391,490.

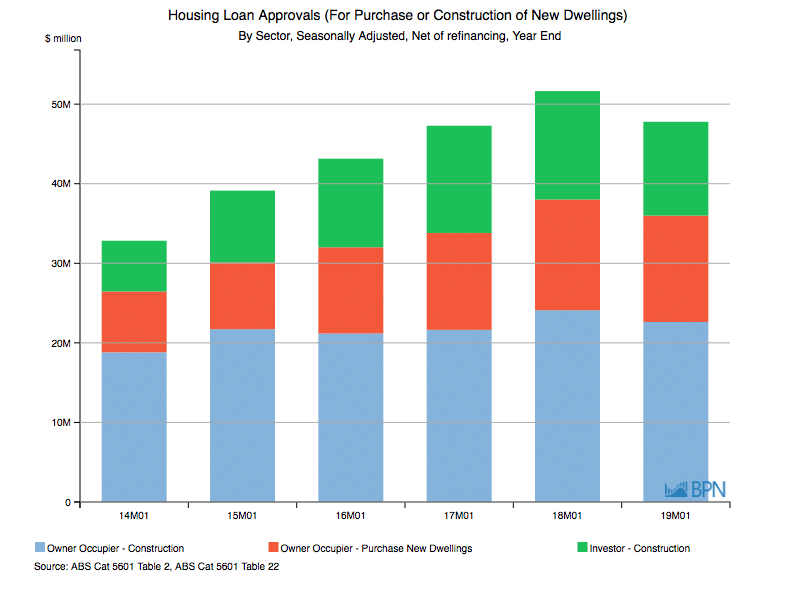

For new dwellings, the data shows the last year was softer than the stellar year to the end of January 2018, but remained just ahead of the also very strong 2017. As the chart and table below show, it is loans for Owner Occupier Construction that continue to dominate, despite the declines.

To go straight to the dashboard and take a closer look at the data, click here.

| AUDM | YE Jan ’18 | YE Jan ’19 | % Change |

| Owner Occupier – Construction | 24,099,401 | 22,624,816 | -6.1 |

| Owner Occupier – Purchase New Dwellings | 13,920,315 | 13,370,077 | -4.0 |

| Investor – Construction | 13,621,647 | 11,790,869 | -13.4 |

We can see that the value of loans to Investors slumped 13.4% over the year, and that owner occupiers purchasing new dwellings (say from developers) had their loan value clipped by just 4.0%. But those building a new dwelling to live in themselves saw their loan value drop 6.1%, accounting for 47.3% of total loan values, up from 46.7% the year earlier.

Although this is still something of a guessing game, we can see that the majority of first time borrowers are most likely to be borrowing for new construction activity, and unlikely to be investing.

The housing credit data provides yet more information that it is First Home Buyers and new construction activity that retains the majority of the action. Couple this with the sometimes surprising resilience of the free-standing house market, and we have some important clues as to where the best opportunities lie.